Economy

Unlocking Pakistan’s Digital Revolution: Special Tech Zones Unveiled! 💥

The establishment of Special Technology Zones (STZs) in Pakistan marks a crucial milestone in the nation’s journey towards economic prosperity and technological development. In today’s rapidly evolving global landscape, the creation of these zones presents Pakistan with a unique opportunity to unleash its full potential, attract foreign investment, and build a thriving tech industry.

These zones are poised to bring about a significant shift in Pakistan’s economic landscape, creating thousands of new jobs and opening up new avenues for innovation and growth. By offering a conducive environment for businesses, the STZs have the potential to transform Pakistan’s technology sector and place it on the global map. In this opinion piece, we will delve deeper into the implications of STZs for Pakistan and explore the immense opportunities that these zones present for the nation’s future.

Introduction: A Vision for Technological Advancement

A Vision Unveiled

The Special Technology Zones (STZs) in Pakistan have emerged as a promising opportunity for businesses to thrive in a conducive environment. These zones have the potential to transform the country’s technology sector and put it on the global map. In this opinion piece, we will explore the far-reaching implications of STZs on the economy, job creation, innovation, and the overall growth of the country’s technology landscape.

The Role of Technology

In today’s world, technology is at the forefront of progress and development. It has become an essential tool for shaping the future of economies and societies across the globe. The ability to harness technology and leverage its power is critical to drive innovation, improve efficiency, and create new growth opportunities. Therefore, highlighting the pivotal role of technology in modern development is more important than ever before.

Setting the Stage for Innovation

Innovation is a key driver of economic growth and technology plays a critical role in this process. Special Technology Zones (STZs) have emerged as important centers for innovation and creativity, which can foster the development of new products and services. Understanding the potential of STZs as innovation hubs is therefore crucial in the ongoing dialogue about how to best support and promote economic growth in the digital age.

The Significance of Special Technology Zones

Foreign Investment and Economic Growth

Special economic zones (STZs) are emerging as a promising avenue for foreign investors seeking lucrative investment opportunities. These zones are designed to provide a range of incentives to foreign businesses, such as tax exemptions and streamlined regulations, making them an attractive proposition for foreign capital. As a result, STZs have the potential to become magnets for foreign investment, leading to significant economic growth and development.

Job Creation and Skills Enhancement

A thriving tech ecosystem necessitates a skilled workforce. This section will examine how the development of STZs can lead to the creation of jobs and the enhancement of the local workforce’s skills.

Bridging the Digital Divide

In today’s digital age, access to technology has become more important than ever. Unfortunately, many people still lack access to basic technological tools, which creates a digital divide. To bridge this gap, we need to explore all possible solutions, including the potential contribution of Special Technology Zones (STZs). By leveraging STZs, we can create more opportunities for people to access technology and ultimately reduce the digital divide.

Possibilities and Opportunities

Technological Infrastructure

The role of infrastructure in technological advancement cannot be overstated. The implementation of advanced infrastructure within STZs is crucial for promoting innovation and facilitating research and development. These zones offer a unique opportunity to create an environment that fosters collaboration and knowledge-sharing among researchers, entrepreneurs, and industry experts. Therefore, it’s important to explore the possibilities of how advanced infrastructure can be leveraged within STZs to drive innovation and accelerate progress.

Research and Development

Research and development (R&D) plays a crucial role in driving innovation and growth in any industry. In this context, Special Technology Zones (STZs) can serve as centres of excellence for cutting-edge research and innovation. With the right policies and investments, STZs can attract top talent, foster collaboration between academia and industry, and promote the development of new products, services, and technologies that can transform entire sectors.

Fostering Startups and Entrepreneurship

Startups are crucial to the growth and innovation of the tech industry. They bring fresh ideas, disruptive solutions, and new perspectives that challenge the status quo. Small Technology Zones (STZs) can play a vital role in fostering a supportive and collaborative environment where startups can thrive. By providing access to resources, mentorship, networking opportunities, and a sense of community, STZs can help startups overcome challenges realize their full potential.

