News

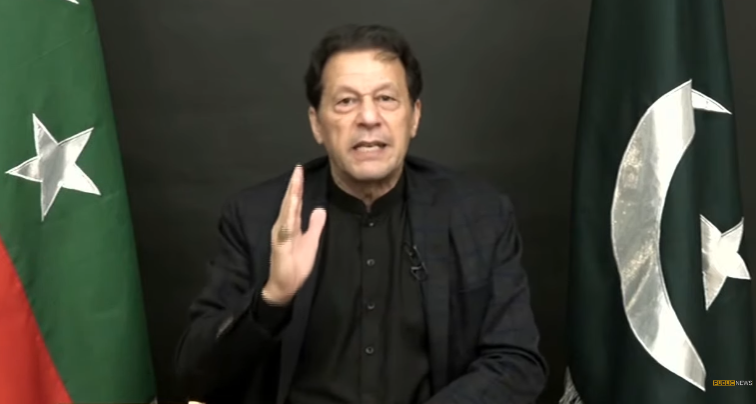

Imran reiterates demand for ‘free and fair’ polls as tussle between govt, opposition deepens in Punjab

Former prime minister and Pakistan Tehreek-e-Insaf (PTI) Chairman Imran Khan on Thursday reiterated the demand for “free and fair polls” as his party’s supporters gathered outside the Punjab Governor House in Lahore to protest against Balighur Rehman’s possible decision to de-notify Chief Minister Chaudhry Parvez Elahi, Aaj News reported.

Addressing his party supporters and parliamentarians, Imran said: “There is a strange environment. Initially, the PML-N was challenging us to dissolve assemblies, saying that they were ready for elections. But when we did that, a vote of confidence and no-trust motions were moved in the Punjab Assembly.

“I believe that never in the 70 years of my life have I seen my nation head towards such darkness.”

Imran’s criticism of Gen Qamar Bajwa (retd) continues

Imran said that one man had plunged the country into a crisis, as he accused the former army chief General Qamar Bajwa (retd) of sidelining his party.

Last week, former premier Imran Khan spoke in detail about his government’s ouster via a no-confidence motion earlier this year.

Imran said that he had a “personal” dispute with former army chief General Qamar Javed Bajwa (Retd) but he will not take any action against him if he comes into power again.

“My question today is, who was responsible for this regime change? Only one man is responsible: General Bajwa,” he said.

“I didn’t speak out against him because he was the army chief. We want our army to be strong so we kept quiet and kept looking at how the conspiracy happened.”

He said the former army chief had “decided to remove his government,” alleging that General Qamar Javed Bajwa (retired) gave “NRO 2” to the ruling coalition.

Imran’s criticism of the former army chief continued even after Chief Minister Punjab Chaudhry Parvez Elahi said on Sunday that he will be the first one to defend General Qamar Javed Bajwa (retired) if he is unduly criticised by anyone in the future.

“I felt very bad when Imran Khan spoke against Gen Bajwa (retd) while having me seated beside him,” Parvez said adding that the former army chief was a “benefactor” and nothing should be said against benefactors.

“Gen Bajwa gave many favours to the PTI government, therefore, the favours shouldn’t be forgotten,” the Punjab CM reminded the PTI chief.

PTI chief claims coalition govt running away from elections

In his address today, Imran claimed that the coalition government is running away from elections.

“The convict sitting abroad and Zardari are scared,” he said.

“They have a one-point agenda to hide their theft and they will hurt the country in the process. They won’t think about Pakistan once. All they want is an NRO 2,” he alleged.

‘Refrain from any adventures’: PTI tells Balighur Rehman

On Wednesday, PTI leader Fawad Chaudhry warned Punjab Governor Balighur Rehman to “refrain from any adventures” as the party stated that Punjab Chief Minister Chaudhry Parvez Elahi will not be seeking a vote of confidence today on Wednesday (Dec 21).

“Ten lawmakers of PML-Q have also expressed confidence in the chief minister. Tomorrow, 177 PTI MPAs will gather in favour of Elahi,” he said, adding that the political crisis in Punjab was a reflection of the need for snap polls.

