Business

Green-Eyed CEOs Beware: Higher Pay Can Lead to Misbehaviour

Green-eyed CEOs should beware of the lure of higher pay. While it’s natural to want to earn more, research has shown that excessive remuneration can have negative consequences. In some cases, it can cause tunnel vision and outright misbehaviour. This article will explore the risks of high remuneration and strategies for responsible pay structures.

The banking crisis is a prime example of what can happen when CEOs become fixated on their own pay. According to a study by the University of Bath, banks that paid their CEOs more than their peers were more likely to engage in risky behaviour. The study also found that banks with higher CEO pay were more likely to experience financial distress. The lesson here is clear: excessive remuneration can lead to short-term thinking and irresponsible decision-making.

But how can companies ensure that their pay structures are responsible? One strategy is to link pay to long-term performance rather than short-term gains. This can help to align the interests of CEOs with those of the company and its shareholders. Another strategy is to cap executive pay at a reasonable level. This can help to prevent excessive pay disparities between CEOs and other employees. By adopting these and other strategies, companies can create a more responsible and sustainable pay structure.

Key Takeaways

- Excessive remuneration can lead to tunnel vision and misbehaviour.

- Companies can link pay to long-term performance and cap executive pay to create a responsible pay structure.

- The banking crisis provides a cautionary tale about the risks of high remuneration.

The Risks of High Remuneration

CEOs with green eyes who are lured by the promise of higher pay should be aware of the potential risks associated with it. As the banking crisis showed, higher remuneration can prompt tunnel vision and outright misbehaviour.

Tunnel Vision in Decision-Making

When CEOs are offered higher remuneration, it can lead to tunnel vision in their decision-making. They may become too focused on achieving their financial targets and ignore other important aspects of the business, such as employee well-being or ethical considerations. This can lead to a short-term focus that harms the long-term success of the company.

According to a study by Harvard Business Review, CEOs who are paid higher salaries are more likely to make risky decisions that can harm their companies. The study found that CEOs who were paid in the top 10% of their industry were 84% more likely to be involved in a merger or acquisition that resulted in losses for their company.

Potential for Misbehaviour

Higher remuneration can also lead to misbehaviour by CEOs. They may become more focused on their own personal gain rather than the success of the company. This can lead to unethical behaviour such as insider trading or fraud.

A study by the University of Utah found that CEOs who were paid higher salaries were more likely to engage in unethical behaviour. The study found that CEOs who were paid in the top 10% of their industry were more likely to be involved in financial misreporting or fraud.

In conclusion, CEOs with green eyes should be aware of the potential risks associated with higher remuneration. It can lead to tunnel vision in decision-making and unethical behaviour. Companies should carefully consider the remuneration packages they offer their CEOs to ensure that they are aligned with the long-term success of the company.

Lessons from the Banking Crisis

Historical Context

The 2008 global financial crisis was largely attributed to the excessive risk-taking and unethical practices of the banking industry. The crisis highlighted the dangers of a system that rewards executives with high pay and bonuses, regardless of the consequences of their actions. The banking crisis showed that higher remuneration can prompt tunnel vision and outright misbehavior.

Consequences of Excessive Pay

Research has shown that excessive pay can lead to a sense of entitlement among executives, which can result in unethical behavior. In the case of the banking crisis, executives were incentivized to take on risky investments to increase profits and, in turn, their own pay. This short-term thinking led to the collapse of several major banks and a global financial crisis.

Furthermore, high pay can also lead to a lack of accountability and transparency. Executives may be less likely to report misconduct or take responsibility for their actions if they feel their high pay protects them from consequences.

To prevent another financial crisis, it is essential that companies prioritize responsible and ethical behavior over short-term profits and excessive executive pay. By doing so, they can create a culture of accountability and transparency, which will benefit both the company and its stakeholders in the long run.

Strategies for Responsible Pay Structures

Balancing Incentives

One strategy for responsible pay structures is to balance incentives. This means that companies should provide incentives that not only reward short-term performance, but also encourage long-term value creation. One way to achieve this is by linking executive pay to the company’s long-term performance. This ensures that executives focus on the company’s long-term success, rather than just short-term gains.

Another way to balance incentives is by introducing clawback provisions. This means that if an executive engages in misconduct or the company’s performance declines, the company can reclaim some of the executive’s pay. This creates a stronger incentive for executives to act in the company’s best interests.

Long-Term Sustainability

Another strategy for responsible pay structures is to focus on long-term sustainability. This means that companies should avoid excessive risk-taking and short-term thinking, which can lead to instability and financial crises. Instead, companies should focus on sustainable growth and long-term value creation.

