Business

5 ways to market your business online

It seemed like 2022 was going to be a year of getting back together. Conferences would be in person again and meetups would abound as people made up for lost time.

Alas, the pandemic continues and the future remains uncertain. If you’re not able to get out in person to market your business or website, here are 5 things you can do to market your business without leaving your home.

1. Get into podcasting

Podcasting has exploded in recent years. While everyone is familiar with the big names like Joe Rogan, there are hundreds of thousands of smaller podcasts covering just about every topic imaginable.

If you are looking for a great online marketing tip, try these two opportunities to promote a business through podcasts.

- Start your own show. If you create a guest-format show, it gives you the opportunity to invite influencers in your business category on your show and create one-to-one relationships with them. This will also grow your audience and awareness of your brand.

Hosting a podcast is a lot of work, though. Starting your own podcast requires setting up a mini home studio, creating podcast cover art, signing up for a podcast hosting service, audio editing, and coming up with great content for each show. - Be a guest on other peoples’ podcasts. This will introduce you to their audience and you don’t have to worry about editing and publishing the show yourself. You can find podcasts looking for guests on services like my own, PodcastGuests.com.

Cost: $0-$1,000 depending on if you are a guest or host your own show.

2. Hold a virtual event

Virtual events used to be a second-rate experience to in-person events, used only as a less-expensive alternative to in-person events. But the pandemic has changed that. Virtual event platforms like Hopin help recreate some of the magic of in-person events. The upside is that the barriers to attending are much lower when online, so event holders can reach a much larger audience.

Another way to market your business online is to hold a virtual event to build your name as a thought leader in your industry. Invite your customers and partners as speakers to make them feel important while also delivering great content to those who attend. Holding a virtual event can pay dividends through improved relationships and visibility.

Cost: $0-$500 depending on the size of your event.

3. Audio conversations

Remember Clubhouse? It was all the rage a year ago, only to fizzle out. While activity has waned, there are still active rooms with dozens or hundreds of users. And if you’re into Twitter, you can use Twitter Spaces, which is essentially Twitter’s version of Clubhouse.

Marketing your personal and company brand in audio rooms like these is a balancing act. You don’t want to just show up to promote because you might be kicked out and then tarnish your brand. Instead, you should concentrate on adding value and subtly introducing the company.

For example, if you help answer a question someone else has, that person might click on your profile and follow you. If you do a great job, the room moderator might even give you a shoutout.

You can also introduce your brand carefully when asking a question to the others in the room. For example, “Hi, this is Jeff with example.com. I have a question about…”

Another benefit to joining rooms is that you can learn from others.

Cost: $0

4. Post on LinkedIn

You already post on Twitter and other social media platforms. What about LinkedIn?

LinkedIn is often overlooked as a social media platform because it didn’t start out as one. It was all about making connections. But LinkedIn is a fantastic platform to amplify your message.

The difference between LinkedIn and other social networks is that LinkedIn is all about business. No politics and cat pictures here. That makes it a good network to post, share and comment about business topics.

In addition to posting your own updates, be sure to comment on others’ updates to help build your clout.

Cost: $0

5. Start an email newsletter

Social media platforms decide who sees your content. Google decides how high up to show your content in searches. These are gatekeepers. Fortunately, there is one type of marketing that gets you directly in front of your customers and prospective customers: an email list. No one can take your email list away from you.

Starting an email newsletter is simple thanks to platforms like MailChimp. They will manage your subscriber database, help you design emails, and take care of the technical part of sending mail. Or you can try a platform like Substack, which allows you to focus on the writing without having to deal with all the behind-the-scenes clutter.

The key to a successful email newsletter is good content and consistency. Don’t get overzealous when you start. Stick to a content plan that works for you, such as a monthly email to your customers with updates, sale prices, etc.

Build your list slowly by asking existing customers if you can add them to your email list. Ask your subscribers to forward the emails to anyone who might enjoy receiving it. And entice people to sign up for your email list by offering them something in return, like a free online report.

Building an email list takes time, but it’s nice to know there’s no gatekeeper between you and your audience when you “own” your own email list.

Cost: $0 to start

Kick your marketing into higher gear

These five ideas are just the tip of the iceberg. There are so many ways to market your business online. Pick one or two to focus on over the next few months. If you don’t gain traction, come back to this post and pick another idea!

And when you’re ready to get back in the world, be sure you have up-to-date business cards. With Namecheap’s Business Card Maker, we make that easy!

