Successful Entrepreneurs

The Entrepreneur: Ranjan Singh, HealthHero

Becoming Europe’s largest telemedicine provider in less than three years is no small feat, but that is exactly what Ranjan Singh’s company HealthHero has done.

Company: HealthHero

Founder: Ranjan Singh

Website: healthhero.com

HealthHero is the brainchild of experienced digital executive and private equity investor Ranjan Singh. Its purpose? To revolutionise the healthcare industry by offering users a suite of virtual healthcare services, delivered 24/7 via phone, video call and online chat.

Ranjan, co-founder and CEO of HealthHero, spoke to Startups about his “Digital Healthcare 3.0” vision, the dangers of hiring the wrong people, and the importance of knowing when to walk away from a business venture.

The Business

Describe your business model and what makes your business unique:

HealthHero is a digital telehealth platform. We offer a suite of virtual healthcare services delivered 24/7 via phone, video call and online chat – but we go far beyond ‘Zoom for GPs’.

HealthHero’s digital triage tool acts as a ‘navigator’ for users, directing them to the right practitioner or course of treatment, which they can access through our bespoke communication tools. This approach makes it easier for people to manage their health, providing more convenient access to a holistic range of health services and facilitating better outcomes for patients.

- We are the largest telehealth platform in Europe by number of consultations and market presence. We’re also one of the few businesses in this field that has traversed separate geographical healthcare markets, integrating with different national healthcare systems.

- We have more than 4,000 clinicians within our network, and they are involved in every layer of the business – from advising platform development teams, to helping with quality regulation and governance, to connecting with the end users seeking care through the platform. This helps us deliver on our joint aims of making care more accessible for users and alleviating pressure on the healthcare system by providing high-quality remote alternatives.

- Most telehealth companies are focused on digitising individual steps of the patient journey, inadvertently preserving the overall inefficient structure – but HealthHero is fundamentally deconstructing and reconfiguring the entire healthcare journey, making it simpler and easier to access. Our combination of digital tools and clinical expertise facilitates pathways of care rearranged around the individual. We are really looking to provide a holistic digital experience covering the entire care spectrum, from prediction, prevention and diagnosis to treatment and management.

What is your greatest business achievement to date?

Growing HealthHero to become Europe’s leading digital telehealth platform in such a short space of time – and all during a pandemic. We increased our revenue 20 fold over a two year period. It’s bonkers!

It is incredible what you can achieve in tough circumstances if you have a strong purpose. For us, that purpose is: simplifying healthcare; improving lives. This guides everything we do and has been the fuel we have needed to get to where we are today. And we are only just getting started.

It is incredible what you can achieve in tough circumstances if you have a strong purpose. For us, that purpose is: simplifying healthcare; improving lives. This guides everything we do and has been the fuel we have needed to get to where we are today. And we are only just getting started.

How did you fund your business?

HealthHero is backed by Marcol, a privately owned pan-European investment house.

What numbers do you look at every day in your business?

There is a range of information that is critical to me on a very regular basis, but first and foremost it is about growth. Are we taking our proposition to more people and increasing our coverage in the markets we serve?

I keep a close eye on metrics related to service levels, the consultations we offer people, and client satisfaction. Then, of course, product integration/development, budgets and where we are placing our bets in terms of investment in technology. We are growing so quickly and we have such a huge opportunity to change healthcare for the better, that being laser-focused on our objectives is critical for success.

To what extent does your business trade internationally?

HealthHero is the largest telehealth platform in Europe by number of consultations and market presence – operating in the UK, Ireland, France and Germany. We are scaling rapidly in our ambition to be the dominant force in digital telehealth in Europe.

Where would you like your business to be in five years?

Beyond geographical expansion, our overall vision is to help achieve what we call ‘Digital Healthcare 3.0’. This is the point at which patient experience and healthcare system efficiency intersect.

We want a world where healthcare is seamless, straightforward, convenient, comprehensive and easy to access. People should be able to get the care they need at a time and place that suits them. They should be empowered to manage their own care with digital tools. Our aim is to have every touchpoint in the healthcare ecosystem connected.

What software or technology has made the biggest difference to your business?

Our online triage tool has the biggest impact on the two critical areas we are looking to influence, namely patient experience and healthcare system efficiency. This is the entry point for many into the HealthHero ecosystem, setting them on the right care pathway for their needs. This tool effectively reduces the burden on the healthcare system.

Growth Challenges

What was your biggest business mistake and what did you learn from it?

When scaling at pace, it is hard to get 100% of your hiring decisions right, and I have learnt a lot about the importance of hiring the right people because of that. There were times when I should have cut ties more quickly when it was clear that a relationship was going in the wrong direction. I think you need to be ready to make difficult decisions, no matter how painful.

What one thing do you wish someone had told you when you started on your business journey?

It is okay to walk away, change and adapt your business. At a previous venture I almost learnt this too late. I think entrepreneurs are fed a narrative that the most important thing to do is never give up. However, as many founders reading this will appreciate, sometimes a business cannot succeed down a certain path for reasons that are completely outside your control.

In that circumstance, even though it is painful, giving up is a better course of action than ploughing more money and resources into an idea that is doomed to failure. I would argue that sometimes giving up is exactly what you need to do in order to gain perspective, find firm ground, and start the entrepreneurial journey again.

It is okay to walk away, change and adapt your business. I think entrepreneurs are fed a narrative that the most important thing to do is never give up. However, as many founders reading this will appreciate, sometimes a business cannot succeed down a certain path for reasons that are completely outside your control.

How has the pandemic affected the market you operate in?

There is no doubt that the pandemic has highlighted that healthcare systems are outdated and failing to keep up. However, these systems were overstretched even prior to the pandemic; services were disconnected and inefficient. COVID-19 will have a lasting impact, but we hope that one positive outcome will be the long-lasting adoption of technology that delivers better outcomes for patients.

Personal Growth

Did you study business or learn on the job?

I have done a bit of both. I have an MBA from INSEAD, and something like that helps you develop unique perspectives on business and create a valuable network. You also gain confidence and get to benchmark yourself against similar people.

80% of where I am today is due to learning on the job, though. There is no substitute for real- life business situations.

