Analysis

6 Best Crypto Currencies to Watch and Invest in 2024

Cryptocurrency has been a hot topic in recent years, with investors and traders alike flocking to the market for a chance to make big gains. While Bitcoin has been the pioneer in the crypto world, there are now numerous other digital currencies that are worth taking a closer look at. As we approach 2024, it’s important to stay up-to-date on the latest trends and developments in the crypto space.

Understanding cryptocurrency investments is crucial before diving into the market. Factors to consider before investing include market capitalization, trading volume, and price history. It’s also important to keep an eye on the news and any potential regulatory changes that could impact the market. By doing your research and staying informed, you can make more informed investment decisions.

With that in mind, here are the 6 best cryptocurrencies to watch and invest in 2024. Each of these digital currencies has unique features and potential for growth, making them worth considering for your investment portfolio.

Key Takeaways

- Understanding cryptocurrency investments is crucial before diving into the market

- Factors to consider before investing include market capitalization, trading volume, and price history

Understanding Cryptocurrency Investments

Cryptocurrency investments have gained significant attention in recent years due to their high volatility and potential for high returns. However, it is important to understand the risks and benefits of investing in cryptocurrencies before making any investment decisions.

One of the main benefits of investing in cryptocurrencies is the potential for high returns. Some cryptocurrencies, such as Bitcoin, have seen significant growth in value over the years. However, it is important to note that cryptocurrency investments are highly volatile and can also result in significant losses.

Another benefit of investing in cryptocurrencies is the decentralized nature of the technology. Cryptocurrencies are not controlled by any central authority, such as a government or bank, which makes them resistant to government or financial institution interference.

Investors can invest in cryptocurrencies through various methods, such as buying and holding, trading, or mining. Buying and holding involves purchasing a cryptocurrency and holding it for a long period of time, with the expectation that its value will increase over time. Trading involves buying and selling cryptocurrencies in order to profit from short-term price fluctuations. Mining involves using specialized software to solve complex mathematical problems in order to validate transactions and earn new cryptocurrency coins.

It is important to conduct thorough research and due diligence before making any investment decisions in cryptocurrencies. This includes researching the specific cryptocurrency, its underlying technology, the team behind it, and its potential for growth and adoption. Additionally, investors should also consider the overall market conditions and trends before making any investment decisions.

Overall, investing in cryptocurrencies can be a high-risk, high-reward investment strategy. It is important for investors to understand the risks and benefits before making any investment decisions and to conduct thorough research and due diligence.

Factors to Consider Before Investing

Investing in cryptocurrencies can be a lucrative opportunity, but it is important to consider several factors before making any investment decisions. Here are some of the key factors to keep in mind:

1. Market Volatility

Cryptocurrencies are known for their high volatility, which can lead to significant fluctuations in their value. Investors should be prepared for sudden price swings and ensure that they have a well-diversified portfolio to mitigate the risks associated with market volatility.

2. Regulatory Environment

The regulatory environment surrounding cryptocurrencies is constantly evolving, and it is important to stay up-to-date with the latest developments. Investors should research the regulatory landscape in their jurisdiction and ensure that they are complying with all applicable laws and regulations.

3. Technology and Security

The underlying technology behind cryptocurrencies, blockchain, is still in its early stages of development and is subject to potential security vulnerabilities. Investors should carefully consider the technology and security measures of the cryptocurrencies they are interested in and ensure that they are investing in reputable projects.

4. Liquidity

Liquidity is an important factor to consider when investing in cryptocurrencies. Investors should ensure that they are investing in cryptocurrencies that have sufficient liquidity to allow for easy buying and selling.

5. Market Capitalization

Market capitalization is a measure of the size of a cryptocurrency and can be an important indicator of its potential for growth. Investors should consider the market capitalization of the cryptocurrencies they are interested in and ensure that they are investing in projects with a solid market position.