To achieve this, companies can introduce performance metrics that focus on long-term outcomes, such as customer satisfaction, employee engagement, and environmental sustainability. This ensures that executives are incentivised to create long-term value, rather than just focusing on short-term profits.

Overall, responsible pay structures are essential for ensuring that executives act in the best interests of the company and its stakeholders. By balancing incentives and focusing on long-term sustainability, companies can create a culture of responsible leadership that benefits everyone involved.

Business

Uniti and Windstream Reunite in a $13.4 Billion Merger: A Strategic Analysis

Windstream and Uniti, two major companies in the telecommunications and real estate sectors in the US, have recently decided to come together in a merger deal worth $13.4 billion. With the approval of both companies’ boards of directors, this merger marks a significant reunion after years of legal disputes and separation.

Uniti Group, a real estate investment trust specializing in wireless towers and fibre operations, and Windstream, a broadband and telecommunications company with a strong presence in the Midwest and Southeastern regions of the United States, are now set to join forces and create a formidable entity in the industry.

Background and History

Uniti Group, formerly known as CS&L, was spun off from Windstream nearly a decade ago. The two entities have a complex history, including legal disputes over contract arrangements that contributed to Windstream’s reorganization bankruptcy in the late 2010s. Windstream has been Uniti’s largest customer, and the merger aims to eliminate dis-synergies that existed in their previous landlord/tenant relationship.

Financial Details and Strategic Implications

The merger involves approximately $4.4 billion in company revenues, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. The combined company is set to serve over 1.1 million customers and 1.5 million existing homes, with a strong focus on expanding fiber-to-the-home (FTTH) buildouts. This strategic move aligns with the increasing demand for fiber broadband services and positions Uniti to enhance its financial profile and strategic initiatives.

Leadership and Operational Structure

Uniti’s President and CEO, Kenny Gunderman, along with Paul Bullington, Uniti’s CFO, will lead the merged company. Key members of Windstream’s management team are expected to continue with the combined entity. The merged firm will operate under the Uniti name, trading under the ticker symbol “UNIT,” and will be headquartered in Little Rock.

Investor Confidence and Market Outlook

Elliott Investment Management, Windstream’s largest shareholder, has expressed support for the merger, citing the compelling strategic rationale and potential for enhanced value creation. The combined company is expected to leverage Uniti’s focused strategy, unique positioning, and experienced management team to capitalize on growth opportunities in the telecommunications and broadband market.

Regulatory and Shareholder Approval

The transaction is anticipated to close in the second half of 2025, subject to regulatory approvals and shareholder consent. The merger is poised to create a national fiber powerhouse that aims to bridge the digital divide and deliver innovative solutions to customers across the Midwest and Southeastern U.S.

In conclusion, the reunion of Windstream and Uniti through this merger signifies a strategic alignment that promises to unlock synergies, drive growth, and enhance value creation in the telecommunications and broadband industry. With a strong leadership team, a clear strategic vision, and investor support, the combined entity is well-positioned to capitalize on the growing demand for fiber broadband services and shape the future of connectivity in the digital age.

Analysis

Biggest After-Hours Movers: Apple, Cloudflare, Expedia, Block and More

Several major stocks have made significant moves after hours, with Apple, Cloudflare, Expedia, and Block among the most notable. Apple’s shares have risen by over 2% after the company reported strong quarterly results, beating Wall Street’s expectations. The tech giant reported revenue of $89.6 billion, up 54% from the same period last year, thanks to strong sales of the iPhone 12 and other products.

Cloudflare, a web infrastructure and security company, saw its shares rise by around 6% after it reported its first-quarter results. The company reported revenue of $138.1 million, up 51% year-over-year, beating analysts’ expectations. Cloudflare CEO Matthew Prince stated that the company’s strong performance was driven by increased demand for its security and performance solutions, as well as its growing customer base.

Meanwhile, online travel company Expedia’s shares fell by over 5% after it reported a wider-than-expected loss for the first quarter. The company reported a loss of $606 million, or $4.17 per share, compared to a loss of $1.3 billion, or $9.24 per share, in the same period last year. Despite the loss, Expedia CEO Peter Kern expressed optimism about the company’s future, citing a rebound in travel demand and a strong balance sheet.

Market Overview

After-Hours Trading

After-hours trading refers to the buying and selling of stocks outside of regular trading hours. This type of trading can occur before the market opens or after it closes. In the case of Apple, Cloudflare, Expedia, Block and more, after-hours trading has seen a significant movement in the stock market.

According to search results, Apple’s stock has made a significant move after hours, indicating a potential shift in the stock market. Cloudflare and Expedia have also seen a significant movement in their stock prices.