The Importance of Collaboration

Public-Private Partnerships

Collaboration between the government and private sector is pivotal in the success of STZs. This section will emphasize the importance of such partnerships.

Global Integration

Special Technology Zones (STZs) in Pakistan have the potential to act as a conduit between the country and the global tech industry. Given this, it is imperative to explore the possibilities of forging international partnerships and collaborations that can emerge from these zones.

Knowledge Transfer and Skill Exchange

Facilitating the exchange of knowledge and skills is essential for the growth of STZs. Highlighting how these zones can foster such exchanges is of great importance.

Conclusion: A Bright Future for Pakistan

The development of Special Technology Zones in Pakistan offers a promising path to a brighter future. By harnessing the potential of technology, attracting foreign investment, and fostering innovation, these zones have the potential to reshape the economic landscape of the nation. The possibilities are vast, and the importance of this endeavour cannot be overstated. As Pakistan marches forward in the digital age, the creation of STZs is a visionary step that holds immense prospects and significance.

With a commitment to innovation and collaboration, Pakistan can position itself on the global tech map and become a beacon of progress and prosperity. The future is indeed bright for Pakistan, and the development of Special Technology Zones is the key to unlocking its full potential.

In a world where technology is the driving force of progress, Pakistan’s journey in establishing STZs is a step in the right direction. The road ahead is paved with opportunities, and the importance of this endeavor is crystal clear. As we move forward, let us embrace the possibilities and work collectively towards a tech-savvy and economically robust Pakistan.

Economy

10 Emerging Economies to Watch in 2024:Uncovering the Next Global Economic Powerhouses

As we move into 2024, the global economic landscape is undergoing a profound transformation. While the traditional economic superpowers continue to play a significant role, a new generation of emerging economies is poised to take center stage. These dynamic markets, driven by a combination of favorable demographics, technological advancements, and strategic policy decisions, are set to reshape the international economic order in the years to come.

In this comprehensive blog post, we will delve into the 10 emerging economies that are expected to make waves in 2024 and beyond. By analyzing their key economic indicators, growth trajectories, and unique competitive advantages, we will provide a well-researched and insightful perspective on the future of the global economy.

1. India: The Ascent of a Demographic Powerhouse

As the world’s second-most populous country, India has long been recognized as a sleeping giant in the global economy. However, in recent years, the country has been awakening to its true potential, with a series of strategic reforms and policy initiatives that have propelled it to the forefront of emerging markets.

In 2024, India is poised to cement its position as a leading economic force, driven by its young and rapidly growing population, a thriving technology sector, and a renewed focus on infrastructure development and manufacturing. With a projected GDP growth rate of over 7% for the year, India is set to outpace many of its peers, solidifying its status as a must-watch economy.

Key factors contributing to India’s rise:

- Demographic dividend: India’s median age of just 28 years, coupled with a burgeoning middle class, provides a vast pool of skilled labor and consumer demand.

- Technological innovation: India’s tech hubs, such as Bangalore and Hyderabad, are driving advancements in sectors like IT, software development, and e-commerce.

- Infrastructure investment: The Indian government’s ambitious infrastructure projects, including the development of high-speed rail and modernized airports, are enhancing connectivity and productivity.

- Manufacturing potential: With initiatives like “Make in India,” the country is positioning itself as a global manufacturing hub, attracting foreign direct investment (FDI) and boosting exports.

2. Vietnam: The Emerging Asian Tiger

Once known primarily for its tumultuous history, Vietnam has emerged as a true economic powerhouse in recent years, earning the moniker of the “Asian Tiger.” This Southeast Asian nation has leveraged its strategic location, favorable demographics, and pro-business policies to become a global manufacturing hub and a rising star in the international trade arena.