6. Team and Development

The team behind a cryptocurrency project can have a significant impact on its success. Investors should research the team and development roadmap of the cryptocurrencies they are interested in and ensure that they are investing in projects with a strong team and clear development plan.

7. Use Case

Finally, investors should consider the use case of the cryptocurrencies they are interested in. Cryptocurrencies with a clear use case and real-world applications are more likely to succeed in the long term. Investors should ensure that they are investing in projects with a clear use case and a strong value proposition.

By considering these factors, investors can make informed decisions when investing in cryptocurrencies and minimize their exposure to risk.

1.Bitcoin: The Pioneer Crypto

Bitcoin is the first and most popular cryptocurrency in the world. It was created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. The main idea behind Bitcoin was to create a decentralized digital currency that could be used for peer-to-peer transactions without the need for intermediaries like banks or financial institutions.

One of the key features of Bitcoin is its limited supply. There will only ever be 21 million Bitcoins in existence, which makes it a deflationary currency. This means that as demand for Bitcoin increases, its value is likely to increase as well. In fact, Bitcoin has already proven to be a great investment opportunity, with its value increasing from just a few cents in 2009 to over $60,000 in 2021.

Bitcoin is also known for its high level of security. Transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This makes it virtually impossible for anyone to tamper with the records or steal Bitcoins.

However, Bitcoin is not without its challenges. One of the biggest issues facing Bitcoin is its high energy consumption. According to a study by the Cambridge Centre for Alternative Finance, Bitcoin mining consumes more energy than entire countries like Argentina and the Netherlands. This is because Bitcoin mining requires a lot of computational power, which is used to solve complex mathematical problems in order to validate transactions and add new blocks to the blockchain.

Despite these challenges, Bitcoin remains the most popular cryptocurrency in the world, and is likely to remain so for the foreseeable future. Its strong brand recognition, high level of security, and limited supply make it a great investment opportunity for those looking to diversify their portfolio with cryptocurrency.

2.Ethereum: The Smart Contract Leader

Ethereum is a blockchain-based platform that enables developers to create decentralized applications (dApps) and smart contracts. It was launched in 2015 and has since become one of the most popular cryptocurrencies in the world. Ethereum’s native cryptocurrency is Ether (ETH), which is used to pay transaction fees and computational services on the Ethereum network.

One of Ethereum’s biggest advantages is its ability to execute smart contracts. Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. This eliminates the need for intermediaries, reduces transaction costs, and increases transparency and security. Ethereum is the leader in smart contract technology, and many other blockchain platforms have followed in its footsteps.

Ethereum has a strong developer community, which has resulted in the creation of many dApps and smart contracts. Some of the most popular dApps built on Ethereum include Uniswap, Aave, and Compound. These dApps enable users to exchange cryptocurrencies, lend and borrow cryptocurrencies, and earn interest on their crypto holdings.

In 2024, Ethereum is expected to undergo a major upgrade called Ethereum 2.0, which will improve its scalability and security. This upgrade will introduce a new consensus algorithm called Proof of Stake (PoS), which will replace the current Proof of Work (PoW) algorithm. PoS is expected to reduce the energy consumption of the Ethereum network and make it more environmentally friendly.

Overall, Ethereum is a strong cryptocurrency to watch and invest in for 2024. Its dominance in the smart contract space, strong developer community, and upcoming upgrade make it a promising investment option.

3.Cardano: The Green Crypto

Cardano (ADA) is a blockchain platform that was created in 2017 by Charles Hoskinson, one of the co-founders of Ethereum. It is a proof-of-stake (PoS) blockchain that uses a consensus algorithm called Ouroboros to validate transactions and create new blocks. Unlike proof-of-work (PoW) blockchains like Bitcoin, PoS blockchains consume significantly less energy, making them more environmentally friendly.

One of the main advantages of Cardano is its focus on sustainability and eco-friendliness. It is often referred to as the “green crypto” due to its commitment to reducing its carbon footprint. In fact, Cardano has partnered with the United Nations to develop a blockchain-based solution that aims to improve the sustainability of supply chains and reduce carbon emissions.