What would make you a better leader?

Time is one valuable resource that I would like more of. Being able to free up time for thinking and developing deeper relationships, rather than focussing on transactional interactions, would have a huge positive impact for me.

One business app and one personal app you can’t do without?

On the business side, I find LinkedIn incredibly valuable and I love Ted Talks for learning and new perspectives.

On the personal side, one app I could not do without is Google Maps!

A business book or podcast that you think is great:

I love ‘Sapiens’ by Yuval Noah Harari. The insight in this book, about connecting the dots between how things have happened and how things will evolve, makes it a must-read. I also am a big fan of ‘Predictably Irrational’, by Dan Ariely – it offers incredible insight into human behaviour.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Analysis

Dubai’s Tech Revolution: 15 Startups Reshaping the Middle East’s Business Landscape

How the Desert City Became MENA’s Unicorn Factory—And Why Silicon Valley Should Pay Attention

The morning sun glints off the Burj Khalifa as Tabby’s co-founder Hosam Arab checks his phone. Another $160 million just landed in the company’s Series E round, pushing valuation to $3.3 billion. It’s not a miracle—it’s Tuesday in Dubai, where billion-dollar startups are becoming as common as sandstorms.

Welcome to the Middle East’s most unlikely tech hub, where fifteen startups are proving that innovation doesn’t require hoodie-clad college dropouts in Palo Alto. With $2.4 billion raised in the first half of 2024 alone and twelve unicorns calling the UAE home, Dubai has quietly built what Saudi Technology Ventures calls “the billion-dollar corridor” of the MENA region.

This isn’t your grandfather’s oil economy. This is something far more disruptive.

Beyond Oil: Dubai’s Economic Metamorphosis

The UAE aims to nurture ten unicorns by 2031, but they’re already halfway there. The transformation from petroleum-dependent economy to tech powerhouse didn’t happen by accident. It required vision, infrastructure, and billions in strategic investment.

The numbers tell a compelling story. In the first half of 2025, UAE startups raised more than $2.1 billion, a 134 percent increase year over year, placing the Emirates ahead of established ecosystems like Japan and Sweden. Dubai accounts for more than 90 percent of this deal flow, cementing its position as the region’s undisputed innovation capital.

What makes Dubai different? Start with government backing that would make any Silicon Valley founder jealous. The Emirates Development Bank offers financing of up to AED 5 million for tech startups, complemented by incubation hubs like in5, Flat6Labs, Astrolabs, and Abu Dhabi’s Hub71. The Mohammed Bin Rashid Innovation Fund provides accelerator placement with mentorship and flexible government-backed loan guarantees.

But money alone doesn’t build unicorns. Dubai’s strategic advantages run deeper: zero capital gains tax, 100 percent foreign ownership in free zones, long-term golden visas for entrepreneurs, and a location that bridges three continents and 2 billion consumers. Add world-class infrastructure, political stability in an often-turbulent region, and aggressive regulatory sandboxes for fintech and emerging tech—suddenly, the exodus from Cairo and beyond makes perfect sense.

The 15 Startups Rewriting MENA’s Future

The Fintech Disruptors

1. Tabby — The MENA Buy-Now-Pay-Later Juggernaut

Tabby reached a $3.3 billion valuation in February 2025 after securing $160 million in Series E funding, making it the most valuable venture capital-backed fintech in the Middle East and North Africa. Founded in 2019 by Hosam Arab, Tabby has grown from a shopping installment service to a comprehensive financial services platform serving over 15 million users across Saudi Arabia, the UAE, and Kuwait.

The company’s trajectory is staggering. Tabby collaborates with over 40,000 brands, including Amazon, Samsung, and Noon, driving approximately $10 billion in annual sales. In December 2023, it secured $700 million in debt financing through a receivables securitization agreement with JP Morgan, demonstrating institutional confidence in its business model.

Tabby’s secret? It tapped into a massive underserved market where credit card penetration remains low and cash still dominates. By offering Shariah-compliant financing and frictionless checkout experiences, Tabby solved a uniquely Middle Eastern problem with globally competitive technology. Now, with an IPO in Saudi Arabia on the horizon, the company is positioning itself as the region’s answer to Affirm and Klarna.

2. Careem — From Ride-Hailing Pioneer to Super App

Before there was Uber in the Middle East, there was Careem. Founded in 2012 by Mudassir Sheikha and Magnus Olsson, Careem became the first unicorn exit in the MENA region when Uber acquired it for $3.1 billion in March 2019, marking the largest technology sector transaction in Middle Eastern history.

Careem has raised $771.7 million over ten rounds, and post-acquisition, it hasn’t stood still. The platform has evolved into a super app incorporating payments, food delivery, grocery services, and even home cleaning and PCR testing. Operating across ten countries with 5,500 employees, Careem processes millions of transactions monthly.

What sets Careem apart isn’t just its ride-hailing technology—it’s cultural adaptation. The company addressed region-specific challenges: female-only driver options in Saudi Arabia, cash payment dominance, areas with no formal addressing systems. This localization strategy proved that understanding your market beats copying Silicon Valley playbooks.

3. YAP — Democratizing Digital Banking

Founded by Marwan Hachem and Anas Zaidan, YAP aims to eliminate the need for multiple bank accounts or various financial apps to manage personal finances. Launched in 2021 in partnership with RAKBank, YAP raised $41 million to expand into new markets and enhance its technology offerings.

In a region where traditional banking often means lengthy paperwork and minimum balance requirements, YAP offers something revolutionary: instant account setup, no minimum balances, spend analytics, and seamless international transfers. The all-in-one money app targets the region’s massive youth population—60 percent of the MENA population is under 30—who expect banking to feel like using Instagram, not visiting a government office.

The E-Commerce Titans

4. Noon — The Amazon of the Middle East

Mohammed Alabbar didn’t build Emaar Properties—creator of the Burj Khalifa—by thinking small. When he launched Noon in 2016 with $1 billion in initial funding and Saudi Arabia’s Public Investment Fund holding 50 percent, the ambition was clear: dominate Middle Eastern e-commerce before Amazon could.