The tussle between the government and the opposition continues to deepen since PTI Chairman Imran Khan announced the dissolution of the assemblies in Punjab and Khyber Pakhtunkhwa on Dec 23, with the PML-N and allies deliberating on ways to prevent the move.

Earlier this week, Punjab Governor Muhammad Baligh-ur-Rehman had asked Chief Minister Parvez Elahi to seek a vote of confidence.

Former premier says one man’s animosity with his party plunged the country into a crisis

Responding to Rehman’s order, Punjab Assembly Speaker Sibtain Khan called Governor Punjab’s move for calling a fresh session of the provincial assembly illegal.

Late on Wednesday, Punjab Governor Balighur Rehman termed the ruling of Punjab Assembly Speaker Sibtain Khan regarding Chief Minister Pervez Elahi’s vote of confidence “unconstitutional and illegal.”

Rehman, in his response, addressed two main concerns raised in Khan’s ruling. Regarding the first concern, the governor said he had implied in his Dec 19 order that “if the ongoing session was prorogued by your good self (PA speaker)” any time before 4pm today then “a new session was required to be summoned” at 4pm today for the vote of confidence.

“In the alternate, a sitting of the assembly at the noted time and date could have been summoned in the 41st session of the assembly, which your good self has also noted that it was summoned by me and was never prorogued; or a fresh session specifically summoned for the purposes of requiring the chief minister to obtain the vote of confidence,” the order reads.

Punjab number game

After Punjab Governor Balighur Rehman asked Punjab CM Parvez Elahi to seek a vote of confidence from the assembly, the number game in the Punjab Assembly is once again in the spotlight.

Parvez Elahi needs the magic number of 186 in the 371-strong House to show the majority and thwart PML-N’s attempt to remove him from office.

The PTI-PML-Q alliance has a total of 190 votes (180 +10). On the other hand, the opposition alliance has the support of 180 lawmakers, including 167 from the PML-N, seven from the PPP, five independent lawmakers, and one from the Rah-i-Haq Party.

Via BR

Technology

Microsoft’s Emissions Surge by 30% Amidst AI Expansion: Sustainability Challenges and Solutions

In a time when artificial intelligence (AI) is rapidly reshaping various sectors and our daily routines, industry leaders such as Microsoft are spearheading this transformation. However, this progress raises significant environmental concerns. Over the past year, Microsoft has seen a substantial surge in its carbon emissions, marking an increase of nearly 30%. This rise is directly associated with the company’s ambitious efforts to meet the growing demand for AI technologies. This piece will explore the factors contributing to this uptick, its consequences, and potential measures to lessen its environmental impact.

The AI Boom and Microsoft’s Role

A Surge in AI Development

Artificial intelligence has become an integral part of modern technology. From enhancing search engine algorithms to developing sophisticated machine learning models for healthcare, AI’s potential is vast and transformative. Microsoft, a key player in the tech industry, has heavily invested in AI research and development. Its Azure cloud platform, AI services, and tools like Azure Machine Learning are critical in the deployment of AI solutions across various sectors.

Meeting AI Demand

The demand for AI technologies has surged, driven by industries seeking to automate processes, gain insights from big data, and improve customer experiences. Microsoft’s commitment to meeting this demand is evident in its continuous expansion of data centers and increased computational power to support complex AI operations. However, this expansion is energy-intensive and has contributed significantly to the company’s carbon footprint.

Understanding the Emissions Increase

Energy Consumption in Data Centers

Data centers are the backbone of AI operations, housing servers that process and store vast amounts of data. These facilities require enormous amounts of electricity to run and cool the servers, leading to high energy consumption. As Microsoft expands its data center infrastructure to accommodate the growing AI workload, its energy use has surged correspondingly. This energy consumption is a primary factor behind the near 30% increase in emissions.

The Carbon Footprint of AI Training

Training AI models, particularly deep learning models, is a computationally intensive task. It involves running numerous algorithms and processing large datasets over extended periods. This process demands substantial computing power, which in turn consumes significant energy. The carbon footprint of training a single large AI model can be equivalent to the emissions from multiple cars over their lifetime. As Microsoft develops and deploys more sophisticated AI models, the associated energy use and emissions have escalated.