Another advantage of Cardano is its scalability. The platform is designed to be highly modular and flexible, allowing developers to create custom solutions tailored to their specific needs. This makes it an attractive option for businesses and organizations looking to build blockchain-based applications.

In terms of market performance, Cardano has been steadily gaining popularity and value. As of November 2023, it is the fifth-largest cryptocurrency by market capitalization, with a market cap of over $75 billion USD. Its price has also been on the rise, reaching an all-time high of over $3.00 USD in September 2023.

Overall, Cardano appears to be a promising cryptocurrency to watch and invest in for 2024. Its focus on sustainability and scalability, combined with its growing popularity and market performance, make it a compelling option for both developers and investors alike.

4.Polkadot: The Multi-Chain Network

Polkadot is a multi-chain technology that aims to provide a scalable, interoperable, and secure platform for decentralized applications. It was launched in 2020 and has quickly gained popularity among developers and investors alike.

One of the unique features of Polkadot is its ability to connect different blockchains, or “parachains,” to its main network. This allows for cross-chain communication and interoperability, which is essential for the growth and adoption of decentralized applications.

Polkadot’s native token, DOT, is used for governance, staking, and transaction fees on the network. It has a current market capitalization of over $50 billion, making it one of the top 10 cryptocurrencies by market cap.

Investors and analysts are optimistic about Polkadot’s future potential, with some predicting that it could become one of the dominant players in the blockchain space. However, as with any investment, it is important to do your own research and assess the risks before investing in Polkadot or any other cryptocurrency.

Here are some key facts about Polkadot:

- Polkadot was founded by Dr. Gavin Wood, who was also a co-founder of Ethereum.

- The Polkadot network uses a unique consensus mechanism called “Nominated Proof-of-Stake” (NPoS).

- Polkadot has partnerships with several leading blockchain projects, including Chainlink and Kusama.

- Polkadot’s ecosystem includes several decentralized finance (DeFi) projects, such as Acala and Moonbeam.

- Polkadot has a strong community of developers and supporters, who are actively building and improving the network.

Overall, Polkadot’s multi-chain architecture and innovative features make it a promising cryptocurrency to watch and invest in for 2024 and beyond.

5. Solana (SOL)

Solana is a high-performance blockchain that aims to provide fast, secure, and scalable solutions for decentralized applications (DApps). Solana was founded in 2017 by a team of former Qualcomm, Intel, and Dropbox engineers, led by Anatoly Yakovenko. Solana claims to be the fastest blockchain in the world, capable of processing over 50,000 transactions per second (TPS) with sub-second finality and low fees. Solana achieves this level of performance by using a novel consensus mechanism called Proof of History (PoH), which creates a historical record of events on the network, allowing validators to process transactions without waiting for other validators. Solana also uses other innovations, such as Turbine, a block propagation protocol; Sealevel, a parallel smart contract runtime; Pipelining, a transaction processing unit; Cloudbreak, a horizontally scalable database; and Archivers, a distributed ledger storage.

Solana has emerged as one of the most promising and competitive platforms in the crypto space, attracting a growing number of developers, users, and investors. Solana has also built a rich and diverse ecosystem of DApps, protocols, and tokens, covering various sectors and use cases, such as DeFi, NFTs, gaming, social media, and more. Some of the notable examples of Solana-based DApps, protocols, and tokens include:

- Serum, a decentralized exchange (DEX) that leverages Solana’s speed and scalability to offer a fast, cheap, and liquid trading experience.

- Raydium, a liquidity provider and automated market maker (AMM) that enables users to swap, provide liquidity, and farm tokens on Solana.

- Audius, a decentralized music streaming platform that allows artists to upload, share, and monetize their music, and listeners to discover and stream music, without intermediaries or fees.

- Star Atlas, a metaverse game that allows users to explore, conquer, and trade in a futuristic galaxy, and earn tokens and NFTs as rewards.