In 2024, Vietnam is expected to continue its impressive growth trajectory, with a projected GDP expansion of over 6.5%. This remarkable performance can be attributed to several key factors:

- Manufacturing prowess: Vietnam has become a preferred destination for multinational companies seeking to diversify their supply chains, particularly in the wake of the COVID-19 pandemic and the US-China trade tensions.

- Export-driven economy: The country’s thriving export sector, which includes products ranging from electronics to textiles and agricultural goods, has been a significant driver of economic growth.

- Foreign direct investment: Vietnam’s business-friendly environment and strategic location have attracted substantial FDI, further fueling its industrial development and integration into global value chains.

- Demographic dividend: With a median age of just 32 years and a growing middle class, Vietnam boasts a young, dynamic, and increasingly affluent population that is driving domestic consumption and entrepreneurial activity.

3. Indonesia: The Archipelagic Powerhouse

Spanning over 17,000 islands, Indonesia has long been recognized as a sleeping giant in the global economy. However, in recent years, this Southeast Asian nation has been steadily awakening to its true potential, transforming itself into a formidable economic force to be reckoned with.

In 2024, Indonesia is poised to cement its position as a leading emerging market, with a projected GDP growth rate of around 5.5%. This impressive performance can be attributed to a combination of factors, including:

- Demographic dividend: Indonesia’s large and youthful population, with a median age of just 30 years, provides a vast pool of labor and a growing consumer base.

- Urbanization and infrastructure development: The Indonesian government’s focus on improving transportation, telecommunications, and other critical infrastructure is enhancing connectivity and productivity across the archipelago.

- Diversified economy: Indonesia’s economy is well-balanced, with significant contributions from sectors such as manufacturing, agriculture, tourism, and a rapidly growing digital economy.

- Domestic consumption: The rise of the Indonesian middle class, coupled with increasing disposable incomes, is driving robust domestic demand and fueling economic growth.

4. Mexico: The North American Powerhouse

Mexico, the second-largest economy in Latin America, has long been a key player in the global economic landscape. However, in recent years, the country has been undergoing a remarkable transformation, positioning itself as a formidable emerging economy with significant growth potential.

In 2024, Mexico is expected to continue its upward trajectory, with a projected GDP growth rate of around 4.5%. This performance can be attributed to several factors, including:

- Manufacturing hub: Mexico’s strategic location, proximity to the United States, and competitive labor costs have made it a prime destination for manufacturing operations, particularly in the automotive and electronics sectors.

- Trade agreements: Mexico’s extensive network of free trade agreements, including the United States-Mexico-Canada Agreement (USMCA), has opened up new markets and opportunities for Mexican exports.

- Demographic dividend: Mexico’s young and growing population, with a median age of just 29 years, provides a vast pool of skilled labor and a burgeoning consumer base.

- Diversified economy: Mexico’s economy is well-balanced, with significant contributions from sectors such as manufacturing, tourism, and a rapidly expanding services sector, including a thriving tech industry.

5. Poland: The European Powerhouse in the Making

Poland, a member of the European Union, has been quietly emerging as a formidable economic force in the region. With a strategic location at the heart of Europe, a skilled workforce, and a pro-business environment, Poland is poised to make waves in the global economy in 2024 and beyond.

In 2024, Poland is expected to post a GDP growth rate of around 4%, outpacing many of its European counterparts. This impressive performance can be attributed to several key factors:

- Manufacturing prowess: Poland has become a hub for manufacturing, particularly in the automotive, electronics, and machinery sectors, attracting significant foreign direct investment.

- EU integration: Poland’s membership in the European Union has provided access to the vast single market, as well as EU structural funds and investment programs that have bolstered infrastructure and economic development.

- Skilled workforce: Poland boasts a highly educated and skilled workforce, with a strong focus on STEM (Science, Technology, Engineering, and Mathematics) education, fueling innovation and productivity.

- Domestic consumption: The rise of the Polish middle class, coupled with increasing disposable incomes, is driving robust domestic demand and fueling economic growth.