Environmental Implications

Contribution to Global Warming

The increase in Microsoft’s emissions has direct implications for global warming. Greenhouse gases, such as carbon dioxide (CO2), released from energy consumption in data centers contribute to the greenhouse effect, trapping heat in the Earth’s atmosphere. This exacerbates climate change, leading to extreme weather patterns, rising sea levels, and biodiversity loss.

Corporate Responsibility and Sustainability Goals

Microsoft has been vocal about its commitment to sustainability, with ambitious goals to become carbon negative by 2030. The recent spike in emissions poses a challenge to these goals, highlighting the tension between technological advancement and environmental responsibility. The company now faces increased scrutiny from stakeholders, including customers, investors, and environmental groups, to uphold its sustainability promises.

Strategies for Reducing Emissions

Transition to Renewable Energy

One of the most effective ways for Microsoft to mitigate its carbon footprint is by transitioning to renewable energy sources. Renewable energy, such as wind, solar, and hydroelectric power, produces minimal greenhouse gas emissions compared to fossil fuels. Microsoft has already made strides in this direction, signing numerous renewable energy agreements to power its data centers. Continuing and expanding these efforts is crucial to reducing its overall emissions.

Enhancing Energy Efficiency

Improving the energy efficiency of data centers can significantly reduce emissions. This can be achieved through several measures, including optimizing server utilization, implementing advanced cooling technologies, and designing data centers with energy-efficient architectures. Microsoft has been investing in cutting-edge cooling techniques, such as liquid cooling and free-air cooling, to enhance the efficiency of its data centers. Further innovations in this area are essential to curbing energy use.

AI for Sustainability

Ironically, AI itself can be a powerful tool for enhancing sustainability. Microsoft is leveraging AI to improve the efficiency of its operations and reduce emissions. For example, AI can optimize energy consumption in data centers by predicting and managing workloads more effectively. Additionally, AI can be used to monitor and manage renewable energy sources, ensuring optimal performance and integration into the power grid. These applications of AI can help Microsoft achieve a more sustainable operational model.

The Broader Impact on the Tech Industry

Setting a Precedent

Microsoft’s situation is not unique; other tech giants like Google, Amazon, and Facebook are also grappling with the environmental impacts of their expanding AI capabilities. The steps Microsoft takes to address its emissions will set a precedent for the industry. By adopting sustainable practices and technologies, Microsoft can lead the way in demonstrating that it is possible to balance technological growth with environmental stewardship.

Industry Collaboration

Addressing the environmental impact of AI and data centers requires industry-wide collaboration. Tech companies can share best practices, invest in joint research initiatives, and advocate for policies that promote sustainability. Collaborative efforts can accelerate the development and adoption of green technologies, making the entire industry more sustainable.

The Role of Policy and Regulation

Government Incentives

Government policies and incentives play a crucial role in encouraging companies to adopt sustainable practices. Subsidies for renewable energy projects, tax breaks for energy-efficient technologies, and grants for research in green technologies can motivate companies like Microsoft to invest more heavily in sustainability. By aligning corporate goals with national and international environmental targets, policy makers can drive significant progress in reducing emissions.

Regulatory Standards

Setting regulatory standards for emissions and energy use in the tech industry can ensure that all companies adhere to minimum environmental requirements. These standards can be enforced through reporting requirements, emissions caps, and penalties for non-compliance. A robust regulatory framework can compel companies to prioritize sustainability alongside growth and innovation.

Microsoft’s Future Sustainability Plans

Carbon Negative by 2030

Microsoft’s pledge to become carbon negative by 2030 is a bold commitment that requires substantial efforts across all aspects of its operations. This goal means not only reducing its emissions but also actively removing more carbon from the atmosphere than it emits. Achieving this will involve scaling up renewable energy use, enhancing energy efficiency, investing in carbon removal technologies, and offsetting any remaining emissions.