Noon’s most recent valuation was near $10 billion and it has previously raised about $2.7 billion. In December 2024, the company secured an additional $500 million from investors including the PIF, advancing preparation for a potential IPO. Operating an online marketplace, grocery delivery, and food delivery services across Saudi Arabia, the UAE, and Egypt, Noon has become the region’s default e-commerce platform.

The company’s success stems from solving logistics challenges unique to the Gulf: same-day delivery in extreme heat, cash-on-delivery preferences, multilingual customer service, and building trust in a market skeptical of online shopping. Where Amazon struggled with regional nuances, Noon thrived.

5. Dubizzle Group — MENA’s Classifieds King

Founded in 2015, the Dubizzle Group attained unicorn status in 2020 and employs about 5,500 people working in ten different countries. The umbrella corporation owns and operates classified portals including Bayut, Zameen, and OLX across emerging markets, primarily serving the real estate industry.

Dubizzle Group has raised $479 million over six rounds, with its latest Series F securing $200 million in October 2022. The platform has become the go-to marketplace for buying, selling, or renting homes, cars, and household goods across the MENA region.

What makes Dubizzle remarkable is its hyperlocal approach. Rather than imposing a one-size-fits-all model, the group adapts each brand to local market dynamics, regulatory environments, and consumer behaviors. This “glocal” strategy—global technology, local execution—has proven devastatingly effective in fragmented markets.

The Cloud Kitchen Revolutionary

6. Kitopi — Scaling Restaurants at Digital Speed

Kitopi has raised $802.2 million over five rounds, achieving unicorn status at a $1 billion valuation in July 2021. Founded in 2018 by Mohamad Ballout, Saman Darkan, Bader Ataya, and Andy Arenas, Kitopi pioneered the Kitchen-as-a-Service model in the Middle East.

The concept is brilliantly simple: restaurants can open delivery-only locations without capital expenditure or time investment. Kitopi provides the managed infrastructure, cloud kitchens, software, and logistics. A restaurant brand can scale from one location to dozens within 14 days—a proposition that proved irresistible during and after the pandemic.

Operating over 60 cloud kitchens across the UAE, Saudi Arabia, Kuwait, and Bahrain, Kitopi partners with global and regional brands. The company briefly expanded to the United States in 2019 but exited post-pandemic to focus on its Middle Eastern stronghold. With SoftBank among its investors, Kitopi represents the future of food service: asset-light, data-driven, and infinitely scalable.

The Healthtech Innovators

7. Vezeeta — Digitizing Healthcare Access

Dr. Amir Barsoum founded Vezeeta in 2012 with a straightforward mission: make booking a doctor appointment as easy as ordering an Uber. Vezeeta is the digital healthcare platform in MEA that connects patients with healthcare providers, serving millions of patients through data and seamless access.

The platform moved its headquarters from Cairo to Dubai to attract global talent—data scientists, product managers, and engineers essential for scaling. Vezeeta achieved unicorn status and has raised multiple funding rounds, with its Series C bringing in $12 million in late 2018.

With over 200,000 verified reviews, patients can search, compare, and book the best doctors in just one minute across Egypt, Saudi Arabia, Jordan, Lebanon, and the UAE. The platform also provides innovative SaaS solutions to healthcare providers through clinic management software, creating a two-sided marketplace that’s transformed outpatient care in the region.

Vezeeta’s expansion into e-pharmacy and telemedicine during COVID-19 demonstrated the platform’s adaptability. Now eyeing Nigeria and Kenya, the company is exporting its model to other emerging markets facing similar healthcare accessibility challenges.

The Logistics Game-Changers

8. Fetchr — Solving the No-Address Problem

In a region where many streets have no names and buildings lack numbers, traditional package delivery is nearly impossible. Enter Fetchr, founded by Idriss Al Rifai, which uses GPS smartphone location instead of physical addresses to deliver packages.

Fetchr is the third most well-funded tech startup in the UAE, having raised $52 million across four rounds, with its Series B led by US-based New Enterprise Associates. The company ranked number one on Forbes’ Top 100 Startups in the Middle East, testament to solving a problem that stumped global logistics giants.

Fetchr’s algorithm matches couriers with appropriate pick-up and drop-off points, much like ride-hailing apps. In areas with no formal addressing, this GPS-based approach isn’t just innovative—it’s essential. The company operates in the UAE, Saudi Arabia, Egypt, and Bahrain, capitalizing on growing smartphone penetration and the rapidly expanding regional e-commerce industry.

Looking ahead, Fetchr is exploring autonomous drone delivery services, positioned to become a strategic asset for any global player seeking Middle Eastern market dominance. Running entirely on Amazon Web Services, the company represents a potential acquisition target as Amazon expands its regional footprint.

9. SWVL — Democratizing Transportation

SWVL, valued at more than $1.5 billion, was founded in Egypt but moved its main office to Dubai in late 2019. The company ranked second on Forbes Middle East’s The Middle East’s 50 Most-Funded Startups list in 2020 with $92 million in funding.

SWVL operates a private premium alternative to public transportation, enabling riders heading in the same direction to share rides during rush hour for a flat fare. Unlike traditional ride-hailing, SWVL uses fixed routes with designated pick-up and drop-off spots, dramatically reducing costs while maintaining convenience.

The model addresses a massive market gap: millions of daily commuters priced out of individual ride-hailing but demanding better than overcrowded, unreliable public transit. By aggregating demand along popular routes, SWVL achieves efficiency impossible for traditional systems while providing predictability and safety.

The Aviation Powerhouse

10. Vista Global — Private Aviation Without Ownership

Founded in 2004, Vista Global became a unicorn in 2018 and provides comprehensive business flight services globally from its Dubai headquarters. The company raised $600 million in its latest funding round, one of the largest deals in the UAE’s recent history.

Vista integrates a unique portfolio of companies offering asset-free services covering all key aspects of business aviation: guaranteed and on-demand global flight coverage, subscription and membership programs, aircraft leasing and finance, and innovative aviation technology. The premise is compelling: consumers pay only for time spent flying, avoiding asset depreciation and ownership risks.