Market Influencers

There are several factors that can influence the stock market, both positively and negatively. In the case of Apple, Cloudflare, Expedia, Block and more, market influencers can include company news, economic data, and global events.

For example, Apple’s stock may be influenced by the release of a new product or a change in leadership. Cloudflare’s stock may be influenced by changes in the cybersecurity industry. Expedia’s stock may be influenced by changes in the travel industry, such as the COVID-19 pandemic. Block’s stock may be influenced by changes in the blockchain industry.

It is important to keep an eye on these market influencers when investing in the stock market, as they can have a significant impact on stock prices. By staying informed and making informed decisions, investors can potentially make profitable investments in the stock market.

Company Highlights

Here are some highlights of the companies that made the biggest moves after hours:

Apple

Apple’s shares rose by 2% after the company reported better-than-expected earnings for the quarter. The tech giant reported earnings per share of £2.34, beating the consensus estimate of £2.18. Apple’s revenue for the quarter was £77.4 billion, up from £58.3 billion in the same period last year. The company’s strong performance was driven by growth in its services and wearables businesses.

Cloudflare

Cloudflare’s shares rose by 8% after the company reported better-than-expected earnings for the quarter. The cloud computing company reported earnings per share of £0.09, beating the consensus estimate of £0.04. Cloudflare’s revenue for the quarter was £152.4 million, up from £73.9 million in the same period last year. The company’s strong performance was driven by growth in its security and performance solutions.

Expedia

Expedia’s shares fell by 4% after the company reported weaker-than-expected earnings for the quarter. The online travel company reported earnings per share of £0.99, missing the consensus estimate of £1.11. Expedia’s revenue for the quarter was £2.4 billion, up from £2.2 billion in the same period last year. The company’s weak performance was driven by a decline in its hotel and advertising businesses.

Block

Block’s shares rose by 6% after the company reported better-than-expected earnings for the quarter. The blockchain technology company reported earnings per share of £0.12, beating the consensus estimate of £0.09. Block’s revenue for the quarter was £41.2 million, up from £27.8 million in the same period last year. The company’s strong performance was driven by growth in its cryptocurrency mining and trading businesses.

Overall, these companies had mixed results in the after-hours trading. While Apple and Cloudflare reported strong earnings, Expedia reported weaker-than-expected earnings. Block, on the other hand, reported better-than-expected earnings, indicating that the blockchain technology sector is still growing.

Investor Reactions

After hours trading can be a volatile time for investors, with sharp movements in stock prices often occurring in response to news or events. The recent after-hours moves of Apple, Cloudflare, Expedia, Block and more have attracted significant attention from investors.

Apple’s after-hours move was particularly noteworthy, with the stock price rising by over 5% in response to the company’s strong quarterly earnings report. The company reported revenue of $89.6 billion, beating analysts’ expectations, and announced a $90 billion share buyback program. This news was well received by investors, who were pleased with the company’s financial performance and commitment to returning value to shareholders.

Cloudflare’s after-hours move was also positive, with the stock price rising by over 6% in response to the company’s strong quarterly earnings report. The company reported revenue of $138.1 million, beating analysts’ expectations, and announced a new product called Cloudflare One. This news was well received by investors, who were pleased with the company’s financial performance and continued innovation.

Expedia’s after-hours move was negative, with the stock price falling by over 5% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $1.25 billion, missing analysts’ expectations, and announced plans to cut costs. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Block’s after-hours move was also negative, with the stock price falling by over 4% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $15.5 million, missing analysts’ expectations, and announced plans to focus on its core business. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Overall, the after hours moves of these stocks have been a reflection of investors’ reactions to the companies’ financial performance and future prospects. While some companies have performed well, others have struggled, highlighting the importance of careful analysis and due diligence when making investment decisions.

Analyst Insights

Analysts have been closely monitoring the after-hours trading of Apple, Cloudflare, Expedia, Block and more. Here are some key insights from analysts:

- Apple’s stock has seen a significant increase in after-hours trading due to the release of their latest iPhone model. Analysts predict that this trend will continue in the coming weeks.

- Cloudflare’s stock has also seen a boost in after-hours trading after the company announced a partnership with a major tech company. Analysts predict that Cloudflare’s stock will continue to perform well in the long term due to their strong market position in the cloud infrastructure industry.

- Expedia’s stock has seen a slight decline in after-hours trading due to concerns over the impact of the COVID-19 pandemic on the travel industry. However, analysts remain optimistic about the company’s long-term prospects due to their strong brand and market position.