Innovative Technologies

Microsoft is exploring various innovative technologies to achieve its sustainability goals. These include advancements in carbon capture and storage (CCS), which can sequester CO2 emissions from industrial processes and store them underground. Additionally, Microsoft is investing in nature-based solutions, such as reforestation and soil carbon sequestration, which leverage natural processes to absorb CO2 from the atmosphere.

Partnering for Sustainability

Microsoft recognizes that achieving its sustainability goals requires collaboration with partners across the value chain. This includes working with suppliers to reduce their emissions, collaborating with customers to implement sustainable solutions, and partnering with environmental organizations to advance research and advocacy. By fostering a network of sustainability-focused partners, Microsoft can amplify its impact.

Conclusion

Microsoft’s near 30% increase in emissions underscores the complex challenge of balancing technological advancement with environmental responsibility. As the demand for AI technologies continues to grow, it is imperative for tech giants like Microsoft to lead the way in adopting sustainable practices. Through a combination of renewable energy adoption, energy efficiency improvements, AI for sustainability, industry collaboration, and supportive policies, Microsoft can navigate this challenge and achieve its ambitious sustainability goals. The steps taken by Microsoft will not only shape its own environmental impact but also set a standard for the broader tech industry. As we move forward in the AI-driven future, sustainability must remain at the forefront of technological innovation.

Economy

10 Emerging Economies to Watch in 2024:Uncovering the Next Global Economic Powerhouses

As we move into 2024, the global economic landscape is undergoing a profound transformation. While the traditional economic superpowers continue to play a significant role, a new generation of emerging economies is poised to take center stage. These dynamic markets, driven by a combination of favorable demographics, technological advancements, and strategic policy decisions, are set to reshape the international economic order in the years to come.

In this comprehensive blog post, we will delve into the 10 emerging economies that are expected to make waves in 2024 and beyond. By analyzing their key economic indicators, growth trajectories, and unique competitive advantages, we will provide a well-researched and insightful perspective on the future of the global economy.

1. India: The Ascent of a Demographic Powerhouse

As the world’s second-most populous country, India has long been recognized as a sleeping giant in the global economy. However, in recent years, the country has been awakening to its true potential, with a series of strategic reforms and policy initiatives that have propelled it to the forefront of emerging markets.

In 2024, India is poised to cement its position as a leading economic force, driven by its young and rapidly growing population, a thriving technology sector, and a renewed focus on infrastructure development and manufacturing. With a projected GDP growth rate of over 7% for the year, India is set to outpace many of its peers, solidifying its status as a must-watch economy.

Key factors contributing to India’s rise:

- Demographic dividend: India’s median age of just 28 years, coupled with a burgeoning middle class, provides a vast pool of skilled labor and consumer demand.

- Technological innovation: India’s tech hubs, such as Bangalore and Hyderabad, are driving advancements in sectors like IT, software development, and e-commerce.

- Infrastructure investment: The Indian government’s ambitious infrastructure projects, including the development of high-speed rail and modernized airports, are enhancing connectivity and productivity.

- Manufacturing potential: With initiatives like “Make in India,” the country is positioning itself as a global manufacturing hub, attracting foreign direct investment (FDI) and boosting exports.

2. Vietnam: The Emerging Asian Tiger

Once known primarily for its tumultuous history, Vietnam has emerged as a true economic powerhouse in recent years, earning the moniker of the “Asian Tiger.” This Southeast Asian nation has leveraged its strategic location, favorable demographics, and pro-business policies to become a global manufacturing hub and a rising star in the international trade arena.

In 2024, Vietnam is expected to continue its impressive growth trajectory, with a projected GDP expansion of over 6.5%. This remarkable performance can be attributed to several key factors:

- Manufacturing prowess: Vietnam has become a preferred destination for multinational companies seeking to diversify their supply chains, particularly in the wake of the COVID-19 pandemic and the US-China trade tensions.

- Export-driven economy: The country’s thriving export sector, which includes products ranging from electronics to textiles and agricultural goods, has been a significant driver of economic growth.

- Foreign direct investment: Vietnam’s business-friendly environment and strategic location have attracted substantial FDI, further fueling its industrial development and integration into global value chains.

