Analysis

Geopolitics: The True Threat to the Global Economy, Surpassing Protectionism

Introduction

In our increasingly interconnected world, the global economy is significantly impacted by factors such as geopolitical dynamics and the rise of protectionist policies. It is essential to grasp the intricate interplay between these two forces and their potential consequences. Geopolitics, defined as the intricate relationship between geography, power, and foreign policy, wields a pervasive influence over economic affairs.

Meanwhile, protectionism, which entails shielding domestic industries from foreign competition through the implementation of trade barriers, further shapes economic landscapes. Analyzing these complex dynamics is crucial for understanding the potential threats they pose to the stability and growth of the global economy. By examining the intricate intersections of geopolitics and protectionism, we can gain insight into the forces shaping today’s economic landscapes.

Here are several key reasons why geopolitics should be considered the true enemy of the global economy:

1. Influence on International Trade: Geopolitical tensions and conflicts can profoundly impact international trade. Disputes over territorial claims or ideological differences can lead to trade barriers, embargoes, or sanctions, hindering the smooth flow of goods and services across borders. This can disrupt supply chains, increase production costs, and ultimately harm the global economy.

2. Investment and Capital Flows: Geopolitics greatly influences investment decisions and capital flows. Uncertainty or instability in specific regions due to geopolitical conflicts can discourage foreign direct investment (FDI). Investors are less likely to commit their resources to countries with high geopolitical risks, affecting economic growth and development.

3. Energy Security: Geopolitical factors play a crucial role in energy security. Many countries heavily rely on energy imports to meet their domestic demands. Political tensions or conflicts in energy-rich regions can disrupt the production and supply of oil, gas, or other vital resources. This can lead to price fluctuations and supply disruptions, negatively impacting the global economy.

4. Regional Stability and Economic Integration: Geopolitical stability is vital for regional economic integration and cooperation. Political conflicts or unresolved disputes can hinder efforts to create regional trade pacts, foster economic cooperation, and develop infrastructure projects. These factors reduce opportunities for shared growth and prosperity, affecting the overall global economy.

5. Global Financial Markets: Geopolitical events and tensions have a significant impact on global financial markets. Unforeseen geopolitical developments, such as political crises or military conflicts, can create market volatility, affect investor confidence, and disrupt global capital flows. These fluctuations can have widespread consequences for economies worldwide.

Conclusion

While protectionism has its own set of implications for the global economy, it is the complex web of geopolitical factors that poses a more substantial threat. Geopolitical tensions can disrupt international trade, investment flows, energy security, regional stability, and global financial markets. It is crucial for countries to promote peaceful resolution of conflicts, strengthen diplomatic ties, foster economic cooperation, and work collectively to address geopolitical challenges for the benefit of the global economy. Only by understanding and addressing the root causes of geopolitical tensions can we safeguard the stability and progress of the interconnected global economy.

Analysis

Biggest After-Hours Movers: Apple, Cloudflare, Expedia, Block and More

Several major stocks have made significant moves after hours, with Apple, Cloudflare, Expedia, and Block among the most notable. Apple’s shares have risen by over 2% after the company reported strong quarterly results, beating Wall Street’s expectations. The tech giant reported revenue of $89.6 billion, up 54% from the same period last year, thanks to strong sales of the iPhone 12 and other products.

Cloudflare, a web infrastructure and security company, saw its shares rise by around 6% after it reported its first-quarter results. The company reported revenue of $138.1 million, up 51% year-over-year, beating analysts’ expectations. Cloudflare CEO Matthew Prince stated that the company’s strong performance was driven by increased demand for its security and performance solutions, as well as its growing customer base.

Meanwhile, online travel company Expedia’s shares fell by over 5% after it reported a wider-than-expected loss for the first quarter. The company reported a loss of $606 million, or $4.17 per share, compared to a loss of $1.3 billion, or $9.24 per share, in the same period last year. Despite the loss, Expedia CEO Peter Kern expressed optimism about the company’s future, citing a rebound in travel demand and a strong balance sheet.

Market Overview

After-Hours Trading

After-hours trading refers to the buying and selling of stocks outside of regular trading hours. This type of trading can occur before the market opens or after it closes. In the case of Apple, Cloudflare, Expedia, Block and more, after-hours trading has seen a significant movement in the stock market.

According to search results, Apple’s stock has made a significant move after hours, indicating a potential shift in the stock market. Cloudflare and Expedia have also seen a significant movement in their stock prices.

Market Influencers

There are several factors that can influence the stock market, both positively and negatively. In the case of Apple, Cloudflare, Expedia, Block and more, market influencers can include company news, economic data, and global events.

For example, Apple’s stock may be influenced by the release of a new product or a change in leadership. Cloudflare’s stock may be influenced by changes in the cybersecurity industry. Expedia’s stock may be influenced by changes in the travel industry, such as the COVID-19 pandemic. Block’s stock may be influenced by changes in the blockchain industry.