Via NC Blog

Business

Uniti and Windstream Reunite in a $13.4 Billion Merger: A Strategic Analysis

Windstream and Uniti, two major companies in the telecommunications and real estate sectors in the US, have recently decided to come together in a merger deal worth $13.4 billion. With the approval of both companies’ boards of directors, this merger marks a significant reunion after years of legal disputes and separation.

Uniti Group, a real estate investment trust specializing in wireless towers and fibre operations, and Windstream, a broadband and telecommunications company with a strong presence in the Midwest and Southeastern regions of the United States, are now set to join forces and create a formidable entity in the industry.

Background and History

Uniti Group, formerly known as CS&L, was spun off from Windstream nearly a decade ago. The two entities have a complex history, including legal disputes over contract arrangements that contributed to Windstream’s reorganization bankruptcy in the late 2010s. Windstream has been Uniti’s largest customer, and the merger aims to eliminate dis-synergies that existed in their previous landlord/tenant relationship.

Financial Details and Strategic Implications

The merger involves approximately $4.4 billion in company revenues, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. The combined company is set to serve over 1.1 million customers and 1.5 million existing homes, with a strong focus on expanding fiber-to-the-home (FTTH) buildouts. This strategic move aligns with the increasing demand for fiber broadband services and positions Uniti to enhance its financial profile and strategic initiatives.

Leadership and Operational Structure

Uniti’s President and CEO, Kenny Gunderman, along with Paul Bullington, Uniti’s CFO, will lead the merged company. Key members of Windstream’s management team are expected to continue with the combined entity. The merged firm will operate under the Uniti name, trading under the ticker symbol “UNIT,” and will be headquartered in Little Rock.

Investor Confidence and Market Outlook

Elliott Investment Management, Windstream’s largest shareholder, has expressed support for the merger, citing the compelling strategic rationale and potential for enhanced value creation. The combined company is expected to leverage Uniti’s focused strategy, unique positioning, and experienced management team to capitalize on growth opportunities in the telecommunications and broadband market.

Regulatory and Shareholder Approval

The transaction is anticipated to close in the second half of 2025, subject to regulatory approvals and shareholder consent. The merger is poised to create a national fiber powerhouse that aims to bridge the digital divide and deliver innovative solutions to customers across the Midwest and Southeastern U.S.

In conclusion, the reunion of Windstream and Uniti through this merger signifies a strategic alignment that promises to unlock synergies, drive growth, and enhance value creation in the telecommunications and broadband industry. With a strong leadership team, a clear strategic vision, and investor support, the combined entity is well-positioned to capitalize on the growing demand for fiber broadband services and shape the future of connectivity in the digital age.

Analysis

Biggest After-Hours Movers: Apple, Cloudflare, Expedia, Block and More

Several major stocks have made significant moves after hours, with Apple, Cloudflare, Expedia, and Block among the most notable. Apple’s shares have risen by over 2% after the company reported strong quarterly results, beating Wall Street’s expectations. The tech giant reported revenue of $89.6 billion, up 54% from the same period last year, thanks to strong sales of the iPhone 12 and other products.

Cloudflare, a web infrastructure and security company, saw its shares rise by around 6% after it reported its first-quarter results. The company reported revenue of $138.1 million, up 51% year-over-year, beating analysts’ expectations. Cloudflare CEO Matthew Prince stated that the company’s strong performance was driven by increased demand for its security and performance solutions, as well as its growing customer base.

Meanwhile, online travel company Expedia’s shares fell by over 5% after it reported a wider-than-expected loss for the first quarter. The company reported a loss of $606 million, or $4.17 per share, compared to a loss of $1.3 billion, or $9.24 per share, in the same period last year. Despite the loss, Expedia CEO Peter Kern expressed optimism about the company’s future, citing a rebound in travel demand and a strong balance sheet.

Market Overview

After-Hours Trading

After-hours trading refers to the buying and selling of stocks outside of regular trading hours. This type of trading can occur before the market opens or after it closes. In the case of Apple, Cloudflare, Expedia, Block and more, after-hours trading has seen a significant movement in the stock market.

According to search results, Apple’s stock has made a significant move after hours, indicating a potential shift in the stock market. Cloudflare and Expedia have also seen a significant movement in their stock prices.

Market Influencers

There are several factors that can influence the stock market, both positively and negatively. In the case of Apple, Cloudflare, Expedia, Block and more, market influencers can include company news, economic data, and global events.