- Demographic dividend: With a median age of just 32 years and a growing middle class, Vietnam boasts a young, dynamic, and increasingly affluent population that is driving domestic consumption and entrepreneurial activity.

3. Indonesia: The Archipelagic Powerhouse

Spanning over 17,000 islands, Indonesia has long been recognized as a sleeping giant in the global economy. However, in recent years, this Southeast Asian nation has been steadily awakening to its true potential, transforming itself into a formidable economic force to be reckoned with.

In 2024, Indonesia is poised to cement its position as a leading emerging market, with a projected GDP growth rate of around 5.5%. This impressive performance can be attributed to a combination of factors, including:

- Demographic dividend: Indonesia’s large and youthful population, with a median age of just 30 years, provides a vast pool of labor and a growing consumer base.

- Urbanization and infrastructure development: The Indonesian government’s focus on improving transportation, telecommunications, and other critical infrastructure is enhancing connectivity and productivity across the archipelago.

- Diversified economy: Indonesia’s economy is well-balanced, with significant contributions from sectors such as manufacturing, agriculture, tourism, and a rapidly growing digital economy.

- Domestic consumption: The rise of the Indonesian middle class, coupled with increasing disposable incomes, is driving robust domestic demand and fueling economic growth.

4. Mexico: The North American Powerhouse

Mexico, the second-largest economy in Latin America, has long been a key player in the global economic landscape. However, in recent years, the country has been undergoing a remarkable transformation, positioning itself as a formidable emerging economy with significant growth potential.

In 2024, Mexico is expected to continue its upward trajectory, with a projected GDP growth rate of around 4.5%. This performance can be attributed to several factors, including:

- Manufacturing hub: Mexico’s strategic location, proximity to the United States, and competitive labor costs have made it a prime destination for manufacturing operations, particularly in the automotive and electronics sectors.

- Trade agreements: Mexico’s extensive network of free trade agreements, including the United States-Mexico-Canada Agreement (USMCA), has opened up new markets and opportunities for Mexican exports.

- Demographic dividend: Mexico’s young and growing population, with a median age of just 29 years, provides a vast pool of skilled labor and a burgeoning consumer base.

- Diversified economy: Mexico’s economy is well-balanced, with significant contributions from sectors such as manufacturing, tourism, and a rapidly expanding services sector, including a thriving tech industry.

5. Poland: The European Powerhouse in the Making

Poland, a member of the European Union, has been quietly emerging as a formidable economic force in the region. With a strategic location at the heart of Europe, a skilled workforce, and a pro-business environment, Poland is poised to make waves in the global economy in 2024 and beyond.

In 2024, Poland is expected to post a GDP growth rate of around 4%, outpacing many of its European counterparts. This impressive performance can be attributed to several key factors:

- Manufacturing prowess: Poland has become a hub for manufacturing, particularly in the automotive, electronics, and machinery sectors, attracting significant foreign direct investment.

- EU integration: Poland’s membership in the European Union has provided access to the vast single market, as well as EU structural funds and investment programs that have bolstered infrastructure and economic development.

- Skilled workforce: Poland boasts a highly educated and skilled workforce, with a strong focus on STEM (Science, Technology, Engineering, and Mathematics) education, fueling innovation and productivity.

- Domestic consumption: The rise of the Polish middle class, coupled with increasing disposable incomes, is driving robust domestic demand and fueling economic growth.

6. Bangladesh: The Emerging Textile Powerhouse

Bangladesh, a South Asian nation, has long been known for its thriving textile industry, which has been a significant driver of its economic growth. However, in recent years, the country has been diversifying its economy and positioning itself as a multi-faceted emerging market with immense potential.

In 2024, Bangladesh is expected to post a GDP growth rate of around 7%, cementing its status as one of the fastest-growing economies in the world. This remarkable performance can be attributed to several key factors:

- Textile industry dominance: Bangladesh has firmly established itself as a global leader in the textile and garment manufacturing industry, accounting for a significant share of the world’s apparel exports.