6. Bangladesh: The Emerging Textile Powerhouse

Bangladesh, a South Asian nation, has long been known for its thriving textile industry, which has been a significant driver of its economic growth. However, in recent years, the country has been diversifying its economy and positioning itself as a multi-faceted emerging market with immense potential.

In 2024, Bangladesh is expected to post a GDP growth rate of around 7%, cementing its status as one of the fastest-growing economies in the world. This remarkable performance can be attributed to several key factors:

- Textile industry dominance: Bangladesh has firmly established itself as a global leader in the textile and garment manufacturing industry, accounting for a significant share of the world’s apparel exports.

- Diversification efforts: The Bangladeshi government has been actively promoting the diversification of the economy, with a focus on sectors such as pharmaceuticals, information technology, and renewable energy.

- Demographic dividend: Bangladesh’s large and youthful population, with a median age of just 27 years, provides a vast pool of skilled labor and a growing consumer base.

- Infrastructure development: Investments in transportation, power generation, and telecommunications infrastructure are enhancing connectivity and productivity across the country.

7. Egypt: The Resurgent North African Giant

Egypt, the most populous country in the Arab world, has long been a pivotal player in the Middle East and North African region. In recent years, the country has been undergoing a remarkable economic transformation, positioning itself as a rising force in the global economy.

In 2024, Egypt is expected to post a GDP growth rate of around 5.5%, driven by a combination of factors, including:

- Strategic location: Egypt’s strategic location at the crossroads of Africa, the Middle East, and the Mediterranean has made it a hub for trade, logistics, and investment.

- Infrastructure development: The Egyptian government has been investing heavily in infrastructure projects, such as the expansion of the Suez Canal and the development of new cities, enhancing the country’s connectivity and productivity.

- Diversified economy: Egypt’s economy is well-balanced, with significant contributions from sectors such as tourism, agriculture, manufacturing, and a rapidly growing services sector, including a thriving tech industry.

- Demographic dividend: Egypt’s large and youthful population, with a median age of just 24 years, provides a vast pool of labor and a growing consumer base.

8. Malaysia: The Resilient Asian Tiger

Malaysia, a Southeast Asian nation, has long been recognized as one of the “Asian Tigers” – a group of highly industrialized and prosperous economies in the region. In recent years, the country has been navigating through various economic challenges, but its resilience and adaptability have positioned it as a rising force in the global economy.

In 2024, Malaysia is expected to post a GDP growth rate of around 5%, driven by a combination of factors, including:

- Diversified economy: Malaysia’s economy is well-balanced, with significant contributions from sectors such as manufacturing, services, agriculture, and a rapidly growing digital economy.

- Foreign direct investment: Malaysia has been successful in attracting foreign direct investment, particularly in high-tech industries and advanced manufacturing, leveraging its strategic location and skilled workforce.

- Infrastructure development: The Malaysian government has been investing heavily in infrastructure projects, such as the development of high-speed rail and the expansion of ports, enhancing the country’s connectivity and productivity.

- Demographic dividend: Malaysia’s relatively young population, with a median age of just 29 years, provides a vast pool of skilled labor and a growing consumer base.

9. Colombia: The Emerging Latin American Powerhouse

Colombia, the fourth-largest economy in Latin America, has been steadily emerging as a force to be reckoned with in the global economy. After overcoming various challenges in the past, the country has been implementing a series of reforms and initiatives that have propelled it to the forefront of emerging markets.

In 2024, Colombia is expected to post a GDP growth rate of around 4.5%, driven by a combination of factors, including:

- Diversified economy: Colombia’s economy is well-balanced, with significant contributions from sectors such as mining, agriculture, manufacturing, and a rapidly growing services sector, including a thriving tech industry.

- Trade agreements: Colombia’s extensive network of free trade agreements, including with the United States, the European Union, and various Latin American countries, has opened up new markets and opportunities for Colombian exports.

- Infrastructure development: The Colombian government has been investing heavily in infrastructure projects, such as the expansion of transportation networks and the modernization of ports, enhancing the country’s connectivity and productivity.