- Solana Monkey Business, a collection of 5,000 unique and randomly generated monkey NFTs, each with a unique name, traits, and rarity.

- Solana Name Service, a decentralized naming service that allows users to register human-readable names for their Solana addresses, making it easier to send and receive payments on Solana.

6. Terra (LUNA)

Terra is a blockchain platform that aims to create a more stable and scalable global payment system, powered by fiat-pegged stablecoins and a native token called LUNA. Terra was founded in 2018 by Daniel Shin and Do Kwon, and is backed by prominent investors, such as Galaxy Digital, Coinbase Ventures, Pantera Capital, and more. Terra uses a proof-of-stake (PoS) consensus mechanism, which requires validators to stake LUNA as collateral, and rewards them with transaction fees and seigniorage. Terra also uses a unique algorithmic mechanism, which adjusts the supply and demand of its stablecoins, to maintain their pegs to various fiat currencies, such as the US dollar, the Korean won, the Euro, and more.

Terra has been one of the most successful and impactful projects in the crypto space, following a pragmatic and market-oriented approach to its development and deployment. Terra has achieved remarkable adoption and growth, especially in Asia, where it has partnered with various e-commerce platforms, such as Chai, PayWithTerra, and MemePay, to enable millions of users and merchants to use its stablecoins as a fast, cheap, and convenient payment method. Terra has also built a thriving and diverse ecosystem of DApps, protocols, and tokens, covering various sectors and use cases, such as DeFi, NFTs, gaming, social media, and more. Some of the notable examples of Terra-based DApps, protocols, and tokens include:

- Anchor, a decentralized savings protocol that offers a stable and high interest rate on deposits of Terra stablecoins, and enables borrowing and lending of other crypto assets.

- Mirror, a decentralized synthetic asset protocol that allows users to create, trade, and invest in synthetic assets that track the price of real-world assets, such as stocks, commodities, ETFs, and more.

- Pylon, a decentralized investment protocol that allows users to invest in various projects and opportunities, and earn passive income from their deposits of Terra stablecoins.

- Nebula, a decentralized protocol that allows users to create and trade thematic portfolios of synthetic assets, such as NFTs, gaming, metaverse, and more.

- Loop, a decentralized social media platform that allows users to create and monetize their own content, communities, and tokens, without intermediaries or fees.

- Terra Name Service, a decentralized naming service that allows users to register human-readable names for their Terra addresses, making it easier to send and receive payments on Terra.

Terra is expected to continue its adoption and innovation in 2024, as it strives to become the leading blockchain platform for global payments and stablecoins. Terra is also likely to benefit from the increasing demand for stable and scalable solutions in the crypto space, especially in the e-commerce and DeFi sectors, which are experiencing rapid growth and innovation. Some of the factors that could boost Terra’s performance in 2024 include:

- The launch of Columbus-5, a major network upgrade that will introduce significant improvements and features to the network, such as lower gas fees, higher security, better interoperability, and more.

- The development and adoption of Terra-based DApps, protocols, and tokens, which will increase the network effects, utility, and value of Terra.

- The expansion and improvement of the Terra ecosystem, which will attract more developers, users, and investors to Terra, and foster innovation and collaboration among Terra projects.

Analysis

Biggest After-Hours Movers: Apple, Cloudflare, Expedia, Block and More

Several major stocks have made significant moves after hours, with Apple, Cloudflare, Expedia, and Block among the most notable. Apple’s shares have risen by over 2% after the company reported strong quarterly results, beating Wall Street’s expectations. The tech giant reported revenue of $89.6 billion, up 54% from the same period last year, thanks to strong sales of the iPhone 12 and other products.

Cloudflare, a web infrastructure and security company, saw its shares rise by around 6% after it reported its first-quarter results. The company reported revenue of $138.1 million, up 51% year-over-year, beating analysts’ expectations. Cloudflare CEO Matthew Prince stated that the company’s strong performance was driven by increased demand for its security and performance solutions, as well as its growing customer base.