- Diversification efforts: The Bangladeshi government has been actively promoting the diversification of the economy, with a focus on sectors such as pharmaceuticals, information technology, and renewable energy.

- Demographic dividend: Bangladesh’s large and youthful population, with a median age of just 27 years, provides a vast pool of skilled labor and a growing consumer base.

- Infrastructure development: Investments in transportation, power generation, and telecommunications infrastructure are enhancing connectivity and productivity across the country.

7. Egypt: The Resurgent North African Giant

Egypt, the most populous country in the Arab world, has long been a pivotal player in the Middle East and North African region. In recent years, the country has been undergoing a remarkable economic transformation, positioning itself as a rising force in the global economy.

In 2024, Egypt is expected to post a GDP growth rate of around 5.5%, driven by a combination of factors, including:

- Strategic location: Egypt’s strategic location at the crossroads of Africa, the Middle East, and the Mediterranean has made it a hub for trade, logistics, and investment.

- Infrastructure development: The Egyptian government has been investing heavily in infrastructure projects, such as the expansion of the Suez Canal and the development of new cities, enhancing the country’s connectivity and productivity.

- Diversified economy: Egypt’s economy is well-balanced, with significant contributions from sectors such as tourism, agriculture, manufacturing, and a rapidly growing services sector, including a thriving tech industry.

- Demographic dividend: Egypt’s large and youthful population, with a median age of just 24 years, provides a vast pool of labor and a growing consumer base.

8. Malaysia: The Resilient Asian Tiger

Malaysia, a Southeast Asian nation, has long been recognized as one of the “Asian Tigers” – a group of highly industrialized and prosperous economies in the region. In recent years, the country has been navigating through various economic challenges, but its resilience and adaptability have positioned it as a rising force in the global economy.

In 2024, Malaysia is expected to post a GDP growth rate of around 5%, driven by a combination of factors, including:

- Diversified economy: Malaysia’s economy is well-balanced, with significant contributions from sectors such as manufacturing, services, agriculture, and a rapidly growing digital economy.

- Foreign direct investment: Malaysia has been successful in attracting foreign direct investment, particularly in high-tech industries and advanced manufacturing, leveraging its strategic location and skilled workforce.

- Infrastructure development: The Malaysian government has been investing heavily in infrastructure projects, such as the development of high-speed rail and the expansion of ports, enhancing the country’s connectivity and productivity.

- Demographic dividend: Malaysia’s relatively young population, with a median age of just 29 years, provides a vast pool of skilled labor and a growing consumer base.

9. Colombia: The Emerging Latin American Powerhouse

Colombia, the fourth-largest economy in Latin America, has been steadily emerging as a force to be reckoned with in the global economy. After overcoming various challenges in the past, the country has been implementing a series of reforms and initiatives that have propelled it to the forefront of emerging markets.

In 2024, Colombia is expected to post a GDP growth rate of around 4.5%, driven by a combination of factors, including:

- Diversified economy: Colombia’s economy is well-balanced, with significant contributions from sectors such as mining, agriculture, manufacturing, and a rapidly growing services sector, including a thriving tech industry.

- Trade agreements: Colombia’s extensive network of free trade agreements, including with the United States, the European Union, and various Latin American countries, has opened up new markets and opportunities for Colombian exports.

- Infrastructure development: The Colombian government has been investing heavily in infrastructure projects, such as the expansion of transportation networks and the modernization of ports, enhancing the country’s connectivity and productivity.

- Political and economic stability: After years of internal conflict, Colombia has achieved a remarkable level of political and economic stability, which has bolstered investor confidence and fueled economic growth.

10. Kenya: The Emerging African Powerhouse

Kenya, the economic powerhouse of East Africa, has been steadily emerging as a force to be reckoned with in the global economy. With a diverse and resilient economy, a young and dynamic population, and a strategic location, Kenya is poised to make waves in 2024 and beyond.

In 2024, Kenya is expected to post a GDP growth rate of around 6%, driven by a combination of factors, including:

- Diversified economy: Kenya’s economy is well-balanced, with significant contributions from sectors such as agriculture, manufacturing, tourism, and a rapidly growing services sector, including a thriving tech industry.