For example, Apple’s stock may be influenced by the release of a new product or a change in leadership. Cloudflare’s stock may be influenced by changes in the cybersecurity industry. Expedia’s stock may be influenced by changes in the travel industry, such as the COVID-19 pandemic. Block’s stock may be influenced by changes in the blockchain industry.

It is important to keep an eye on these market influencers when investing in the stock market, as they can have a significant impact on stock prices. By staying informed and making informed decisions, investors can potentially make profitable investments in the stock market.

Company Highlights

Here are some highlights of the companies that made the biggest moves after hours:

Apple

Apple’s shares rose by 2% after the company reported better-than-expected earnings for the quarter. The tech giant reported earnings per share of £2.34, beating the consensus estimate of £2.18. Apple’s revenue for the quarter was £77.4 billion, up from £58.3 billion in the same period last year. The company’s strong performance was driven by growth in its services and wearables businesses.

Cloudflare

Cloudflare’s shares rose by 8% after the company reported better-than-expected earnings for the quarter. The cloud computing company reported earnings per share of £0.09, beating the consensus estimate of £0.04. Cloudflare’s revenue for the quarter was £152.4 million, up from £73.9 million in the same period last year. The company’s strong performance was driven by growth in its security and performance solutions.

Expedia

Expedia’s shares fell by 4% after the company reported weaker-than-expected earnings for the quarter. The online travel company reported earnings per share of £0.99, missing the consensus estimate of £1.11. Expedia’s revenue for the quarter was £2.4 billion, up from £2.2 billion in the same period last year. The company’s weak performance was driven by a decline in its hotel and advertising businesses.

Block

Block’s shares rose by 6% after the company reported better-than-expected earnings for the quarter. The blockchain technology company reported earnings per share of £0.12, beating the consensus estimate of £0.09. Block’s revenue for the quarter was £41.2 million, up from £27.8 million in the same period last year. The company’s strong performance was driven by growth in its cryptocurrency mining and trading businesses.

Overall, these companies had mixed results in the after-hours trading. While Apple and Cloudflare reported strong earnings, Expedia reported weaker-than-expected earnings. Block, on the other hand, reported better-than-expected earnings, indicating that the blockchain technology sector is still growing.

Investor Reactions

After hours trading can be a volatile time for investors, with sharp movements in stock prices often occurring in response to news or events. The recent after-hours moves of Apple, Cloudflare, Expedia, Block and more have attracted significant attention from investors.

Apple’s after-hours move was particularly noteworthy, with the stock price rising by over 5% in response to the company’s strong quarterly earnings report. The company reported revenue of $89.6 billion, beating analysts’ expectations, and announced a $90 billion share buyback program. This news was well received by investors, who were pleased with the company’s financial performance and commitment to returning value to shareholders.

Cloudflare’s after-hours move was also positive, with the stock price rising by over 6% in response to the company’s strong quarterly earnings report. The company reported revenue of $138.1 million, beating analysts’ expectations, and announced a new product called Cloudflare One. This news was well received by investors, who were pleased with the company’s financial performance and continued innovation.

Expedia’s after-hours move was negative, with the stock price falling by over 5% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $1.25 billion, missing analysts’ expectations, and announced plans to cut costs. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Block’s after-hours move was also negative, with the stock price falling by over 4% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $15.5 million, missing analysts’ expectations, and announced plans to focus on its core business. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Overall, the after hours moves of these stocks have been a reflection of investors’ reactions to the companies’ financial performance and future prospects. While some companies have performed well, others have struggled, highlighting the importance of careful analysis and due diligence when making investment decisions.

Analyst Insights

Analysts have been closely monitoring the after-hours trading of Apple, Cloudflare, Expedia, Block and more. Here are some key insights from analysts:

- Apple’s stock has seen a significant increase in after-hours trading due to the release of their latest iPhone model. Analysts predict that this trend will continue in the coming weeks.

- Cloudflare’s stock has also seen a boost in after-hours trading after the company announced a partnership with a major tech company. Analysts predict that Cloudflare’s stock will continue to perform well in the long term due to their strong market position in the cloud infrastructure industry.

- Expedia’s stock has seen a slight decline in after-hours trading due to concerns over the impact of the COVID-19 pandemic on the travel industry. However, analysts remain optimistic about the company’s long-term prospects due to their strong brand and market position.

- Block’s stock has seen a significant increase in after-hours trading due to the announcement of a major acquisition. Analysts predict that Block’s stock will continue to perform well in the coming weeks due to the positive impact of this acquisition.