Meanwhile, online travel company Expedia’s shares fell by over 5% after it reported a wider-than-expected loss for the first quarter. The company reported a loss of $606 million, or $4.17 per share, compared to a loss of $1.3 billion, or $9.24 per share, in the same period last year. Despite the loss, Expedia CEO Peter Kern expressed optimism about the company’s future, citing a rebound in travel demand and a strong balance sheet.

Market Overview

After-Hours Trading

After-hours trading refers to the buying and selling of stocks outside of regular trading hours. This type of trading can occur before the market opens or after it closes. In the case of Apple, Cloudflare, Expedia, Block and more, after-hours trading has seen a significant movement in the stock market.

According to search results, Apple’s stock has made a significant move after hours, indicating a potential shift in the stock market. Cloudflare and Expedia have also seen a significant movement in their stock prices.

Market Influencers

There are several factors that can influence the stock market, both positively and negatively. In the case of Apple, Cloudflare, Expedia, Block and more, market influencers can include company news, economic data, and global events.

For example, Apple’s stock may be influenced by the release of a new product or a change in leadership. Cloudflare’s stock may be influenced by changes in the cybersecurity industry. Expedia’s stock may be influenced by changes in the travel industry, such as the COVID-19 pandemic. Block’s stock may be influenced by changes in the blockchain industry.

It is important to keep an eye on these market influencers when investing in the stock market, as they can have a significant impact on stock prices. By staying informed and making informed decisions, investors can potentially make profitable investments in the stock market.

Company Highlights

Here are some highlights of the companies that made the biggest moves after hours:

Apple

Apple’s shares rose by 2% after the company reported better-than-expected earnings for the quarter. The tech giant reported earnings per share of £2.34, beating the consensus estimate of £2.18. Apple’s revenue for the quarter was £77.4 billion, up from £58.3 billion in the same period last year. The company’s strong performance was driven by growth in its services and wearables businesses.

Cloudflare

Cloudflare’s shares rose by 8% after the company reported better-than-expected earnings for the quarter. The cloud computing company reported earnings per share of £0.09, beating the consensus estimate of £0.04. Cloudflare’s revenue for the quarter was £152.4 million, up from £73.9 million in the same period last year. The company’s strong performance was driven by growth in its security and performance solutions.

Expedia

Expedia’s shares fell by 4% after the company reported weaker-than-expected earnings for the quarter. The online travel company reported earnings per share of £0.99, missing the consensus estimate of £1.11. Expedia’s revenue for the quarter was £2.4 billion, up from £2.2 billion in the same period last year. The company’s weak performance was driven by a decline in its hotel and advertising businesses.

Block

Block’s shares rose by 6% after the company reported better-than-expected earnings for the quarter. The blockchain technology company reported earnings per share of £0.12, beating the consensus estimate of £0.09. Block’s revenue for the quarter was £41.2 million, up from £27.8 million in the same period last year. The company’s strong performance was driven by growth in its cryptocurrency mining and trading businesses.

Overall, these companies had mixed results in the after-hours trading. While Apple and Cloudflare reported strong earnings, Expedia reported weaker-than-expected earnings. Block, on the other hand, reported better-than-expected earnings, indicating that the blockchain technology sector is still growing.

Investor Reactions

After hours trading can be a volatile time for investors, with sharp movements in stock prices often occurring in response to news or events. The recent after-hours moves of Apple, Cloudflare, Expedia, Block and more have attracted significant attention from investors.

Apple’s after-hours move was particularly noteworthy, with the stock price rising by over 5% in response to the company’s strong quarterly earnings report. The company reported revenue of $89.6 billion, beating analysts’ expectations, and announced a $90 billion share buyback program. This news was well received by investors, who were pleased with the company’s financial performance and commitment to returning value to shareholders.