In a region where private aviation is synonymous with status, Vista democratized access through technology and fractional ownership models. The company’s AI-powered booking software optimizes aircraft utilization, reducing empty-leg flights and passing savings to customers. With sustainability increasingly critical, Vista’s efficiency-driven approach positions it at the intersection of luxury and responsibility.

The AgriTech Pioneer

11. Pure Harvest Smart Farms — Farming in the Desert

Sky Kurtz admits people thought he was crazy when he proposed indoor farming in the Dubai desert in 2017. Eight years later, Pure Harvest Smart Farms has raised $180.5 million in its latest funding round, with total funding reaching $387.1 million, making it one of the largest agri-tech firms in the region.

The UAE imports at least 80 percent of its food—a vulnerability exposed during every global crisis. Pure Harvest’s controlled-environment agriculture addresses this head-on. The company’s farms across the UAE produce over 33 million pounds of food annually, selling to major grocery stores in the region, including Carrefour, Spinney’s, and Waitrose.

Growing tomatoes, leafy greens, strawberries, and berries year-round in temperature-controlled facilities, Pure Harvest has proven that climate doesn’t dictate agricultural viability—technology does. The company’s systems are specifically designed for harsh Middle Eastern conditions, unlike competitors’ solutions built for temperate climates.

Initial funding came from the Mohammed bin Rashid Innovation Fund’s $1.5 million loan, with the Abu Dhabi Investment Office providing grants for expansion. Now eyeing Kuwait, Morocco, and Singapore, Pure Harvest is exporting its model to other food-insecure regions. The company even produces strawberry preserves and tomato sauces from leftover seasonal produce, reducing waste while generating additional revenue.

The PropTech Disruptor

12. Huspy — Turning Mortgages into Celebrations

Founded in 2020, Huspy reimagines the home buying process with a simple premise: getting a mortgage shouldn’t be painful. In less than 12 months, the company became the UAE market leader in digital mortgage solutions.

Using technology and internal expert knowledge, Huspy creates transparent, easy-to-use experiences. In a market where buying property traditionally involved dozens of bank visits, mountains of paperwork, and opaque pricing, Huspy’s digital-first approach feels revolutionary. The platform guides buyers through mortgage options, provides instant pre-approvals, and connects them with the best rates.

The proptech startup is now expanding its vision beyond mortgages to shape an entire category enabling and empowering the ecosystem: homebuyers, sellers, agents, and mortgage brokers throughout the UAE and beyond. In a region experiencing massive real estate growth, Huspy is positioning itself as the essential infrastructure for property transactions.

The E-Commerce Specialists

13. Eyewa — Disrupting Eyewear

Founded by ex-Bain consultants and former Rocket Internet managing directors, Eyewa aims to make eyewear accessible and affordable for everyone in the Middle East and North Africa. The Dubai-based startup offers sunglasses, prescription glasses, blue-light reading glasses, and contact lenses through an online platform that streams the purchasing process.

Building on successful eyewear e-commerce models from Europe, Asia, and the US, Eyewa leverages best-in-class technology to offer the most convenient online experience and disruptive retail store concepts. The company addresses a market where traditional optical stores charge premium prices with limited selection.

By combining virtual try-on technology, home delivery, free returns, and competitive pricing, Eyewa has captured significant market share among the region’s tech-savvy youth. The startup has raised multiple funding rounds and continues expanding its footprint across MENA markets.

14. The Luxury Closet — Circular Luxury Economy

The Luxury Closet specializes in the resale of high-end luxury goods, promoting sustainable consumption by offering a platform for authenticated pre-owned luxury items. In a region known for conspicuous consumption, the startup is pioneering the circular economy concept.

The platform attracts a growing clientele interested in both quality and sustainability. By providing authentication services, competitive pricing, and a curated selection, The Luxury Closet has made pre-owned luxury acceptable—even desirable—in markets traditionally focused on brand-new goods.

With rising awareness about sustainable consumption and the authentic luxury goods market growing globally, The Luxury Closet represents a new approach to retail in the Middle East: responsible, transparent, and technology-enabled.

The AI Powerhouse

15. G42 — The Regional AI Champion

Founded in 2018 and based in Abu Dhabi, G42 achieved unicorn status in 2021 after receiving $800 million from investors including Silver Lake. In April 2024, Microsoft announced it would invest $1.5 billion in G42, with Microsoft’s president Brad Smith joining G42’s board.

G42 is an artificial intelligence development company focused on advanced AI technology to improve life across multiple sectors. The company’s platforms and industry solutions harness the latest scientific research, applying it responsibly from healthcare to government services, finance to aviation.

Subsidiaries include healthtech company M42, the Presight analytics platform, Khazna data centers, and Core42 for cybersecurity and digital services. G42 partnered with OpenAI in October 2023 to develop AI in the UAE and regional markets.

The company’s $10 billion technology investment arm, 42XFund, signals ambitions extending far beyond the Middle East. In 2024, G42 helped launch MGX, an investment firm specializing in AI technologies with plans to raise $25 billion. With Microsoft Azure powering its operations and strategic partnerships with tech giants, G42 represents the UAE’s bet on becoming a global AI hub.

The Investment Equation: Why Capital Flows to Dubai

Follow the money, and you’ll understand the ecosystem. UAE startups raised nearly $2.4 billion in H1 2024, led by G42’s $1.5 billion round. But size isn’t everything—it’s who’s investing and why.

The Investor Landscape

Sovereign wealth funds dominate the cap table. Saudi Arabia’s Public Investment Fund, Abu Dhabi’s Mubadala Investment Company, and Kuwait’s Wafra International Investment Company aren’t passive check-writers—they’re strategic partners with decade-long visions. When PIF backs Noon with $500 million, it’s not seeking quick returns; it’s building regional infrastructure.

International VCs have taken notice. Sequoia Capital India, SoftBank, Wellington Management, Blue Pool Capital, and Silver Lake have all made significant Middle Eastern bets. This isn’t tourism—it’s recognition that the next generation of unicorns might wear kanduras instead of hoodies.

Late-stage deals dominated, taking about $817 million, while seed-stage funding shrank to just $32.7 million. This concentration signals maturity: investors are backing proven scale-ups rather than spreading bets thinly across early-stage startups. It also creates opportunity gaps for seed investors willing to place contrarian bets.