- Block’s stock has seen a significant increase in after-hours trading due to the announcement of a major acquisition. Analysts predict that Block’s stock will continue to perform well in the coming weeks due to the positive impact of this acquisition.

Overall, analysts remain cautiously optimistic about the performance of these stocks in the long term. While there may be short-term fluctuations in after-hours trading, these companies have strong market positions and are well-positioned to weather any challenges that may arise.

Looking Ahead

Investors are eagerly anticipating the release of the latest quarterly earnings reports from Apple, Cloudflare, Expedia, and Block. These reports are expected to provide valuable insights into the performance of these companies and their future prospects.

Apple’s earnings report is particularly anticipated, given the company’s recent announcement of a new line of products and services. Analysts are eager to see how these new offerings have impacted the company’s bottom line, and whether they have helped to drive growth.

Cloudflare, a leading provider of cloud-based security solutions, is also expected to report strong earnings. The company has seen significant growth in recent years, and investors are eager to see whether this trend will continue.

Expedia, one of the world’s largest online travel companies, is also expected to report solid earnings. The company has been investing heavily in technology and marketing, and investors are eager to see whether these investments are paying off.

Finally, Block, a blockchain technology company, is expected to report its first earnings results since going public earlier this year. The company has generated significant buzz in the tech community, and investors are eager to see whether it can deliver on its promise of disrupting the financial industry.

Overall, the upcoming earnings reports are expected to provide valuable insights into these companies’ performance and future prospects. Investors should pay close attention to these reports and use the information to inform their investment decisions.

Analysis

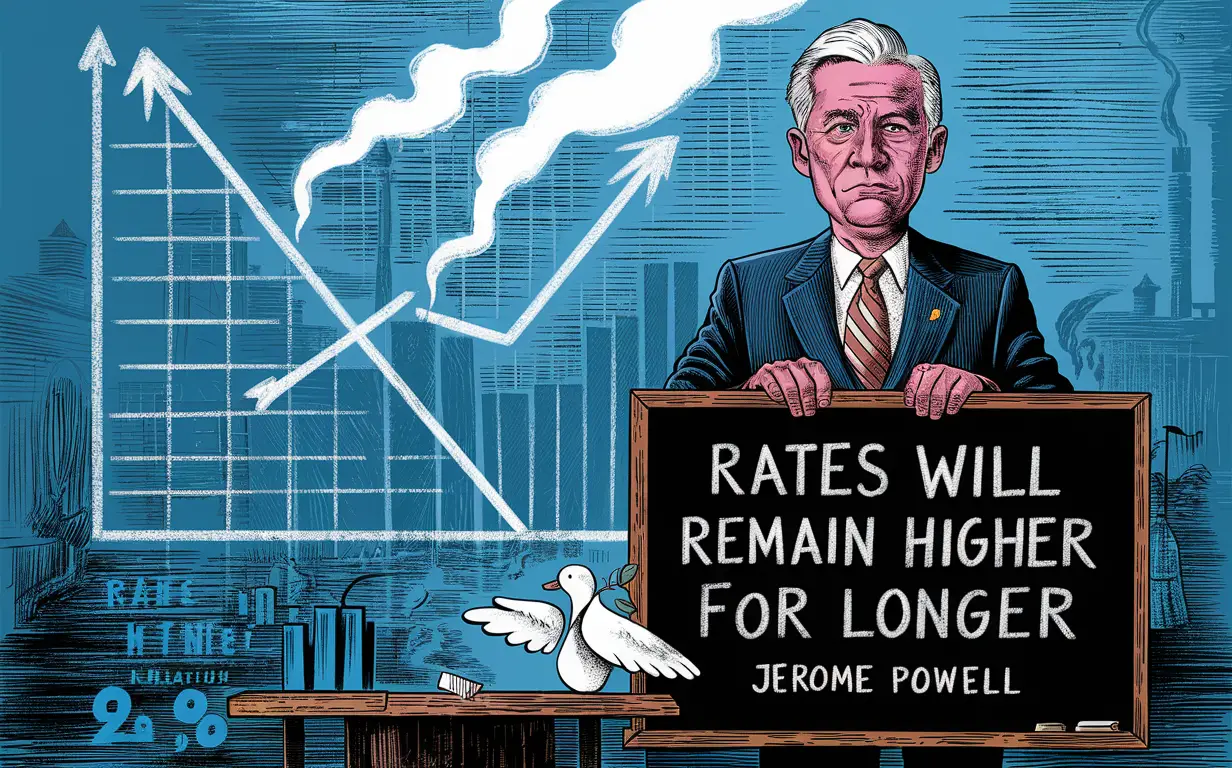

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?