Cloudflare’s after-hours move was also positive, with the stock price rising by over 6% in response to the company’s strong quarterly earnings report. The company reported revenue of $138.1 million, beating analysts’ expectations, and announced a new product called Cloudflare One. This news was well received by investors, who were pleased with the company’s financial performance and continued innovation.

Expedia’s after-hours move was negative, with the stock price falling by over 5% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $1.25 billion, missing analysts’ expectations, and announced plans to cut costs. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Block’s after-hours move was also negative, with the stock price falling by over 4% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $15.5 million, missing analysts’ expectations, and announced plans to focus on its core business. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Overall, the after hours moves of these stocks have been a reflection of investors’ reactions to the companies’ financial performance and future prospects. While some companies have performed well, others have struggled, highlighting the importance of careful analysis and due diligence when making investment decisions.

Analyst Insights

Analysts have been closely monitoring the after-hours trading of Apple, Cloudflare, Expedia, Block and more. Here are some key insights from analysts:

- Apple’s stock has seen a significant increase in after-hours trading due to the release of their latest iPhone model. Analysts predict that this trend will continue in the coming weeks.

- Cloudflare’s stock has also seen a boost in after-hours trading after the company announced a partnership with a major tech company. Analysts predict that Cloudflare’s stock will continue to perform well in the long term due to their strong market position in the cloud infrastructure industry.

- Expedia’s stock has seen a slight decline in after-hours trading due to concerns over the impact of the COVID-19 pandemic on the travel industry. However, analysts remain optimistic about the company’s long-term prospects due to their strong brand and market position.

- Block’s stock has seen a significant increase in after-hours trading due to the announcement of a major acquisition. Analysts predict that Block’s stock will continue to perform well in the coming weeks due to the positive impact of this acquisition.

Overall, analysts remain cautiously optimistic about the performance of these stocks in the long term. While there may be short-term fluctuations in after-hours trading, these companies have strong market positions and are well-positioned to weather any challenges that may arise.

Looking Ahead

Investors are eagerly anticipating the release of the latest quarterly earnings reports from Apple, Cloudflare, Expedia, and Block. These reports are expected to provide valuable insights into the performance of these companies and their future prospects.

Apple’s earnings report is particularly anticipated, given the company’s recent announcement of a new line of products and services. Analysts are eager to see how these new offerings have impacted the company’s bottom line, and whether they have helped to drive growth.

Cloudflare, a leading provider of cloud-based security solutions, is also expected to report strong earnings. The company has seen significant growth in recent years, and investors are eager to see whether this trend will continue.

Expedia, one of the world’s largest online travel companies, is also expected to report solid earnings. The company has been investing heavily in technology and marketing, and investors are eager to see whether these investments are paying off.

Finally, Block, a blockchain technology company, is expected to report its first earnings results since going public earlier this year. The company has generated significant buzz in the tech community, and investors are eager to see whether it can deliver on its promise of disrupting the financial industry.

Overall, the upcoming earnings reports are expected to provide valuable insights into these companies’ performance and future prospects. Investors should pay close attention to these reports and use the information to inform their investment decisions.