The Strategic Advantage

Unlike Silicon Valley’s geographic luck—elite universities, defense spending, venture capital culture—Dubai manufactured its advantages through policy. Zero corporate tax until recently, streamlined company registration, golden visas for entrepreneurs and investors, and regulatory sandboxes for fintech and emerging tech.

The Dubai International Financial Centre and Abu Dhabi Global Market provide common law jurisdictions within civil law countries, offering international investors familiar legal frameworks. Free zones like Dubai Silicon Oasis and Dubai Internet City offer 100 percent foreign ownership, tax exemptions, and custom regulations.

Most critically, Dubai offers access to high-growth markets. The MENA region’s population will reach 600 million by 2030, with a median age of 25 and rapidly growing internet penetration. These aren’t mature, saturated markets—they’re greenfield opportunities for digital services.

The Challenges Lurking Beneath the Glitter

Honesty demands acknowledging the obstacles. Dubai’s startup ecosystem isn’t perfect, and challenges threaten to constrain growth.

Talent Retention and Brain Drain

The region produces talented engineers and entrepreneurs, but many still seek Silicon Valley credentials before returning. While improving, technical talent depth lags behind established hubs. Visa complexities, despite reforms, still frustrate international recruitment.

Pure Harvest and Vezeeta both cited talent attraction as key drivers for Dubai moves. But moving headquarters is expensive—it’s a symptom of a problem. Until regional universities produce sufficient technical talent and entrepreneurial culture deepens, this constraint will persist.

Market Fragmentation

“The Middle East” isn’t monolithic. Saudi Arabia, UAE, Egypt, and others have different regulations, languages, payment preferences, and consumer behaviors. Scaling across the region requires navigating political tensions, varying regulatory environments, and cultural sensitivities.

Startups face a choice: dominate one market or spread resources thin. Tabby chose three core markets; others attempt broader expansion and struggle. Regional integration remains more aspiration than reality.

Dependency on Government Support

Nearly every success story includes government backing: sovereign wealth fund investments, development bank loans, regulatory sandboxes, infrastructure projects. This creates vulnerability. Political shifts, budget reallocations, or policy changes could destabilize the ecosystem overnight.

Contrast this with Silicon Valley’s decentralized, private-sector-driven innovation. When governments drive growth, governments can also halt it. The challenge is transitioning to self-sustaining cycles where successful exits fund the next generation—a process that takes decades to establish.

Exit Constraints

Careem’s $3.1 billion acquisition by Uber remains the largest technology sector transaction in Middle Eastern history—and it happened in 2019. Since then, exits have been limited. Public markets remain underdeveloped, with NASDAQ Dubai seeing limited activity. Most acquisitions are regional, limiting valuation potential.

Until viable IPO markets develop and international acquirers view the region as strategic, founders face constrained exit options. This affects fundraising dynamics, employee equity value, and ecosystem recycling of capital and talent.

Cultural and Regulatory Complexity

Despite reforms, doing business in the Middle East requires navigating complex cultural norms, Islamic finance principles, and sometimes unpredictable regulatory environments. Data localization requirements, content regulations, and evolving tech policies create compliance overhead.

For international founders and investors, these frictions add cost and risk. While improving, the region’s reputation for bureaucracy and opacity still deters some capital and talent.

Looking Ahead: The 2025 Outlook

Where does Dubai’s startup ecosystem go from here? Several trends will define the next 24 months.

The IPO Wave

Tabby’s planned Saudi IPO could unlock a wave of public listings. If successful, expect other unicorns to follow. Public markets provide liquidity, validate valuations, and create wealth that recycles into the ecosystem. The Saudi Stock Exchange (Tadawul) and Abu Dhabi Securities Exchange are positioning themselves as regional tech hubs.

AI and Emerging Tech

G42’s Microsoft partnership signals that AI investment is just beginning. Expect significant capital flowing into machine learning, computer vision, natural language processing, and AI applications across industries. The UAE’s strategy of becoming a global AI hub requires continued aggressive investment.

Climate tech and agri-tech will also see growth. Pure Harvest’s success proves that controlled-environment agriculture works in harsh climates. With food security a national priority and climate change accelerating, expect more capital into sustainable agriculture, water technology, and renewable energy.

Regional Consolidation

Markets are fragmenting along national lines—Saudi Arabia building its own ecosystem, Egypt struggling but persisting, Qatar investing in tech. Dubai must consolidate its position as the regional hub while navigating geopolitical complexity.

We’ll likely see more M&A activity as leading startups acquire regional competitors to achieve scale. Vertical integration will accelerate as platforms add adjacent services—e-commerce companies launching fintech, fintech companies offering e-commerce, super apps expanding into everything.

International Expansion

Leading startups will expand beyond MENA. Careem, Tabby, and Pure Harvest already have global ambitions. Expect more startups using Dubai as a launchpad to enter Southeast Asia, Sub-Saharan Africa, and South Asia—regions with similar characteristics and challenges.

This international expansion will attract more foreign capital and talent, further cementing Dubai’s position. Success breeds success; regional wins are nice, but global scale creates generational companies.

The Regulatory Evolution

As the ecosystem matures, expect regulations to tighten. The Wild West phase is ending; consumer protection, data privacy, financial regulation, and content moderation will all see increased scrutiny. How Dubai balances innovation and regulation will determine long-term competitiveness.

Regulatory sandboxes must evolve into permanent frameworks. The UAE’s progressive approach to crypto, fintech, and emerging tech regulation gives it an edge—but this requires continuous adaptation as technologies evolve.

The Verdict: Dawn of a New Tech Power

Twenty years ago, Dubai was known for oil, gold souks, and audacious real estate projects. Today, it’s home to twelve unicorns, $2+ billion in annual startup funding, and a generation of founders building billion-dollar companies.

This transformation reflects vision and execution. Government backing provided infrastructure and capital. Strategic reforms created business-friendly environments. Geographic positioning offered market access. Cultural adaptation allowed technology to solve local problems.