- Political and economic stability: After years of internal conflict, Colombia has achieved a remarkable level of political and economic stability, which has bolstered investor confidence and fueled economic growth.

10. Kenya: The Emerging African Powerhouse

Kenya, the economic powerhouse of East Africa, has been steadily emerging as a force to be reckoned with in the global economy. With a diverse and resilient economy, a young and dynamic population, and a strategic location, Kenya is poised to make waves in 2024 and beyond.

In 2024, Kenya is expected to post a GDP growth rate of around 6%, driven by a combination of factors, including:

- Diversified economy: Kenya’s economy is well-balanced, with significant contributions from sectors such as agriculture, manufacturing, tourism, and a rapidly growing services sector, including a thriving tech industry.

- Technological innovation: Kenya has been at the forefront of technological innovation in Africa, with the development of groundbreaking mobile payment systems and a thriving startup ecosystem.

- Infrastructure development: The Kenyan government has been investing heavily in infrastructure projects, such as the construction of new roads, railways, and ports, enhancing the country’s connectivity and productivity.

- Demographic dividend: Kenya’s large and youthful population, with a median age of just 20 years, provides a vast pool of labor and a growing consumer base.

Conclusion: Embracing the Emerging Economies of the Future

As we look ahead to 2024 and beyond, the global economic landscape is poised for a profound transformation. The 10 emerging economies highlighted in this blog post – India, Vietnam, Indonesia, Mexico, Poland, Bangladesh, Egypt, Malaysia, Colombia, and Kenya – are set to play a pivotal role in shaping the future of the global economy.

These dynamic markets, driven by a combination of favorable demographics, technological advancements, strategic policy decisions, and a relentless pursuit of economic diversification, are poised to challenge the traditional economic order. By capitalizing on their unique strengths and competitive advantages, these emerging economies are set to become the economic powerhouses of the future.

As investors, policymakers, and global citizens, it is crucial to closely monitor the developments in these emerging markets and to recognize the immense opportunities they present. By embracing the growth and innovation emanating from these dynamic economies, we can collectively shape a more prosperous and interconnected global economic landscape in the years to come.

Business

Uniti and Windstream Reunite in a $13.4 Billion Merger: A Strategic Analysis

Windstream and Uniti, two major companies in the telecommunications and real estate sectors in the US, have recently decided to come together in a merger deal worth $13.4 billion. With the approval of both companies’ boards of directors, this merger marks a significant reunion after years of legal disputes and separation.

Uniti Group, a real estate investment trust specializing in wireless towers and fibre operations, and Windstream, a broadband and telecommunications company with a strong presence in the Midwest and Southeastern regions of the United States, are now set to join forces and create a formidable entity in the industry.

Background and History

Uniti Group, formerly known as CS&L, was spun off from Windstream nearly a decade ago. The two entities have a complex history, including legal disputes over contract arrangements that contributed to Windstream’s reorganization bankruptcy in the late 2010s. Windstream has been Uniti’s largest customer, and the merger aims to eliminate dis-synergies that existed in their previous landlord/tenant relationship.

Financial Details and Strategic Implications

The merger involves approximately $4.4 billion in company revenues, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. The combined company is set to serve over 1.1 million customers and 1.5 million existing homes, with a strong focus on expanding fiber-to-the-home (FTTH) buildouts. This strategic move aligns with the increasing demand for fiber broadband services and positions Uniti to enhance its financial profile and strategic initiatives.

Leadership and Operational Structure

Uniti’s President and CEO, Kenny Gunderman, along with Paul Bullington, Uniti’s CFO, will lead the merged company. Key members of Windstream’s management team are expected to continue with the combined entity. The merged firm will operate under the Uniti name, trading under the ticker symbol “UNIT,” and will be headquartered in Little Rock.