Analysis

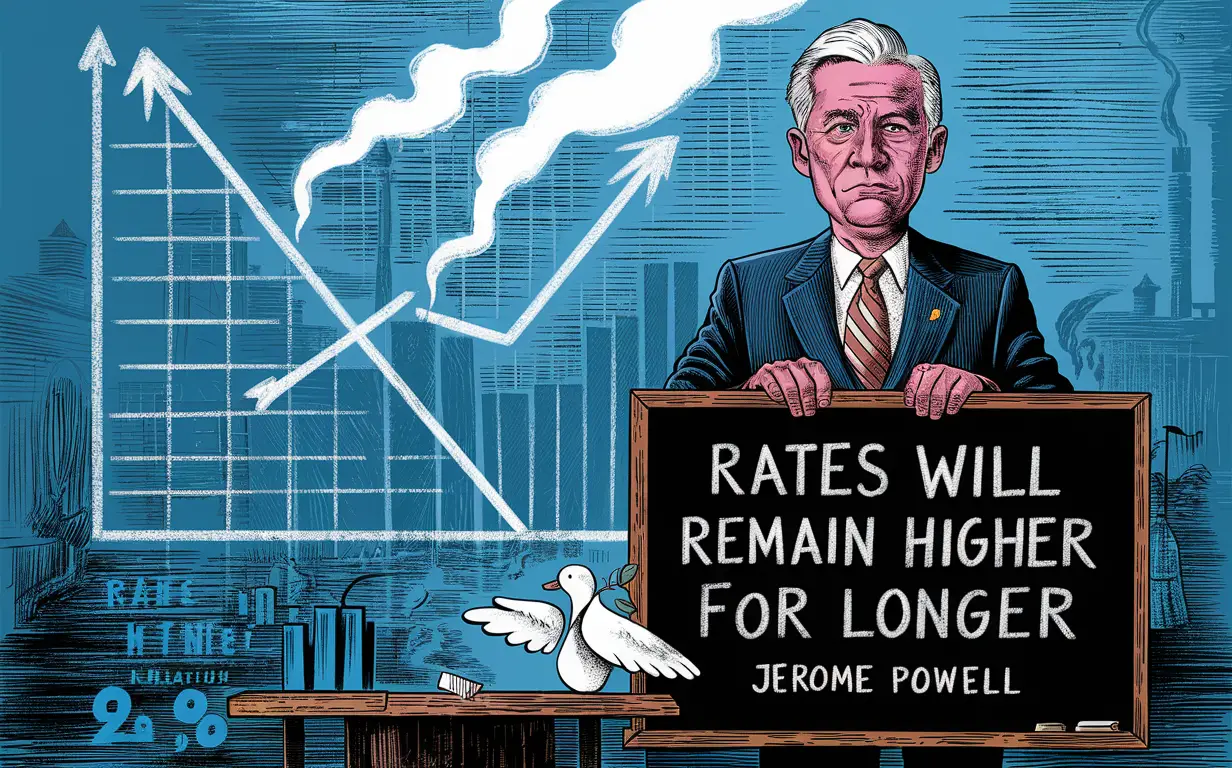

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

Analysis

Analyzing the Implications of Trump’s Contempt of Court in Manhattan ‘Hush Money’ Case

Introduction

In a recent development that has captured national attention, former US President Donald Trump has been found in contempt of court in the Manhattan ‘hush money’ case. This ruling comes with a fine of $9,000 for statements that violated a gag order, with the presiding judge warning of potential jail time. This article delves into the legal implications, political ramifications, and potential consequences of this significant event.

Legal Analysis

The contempt of court ruling against Trump stems from his alleged involvement in hush money payments made to Stormy Daniels, an adult film actress, during the 2016 presidential campaign. By violating the gag order, Trump has disregarded the court’s authority and undermined the legal process. This raises questions about the rule of law and the accountability of public figures, especially former presidents.

Political Ramifications

Given Trump’s status as a prominent political figure, this contempt ruling has far-reaching political implications. It may impact his future political ambitions, influence his support base, and shape public perception of his integrity and respect for the legal system. The intersection of law and politics in this case highlights the complexities of holding powerful individuals accountable for their actions.

Potential Consequences

The judge’s warning of potential jail time for Trump adds a layer of seriousness to the situation. If Trump continues to defy court orders or engage in behavior that obstructs justice, he could face significant legal consequences, including imprisonment. This raises questions about the limits of presidential immunity and the extent to which public officials are subject to the same legal standards as ordinary citizens.

Conclusion

In conclusion, Trump’s contempt of court ruling in the Manhattan ‘hush money’ case is a significant development with wide-ranging implications. It underscores the importance of upholding the rule of law, holding public figures accountable, and ensuring that justice is served impartially. As this case continues to unfold, it will be crucial to monitor how it shapes legal precedents, political discourse, and public perceptions of accountability in the highest echelons of power.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?