But ultimately, Dubai’s startup success comes down to people. Entrepreneurs like Hosam Arab, Mudassir Sheikha, Sky Kurtz, and thousands of others who saw opportunities where others saw obstacles. Investors who bet on potential rather than certainty. Governments who supported innovation rather than stifling it.

The fifteen startups profiled here represent broader trends: fintech’s rise, e-commerce’s inevitability, healthcare’s digitization, sustainability’s necessity, AI’s transformative potential. They prove that geography doesn’t determine destiny—vision, capital, talent, and execution do.

Is Dubai the next Silicon Valley? Perhaps that’s the wrong question. Silicon Valley is a 70-year-old ecosystem built on specific historical circumstances unlikely to be replicated. Dubai doesn’t need to be Silicon Valley—it needs to be Dubai: a uniquely Middle Eastern innovation hub addressing regional challenges with global technologies.

The challenges are real: talent constraints, market fragmentation, government dependency, limited exit options. But the momentum is undeniable. When sovereign wealth funds worth trillions commit to building tech ecosystems, when Microsoft invests $1.5 billion into regional AI companies, when founders successfully navigate from seed to IPO—the ecosystem becomes self-reinforcing.

For investors seeking emerging market exposure, Dubai offers unmatched opportunity. For entrepreneurs building global companies, it provides capital, talent, and market access. For governments seeking diversification, it demonstrates that economic transformation is possible with commitment and resources.

The desert has always been a place of transformation—where harsh conditions forge resilience, where trade routes connected civilizations, where vision transformed sand into cities. Today, that transformation is technological. And the fifteen startups leading this change are writing the next chapter of Middle Eastern history.

The sun still glints off the Burj Khalifa. But now, it illuminates something more than architectural ambition—it lights up a future where the Middle East isn’t just consuming technology but creating it, not just following global trends but defining them, not just building startups but building the ecosystems that produce the next generation of global giants.

The revolution has only just begun.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Analysis

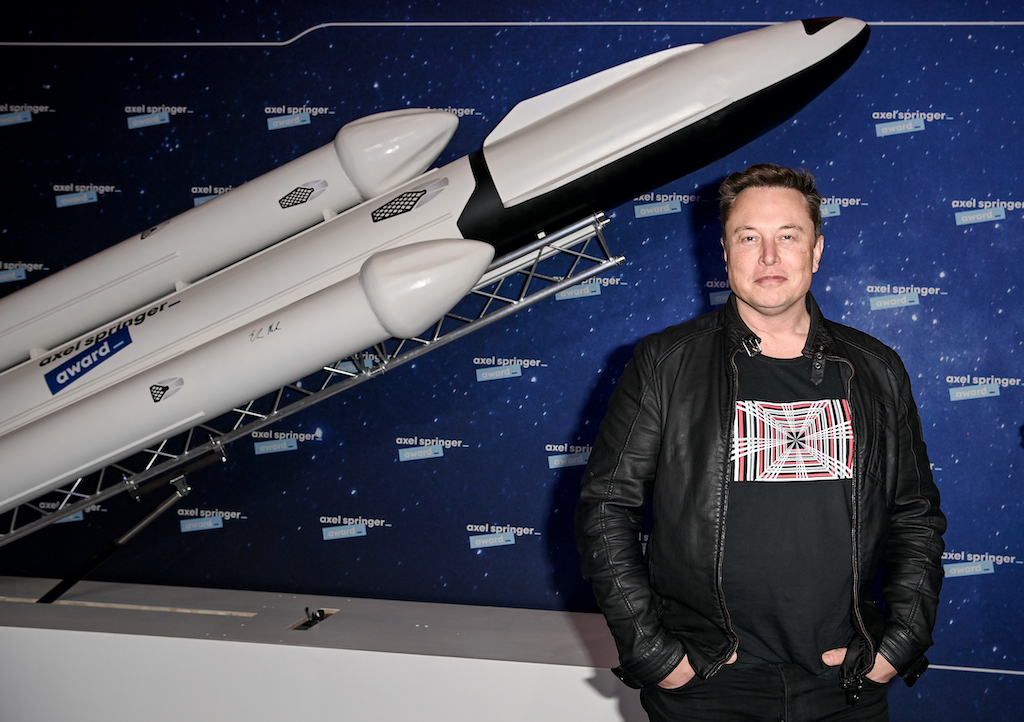

A Theory of Elon Musk’s Maniacal Drive

Introduction

Elon Musk, the enigmatic entrepreneur, inventor, and CEO of multiple groundbreaking companies, has captivated the world with his relentless drive and audacious vision. From Tesla’s electric cars to SpaceX’s ambitious goal of colonizing Mars, Musk’s ventures have redefined industries and challenged conventional thinking. But what fuels this maniacal drive that sets him apart from his contemporaries? In this blog post, we will delve deep into the psyche of Elon Musk to explore the theory behind his insatiable ambition and relentless pursuit of innovation.

The Genesis of Elon Musk’s Ambition

To understand the origins of Musk’s drive, we must first look at his upbringing and early experiences. Born in Pretoria, South Africa, in 1971, Musk’s childhood was marked by curiosity and a voracious appetite for knowledge. He was an avid reader, devouring science fiction novels and books on engineering and physics, which undoubtedly fueled his imagination.

Musk’s parents divorced when he was young, and he developed a close bond with his father, Errol Musk, an electromechanical engineer. It was through this relationship that Musk gained early exposure to engineering concepts and technology. These formative years, spent exploring the world of electronics and mechanics, laid the foundation for his future endeavours.

The PayPal Windfall

Elon Musk’s journey as an entrepreneur began with Zip2, an online business directory he co-founded in 1996. The sale of Zip2 in 1999 brought him his first significant financial success. However, it was his involvement in the creation of PayPal that truly catapulted him into the ranks of Silicon Valley’s elite.

In 2002, PayPal was acquired by eBay for $1.5 billion in stock. Musk’s share of the proceeds amounted to approximately $165 million. This massive windfall provided him with the financial means to pursue his grand ambitions, and it marked a pivotal moment in his career.

The PayPal sale not only gave Musk the resources he needed but also a taste of the impact he could have on the world through technology and innovation. It was a glimpse of what lay ahead, and he was determined to make the most of it.