Investor Confidence and Market Outlook

Elliott Investment Management, Windstream’s largest shareholder, has expressed support for the merger, citing the compelling strategic rationale and potential for enhanced value creation. The combined company is expected to leverage Uniti’s focused strategy, unique positioning, and experienced management team to capitalize on growth opportunities in the telecommunications and broadband market.

Regulatory and Shareholder Approval

The transaction is anticipated to close in the second half of 2025, subject to regulatory approvals and shareholder consent. The merger is poised to create a national fiber powerhouse that aims to bridge the digital divide and deliver innovative solutions to customers across the Midwest and Southeastern U.S.

In conclusion, the reunion of Windstream and Uniti through this merger signifies a strategic alignment that promises to unlock synergies, drive growth, and enhance value creation in the telecommunications and broadband industry. With a strong leadership team, a clear strategic vision, and investor support, the combined entity is well-positioned to capitalize on the growing demand for fiber broadband services and shape the future of connectivity in the digital age.

Analysis

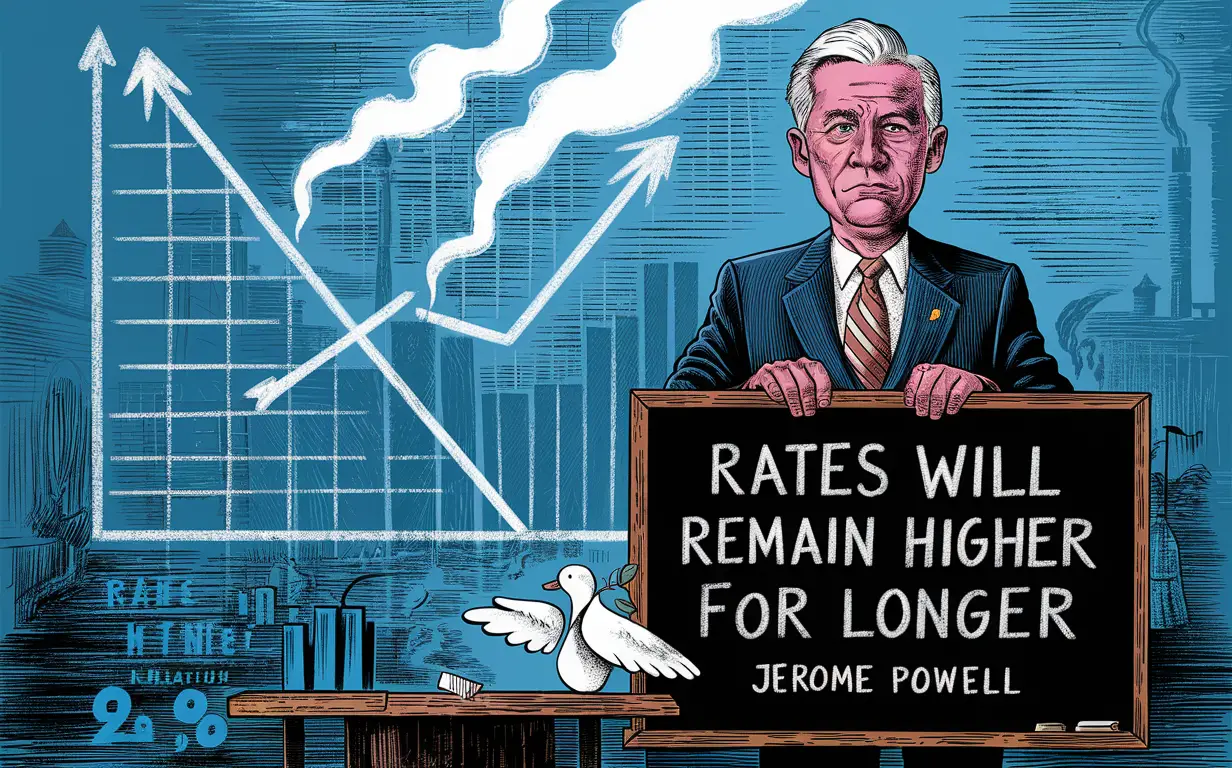

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?