- Technological innovation: Kenya has been at the forefront of technological innovation in Africa, with the development of groundbreaking mobile payment systems and a thriving startup ecosystem.

- Infrastructure development: The Kenyan government has been investing heavily in infrastructure projects, such as the construction of new roads, railways, and ports, enhancing the country’s connectivity and productivity.

- Demographic dividend: Kenya’s large and youthful population, with a median age of just 20 years, provides a vast pool of labor and a growing consumer base.

Conclusion: Embracing the Emerging Economies of the Future

As we look ahead to 2024 and beyond, the global economic landscape is poised for a profound transformation. The 10 emerging economies highlighted in this blog post – India, Vietnam, Indonesia, Mexico, Poland, Bangladesh, Egypt, Malaysia, Colombia, and Kenya – are set to play a pivotal role in shaping the future of the global economy.

These dynamic markets, driven by a combination of favorable demographics, technological advancements, strategic policy decisions, and a relentless pursuit of economic diversification, are poised to challenge the traditional economic order. By capitalizing on their unique strengths and competitive advantages, these emerging economies are set to become the economic powerhouses of the future.

As investors, policymakers, and global citizens, it is crucial to closely monitor the developments in these emerging markets and to recognize the immense opportunities they present. By embracing the growth and innovation emanating from these dynamic economies, we can collectively shape a more prosperous and interconnected global economic landscape in the years to come.

Business

Uniti and Windstream Reunite in a $13.4 Billion Merger: A Strategic Analysis

Windstream and Uniti, two major companies in the telecommunications and real estate sectors in the US, have recently decided to come together in a merger deal worth $13.4 billion. With the approval of both companies’ boards of directors, this merger marks a significant reunion after years of legal disputes and separation.

Uniti Group, a real estate investment trust specializing in wireless towers and fibre operations, and Windstream, a broadband and telecommunications company with a strong presence in the Midwest and Southeastern regions of the United States, are now set to join forces and create a formidable entity in the industry.

Background and History

Uniti Group, formerly known as CS&L, was spun off from Windstream nearly a decade ago. The two entities have a complex history, including legal disputes over contract arrangements that contributed to Windstream’s reorganization bankruptcy in the late 2010s. Windstream has been Uniti’s largest customer, and the merger aims to eliminate dis-synergies that existed in their previous landlord/tenant relationship.

Financial Details and Strategic Implications

The merger involves approximately $4.4 billion in company revenues, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. The combined company is set to serve over 1.1 million customers and 1.5 million existing homes, with a strong focus on expanding fiber-to-the-home (FTTH) buildouts. This strategic move aligns with the increasing demand for fiber broadband services and positions Uniti to enhance its financial profile and strategic initiatives.

Leadership and Operational Structure

Uniti’s President and CEO, Kenny Gunderman, along with Paul Bullington, Uniti’s CFO, will lead the merged company. Key members of Windstream’s management team are expected to continue with the combined entity. The merged firm will operate under the Uniti name, trading under the ticker symbol “UNIT,” and will be headquartered in Little Rock.

Investor Confidence and Market Outlook

Elliott Investment Management, Windstream’s largest shareholder, has expressed support for the merger, citing the compelling strategic rationale and potential for enhanced value creation. The combined company is expected to leverage Uniti’s focused strategy, unique positioning, and experienced management team to capitalize on growth opportunities in the telecommunications and broadband market.

Regulatory and Shareholder Approval

The transaction is anticipated to close in the second half of 2025, subject to regulatory approvals and shareholder consent. The merger is poised to create a national fiber powerhouse that aims to bridge the digital divide and deliver innovative solutions to customers across the Midwest and Southeastern U.S.

In conclusion, the reunion of Windstream and Uniti through this merger signifies a strategic alignment that promises to unlock synergies, drive growth, and enhance value creation in the telecommunications and broadband industry. With a strong leadership team, a clear strategic vision, and investor support, the combined entity is well-positioned to capitalize on the growing demand for fiber broadband services and shape the future of connectivity in the digital age.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?