Visionary Ventures

With his newfound wealth, Elon Musk embarked on a journey that would see him establish some of the most groundbreaking companies of the 21st century. Here, we’ll explore Musk’s ventures and the driving forces behind each of them:

- Tesla, Inc.: In 2004, Musk co-founded Tesla Motors (now Tesla, Inc.) with a mission to accelerate the world’s transition to sustainable energy. His relentless pursuit of electric vehicles (EVs) as a solution to climate change and fossil fuel dependence stemmed from his concern for the environment and a desire to disrupt the automotive industry. Musk’s commitment to innovation in battery technology and EV design has made Tesla a global leader in the electric car market.

- The Drive Factor: Musk’s drive in the electric vehicle sector is rooted in a deep sense of responsibility toward the planet’s future. He envisions a world where sustainable energy sources replace fossil fuels, and he’s determined to make that future a reality.

- SpaceX: In 2002, Musk founded SpaceX with the goal of reducing the cost of space exploration and making it possible for humans to colonize Mars. SpaceX has achieved numerous milestones, including the first privately funded spacecraft to reach orbit and the development of the reusable Falcon 9 rocket.

- The Drive Factor: Musk’s obsession with space exploration is driven by a belief that humanity should become a multi-planetary species to ensure our survival. His desire to establish a human presence on Mars is a testament to his audacious ambition and long-term thinking.

- SolarCity (Now Tesla Solar): Musk’s vision for a sustainable future extended beyond electric cars. In 2006, he co-founded SolarCity (now part of Tesla) to accelerate the adoption of solar energy. By providing solar panels and energy storage solutions, Musk aimed to reduce the world’s reliance on fossil fuels for electricity.

- The Drive Factor: Musk’s drive in the renewable energy sector is tied to his conviction that transitioning to clean, renewable energy sources is essential to combat climate change and create a more sustainable world.

- Neuralink: In 2016, Musk founded Neuralink, a neurotechnology company focused on developing brain-computer interfaces. The aim is to merge the human brain with artificial intelligence (AI) to enhance cognitive abilities and potentially address neurological conditions.

- The Drive Factor: Musk’s involvement in Neuralink stems from his concerns about the existential risks posed by AI and his belief that merging with AI is a way for humanity to remain relevant in an increasingly AI-driven world.

- The Boring Company: Musk founded The Boring Company in 2016, with the goal of revolutionizing tunnel construction and transportation. The company’s projects include high-speed underground transportation systems (e.g., the Hyperloop) and urban tunnel networks.

- The Drive Factor: Musk’s motivation for The Boring Company is rooted in his frustration with traffic congestion and a desire to improve urban transportation. His commitment to solving such seemingly intractable problems showcases his persistence and innovative thinking.

Driving Forces Behind Musk’s Maniacal Ambition

Elon Musk’s maniacal drive can be attributed to several key factors:

- Mission-Driven Leadership: Musk’s ventures are fueled by missions that transcend profit motives. He sees himself as a catalyst for positive change in the world, whether it’s reducing carbon emissions, enabling space exploration, or advancing neurotechnology. This sense of purpose drives him relentlessly.

- Risk-Taking: Musk is not afraid to take enormous risks, both personally and financially. He invested nearly all his wealth in SpaceX and Tesla, even when both companies faced existential threats. This willingness to risk it all is a testament to his unwavering commitment to his visions.

- Long-Term Vision: Musk thinks in terms of decades and centuries, not just quarters or years. His focus on long-term goals allows him to overcome short-term setbacks and persevere in the face of adversity.

- Relentless Work Ethic: Musk is known for his grueling work schedule, often putting in 80-100 hour weeks. His dedication to his companies and projects is unmatched, and he leads by example, expecting the same level of commitment from his teams.

- Fearlessness in the Face of Failure: Musk has faced numerous failures and setbacks throughout his career, from rocket explosions to production delays. Yet, he views failure as a stepping stone to success and remains undeterred by it.

- Innovation and Disruption: Musk’s drive is fueled by a desire to disrupt industries and challenge the status quo. He thrives on pushing the boundaries of what’s possible and is relentless in his pursuit of innovation.

Conclusion

Elon Musk’s maniacal drive is a complex interplay of his upbringing, early experiences, and unwavering commitment to missions that go beyond personal gain. His relentless pursuit of ambitious goals has not only revolutionized multiple industries but has also inspired countless individuals to think bigger and bolder.

Musk’s legacy extends far beyond the companies he’s founded; it’s a testament to the power of vision, determination, and a refusal to accept the limitations of the status quo. As we look to the future, Elon Musk serves as a reminder that the world needs more dreamers and doers who are willing to take risks, challenge convention, and strive for greatness.

In the end, Elon Musk’s maniacal drive isn’t just about success; it’s about changing the world, one audacious idea at a time.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Analysis

Why Most Long-Term Investors Can Safely Overlook the Federal Reserve’s Current Actions

Introduction

In the investing world, there are few institutions as influential and closely watched as the Federal Reserve. The actions and decisions of this central bank of the United States can have profound effects on financial markets, interest rates, and the broader economy. As a result, investors often pay keen attention to Federal Reserve announcements, especially regarding changes in interest rates and monetary policy. However, for most long-term investors, the Federal Reserve’s actions today should not be a primary concern. In this blog post, we will explore why most long-term investors can afford to ignore whatever the Federal Reserve does today and focus on their broader investment strategy.

Understanding the Federal Reserve

Before we delve into why long-term investors can overlook short-term Federal Reserve actions, let’s first establish a clear understanding of what the Federal Reserve is and what it does.

The Federal Reserve, often referred to simply as “the Fed,” is the central banking system of the United States. It was established in 1913 with the primary mission of promoting a stable and sound financial system. The Fed has several key functions, including:

- Monetary Policy: One of the most well-known roles of the Fed is to set and implement monetary policy. This includes decisions on interest rates, open market operations, and regulating the money supply. Through its monetary policy tools, the Fed aims to achieve maximum employment, stable prices, and moderate long-term interest rates.

- Bank Regulation: The Fed supervises and regulates banks to ensure the safety and soundness of the financial system. It also helps maintain the stability of the banking sector and oversees compliance with various banking laws and regulations.