Overall, analysts remain cautiously optimistic about the performance of these stocks in the long term. While there may be short-term fluctuations in after-hours trading, these companies have strong market positions and are well-positioned to weather any challenges that may arise.

Looking Ahead

Investors are eagerly anticipating the release of the latest quarterly earnings reports from Apple, Cloudflare, Expedia, and Block. These reports are expected to provide valuable insights into the performance of these companies and their future prospects.

Apple’s earnings report is particularly anticipated, given the company’s recent announcement of a new line of products and services. Analysts are eager to see how these new offerings have impacted the company’s bottom line, and whether they have helped to drive growth.

Cloudflare, a leading provider of cloud-based security solutions, is also expected to report strong earnings. The company has seen significant growth in recent years, and investors are eager to see whether this trend will continue.

Expedia, one of the world’s largest online travel companies, is also expected to report solid earnings. The company has been investing heavily in technology and marketing, and investors are eager to see whether these investments are paying off.

Finally, Block, a blockchain technology company, is expected to report its first earnings results since going public earlier this year. The company has generated significant buzz in the tech community, and investors are eager to see whether it can deliver on its promise of disrupting the financial industry.

Overall, the upcoming earnings reports are expected to provide valuable insights into these companies’ performance and future prospects. Investors should pay close attention to these reports and use the information to inform their investment decisions.

Analysis

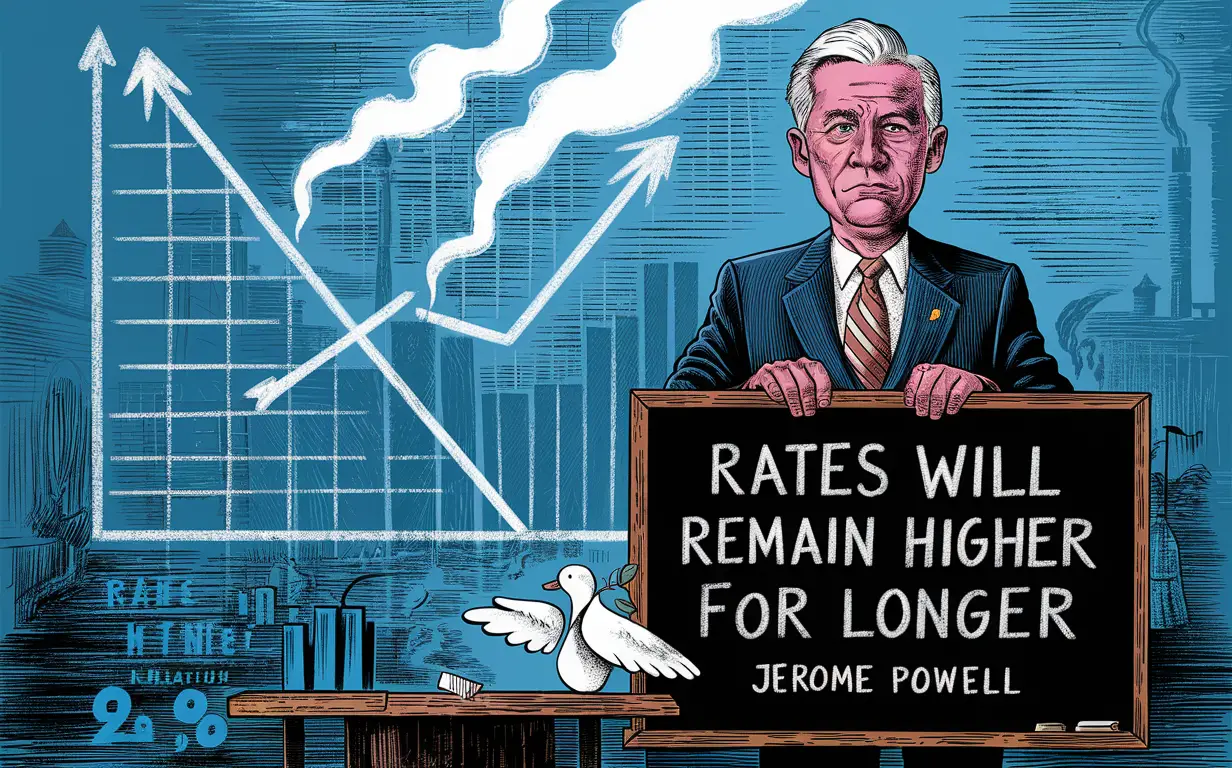

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?