- Financial Services: The Fed provides various financial services to banks and the U.S. government, such as clearing checks, processing electronic payments, and managing the U.S. Treasury’s accounts.

- Economic Research: The Federal Reserve conducts economic research and analysis to better understand economic trends and inform its policy decisions.

Now that we have a basic understanding of the Fed’s functions, let’s explore why long-term investors should not be overly concerned with its short-term actions.

1. Long-term investing vs. Short-Term Speculation

One of the fundamental principles of successful investing is to distinguish between long-term investing and short-term speculation. Long-term investors have a different mindset and strategy compared to short-term traders and speculators. Long-term investing typically involves holding assets for an extended period, often years or even decades, with the expectation that their value will increase over time.

In contrast, short-term speculation involves trying to profit from short-term price fluctuations in financial markets. Speculators often react quickly to news events, economic data releases, and central bank decisions, such as those made by the Federal Reserve. Their focus is on timing the market to make quick gains or avoid losses.

For long-term investors, the emphasis is on the fundamentals of the investments they hold. They understand that short-term market fluctuations are part of investing, and they are willing to weather these ups and downs with a focus on the long-term horizon. As such, the day-to-day actions of the Federal Reserve are of limited importance to their investment decisions.

2. Time Horizon Matters

One of the critical reasons long-term investors can largely disregard the Federal Reserve’s actions is their longer time horizon. Long-term investors are not primarily concerned with what happens in the market today or even this year. They are looking at a time frame that extends far beyond the latest Federal Reserve meeting or interest rate decision.

When you have a long investment horizon, short-term fluctuations become less relevant. What matters most is the overall trajectory of your investments over many years. History has shown that financial markets tend to recover from short-term setbacks and continue to grow over extended periods. This perspective allows long-term investors to maintain a level of patience and discipline that can be crucial for success.

3. Market Timing Is a Risky Game

Attempting to time the market based on Federal Reserve actions or any other short-term events is a risky endeavour. Even seasoned professionals often struggle to consistently make accurate predictions about market movements. Market timing relies on getting both the entry and exit points right, which is challenging, if not impossible, to do consistently over the long term.

Moreover, investors who try to time the market often miss out on the best-performing days. A study by J.P. Morgan Asset Management found that investors who remained fully invested in the S&P 500 from 1999 to 2019 would have earned an average annual return of 5.6%. However, missing just the 10 best days in the market during that period would have reduced their return to just 2.0%.

This highlights the danger of trying to avoid short-term market volatility by making reactionary moves based on Federal Reserve decisions. Long-term investors are better off staying invested and focusing on their overall asset allocation and investment strategy.

4. Diversification and Asset Allocation Are Key

For long-term investors, the most important factors in achieving their financial goals are often asset allocation and diversification. Asset allocation refers to the distribution of investments among different asset classes, such as stocks, bonds, and real estate. Diversification involves spreading investments within each asset class to reduce risk.

The decisions made by the Federal Reserve can certainly impact the performance of different asset classes and sectors within the market. However, a well-diversified portfolio can help mitigate the effects of these short-term fluctuations. By holding a mix of assets, including those with low correlation to one another, long-term investors can reduce their exposure to individual market events.

Additionally, the right asset allocation should be based on an investor’s financial goals, risk tolerance, and time horizon. These factors should drive the allocation decisions more than any short-term central bank actions.

5. Staying the Course: The Power of Discipline

Long-term investors who ignore the noise of daily market fluctuations and Federal Reserve announcements often exhibit a high level of discipline. Discipline is a key characteristic of successful investors because it allows them to stick to their investment plan and resist emotional reactions to market events.

The Federal Reserve can surprise the markets with unexpected decisions, and short-term market reactions can be volatile. However, investors who maintain their discipline and stay committed to their long-term strategy are more likely to achieve their financial goals.

In the face of uncertainty and market turbulence, it’s essential for long-term investors to have confidence in their investment strategy and the resilience to withstand short-term setbacks. This confidence comes from having a well-thought-out plan that considers their individual financial circumstances and goals.

6. Focus on Fundamentals and Quality Investments

Rather than fixating on Federal Reserve actions, long-term investors should prioritize fundamental analysis and quality investments. Fundamental analysis involves assessing the underlying financial health and prospects of the companies or assets in which you invest.

Quality investments are those that have strong fundamentals, including stable earnings, a competitive advantage, and a history of prudent management. These characteristics are more likely to drive long-term success than attempting to time the market based on short-term central bank actions.

By conducting thorough research and focusing on quality, long-term investors can build a portfolio of assets that are well-positioned to weather various economic and market conditions, including changes in monetary policy.

7. The Importance of a Financial Advisor

For many long-term investors, working with a qualified financial advisor can provide valuable guidance and perspective. Financial advisors can help investors create a customized investment plan that aligns with their goals and risk tolerance. They can also offer reassurance during times of market volatility and help clients stay on course.

Furthermore, financial advisors can provide expertise on how to navigate the potential impact of Federal Reserve actions on an investment portfolio. They can help clients understand the implications of interest rate changes and adjust their strategy accordingly, if necessary. However, these adjustments are typically made within the context of a well-structured, long-term plan.

Conclusion

In the world of investing, it’s easy to get caught up in the day-to-day headlines and market reactions to Federal Reserve actions. However, for most long-term investors, this focus on short-term events can be counterproductive and even detrimental to their financial goals.

Long-term investors benefit from having a clear investment plan, a disciplined approach, and a focus on fundamentals. They understand that short-term market fluctuations are a natural part of investing, and they resist the urge to make reactionary decisions based on transient events.

While the Federal Reserve plays a crucial role in the economy and financial markets, long-term investors can afford to look past the noise of today’s actions and maintain their commitment to their long-term strategy. By doing so, they increase their chances of achieving their financial objectives and building wealth over time. Remember, investing is a marathon, not a sprint, and the Federal Reserve’s actions today should not divert you from your path to long-term financial success.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

-

Digital5 years ago

Social Media and polarization of society

-

Digital5 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital5 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News5 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Digital5 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Kashmir5 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Business4 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China5 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?