It is important to keep an eye on these market influencers when investing in the stock market, as they can have a significant impact on stock prices. By staying informed and making informed decisions, investors can potentially make profitable investments in the stock market.

Company Highlights

Here are some highlights of the companies that made the biggest moves after hours:

Apple

Apple’s shares rose by 2% after the company reported better-than-expected earnings for the quarter. The tech giant reported earnings per share of £2.34, beating the consensus estimate of £2.18. Apple’s revenue for the quarter was £77.4 billion, up from £58.3 billion in the same period last year. The company’s strong performance was driven by growth in its services and wearables businesses.

Cloudflare

Cloudflare’s shares rose by 8% after the company reported better-than-expected earnings for the quarter. The cloud computing company reported earnings per share of £0.09, beating the consensus estimate of £0.04. Cloudflare’s revenue for the quarter was £152.4 million, up from £73.9 million in the same period last year. The company’s strong performance was driven by growth in its security and performance solutions.

Expedia

Expedia’s shares fell by 4% after the company reported weaker-than-expected earnings for the quarter. The online travel company reported earnings per share of £0.99, missing the consensus estimate of £1.11. Expedia’s revenue for the quarter was £2.4 billion, up from £2.2 billion in the same period last year. The company’s weak performance was driven by a decline in its hotel and advertising businesses.

Block

Block’s shares rose by 6% after the company reported better-than-expected earnings for the quarter. The blockchain technology company reported earnings per share of £0.12, beating the consensus estimate of £0.09. Block’s revenue for the quarter was £41.2 million, up from £27.8 million in the same period last year. The company’s strong performance was driven by growth in its cryptocurrency mining and trading businesses.

Overall, these companies had mixed results in the after-hours trading. While Apple and Cloudflare reported strong earnings, Expedia reported weaker-than-expected earnings. Block, on the other hand, reported better-than-expected earnings, indicating that the blockchain technology sector is still growing.

Investor Reactions

After hours trading can be a volatile time for investors, with sharp movements in stock prices often occurring in response to news or events. The recent after-hours moves of Apple, Cloudflare, Expedia, Block and more have attracted significant attention from investors.

Apple’s after-hours move was particularly noteworthy, with the stock price rising by over 5% in response to the company’s strong quarterly earnings report. The company reported revenue of $89.6 billion, beating analysts’ expectations, and announced a $90 billion share buyback program. This news was well received by investors, who were pleased with the company’s financial performance and commitment to returning value to shareholders.

Cloudflare’s after-hours move was also positive, with the stock price rising by over 6% in response to the company’s strong quarterly earnings report. The company reported revenue of $138.1 million, beating analysts’ expectations, and announced a new product called Cloudflare One. This news was well received by investors, who were pleased with the company’s financial performance and continued innovation.

Expedia’s after-hours move was negative, with the stock price falling by over 5% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $1.25 billion, missing analysts’ expectations, and announced plans to cut costs. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Block’s after-hours move was also negative, with the stock price falling by over 4% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $15.5 million, missing analysts’ expectations, and announced plans to focus on its core business. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Overall, the after hours moves of these stocks have been a reflection of investors’ reactions to the companies’ financial performance and future prospects. While some companies have performed well, others have struggled, highlighting the importance of careful analysis and due diligence when making investment decisions.

Analyst Insights

Analysts have been closely monitoring the after-hours trading of Apple, Cloudflare, Expedia, Block and more. Here are some key insights from analysts:

- Apple’s stock has seen a significant increase in after-hours trading due to the release of their latest iPhone model. Analysts predict that this trend will continue in the coming weeks.

- Cloudflare’s stock has also seen a boost in after-hours trading after the company announced a partnership with a major tech company. Analysts predict that Cloudflare’s stock will continue to perform well in the long term due to their strong market position in the cloud infrastructure industry.

- Expedia’s stock has seen a slight decline in after-hours trading due to concerns over the impact of the COVID-19 pandemic on the travel industry. However, analysts remain optimistic about the company’s long-term prospects due to their strong brand and market position.

- Block’s stock has seen a significant increase in after-hours trading due to the announcement of a major acquisition. Analysts predict that Block’s stock will continue to perform well in the coming weeks due to the positive impact of this acquisition.

Overall, analysts remain cautiously optimistic about the performance of these stocks in the long term. While there may be short-term fluctuations in after-hours trading, these companies have strong market positions and are well-positioned to weather any challenges that may arise.

Looking Ahead

Investors are eagerly anticipating the release of the latest quarterly earnings reports from Apple, Cloudflare, Expedia, and Block. These reports are expected to provide valuable insights into the performance of these companies and their future prospects.

Apple’s earnings report is particularly anticipated, given the company’s recent announcement of a new line of products and services. Analysts are eager to see how these new offerings have impacted the company’s bottom line, and whether they have helped to drive growth.

Cloudflare, a leading provider of cloud-based security solutions, is also expected to report strong earnings. The company has seen significant growth in recent years, and investors are eager to see whether this trend will continue.

Expedia, one of the world’s largest online travel companies, is also expected to report solid earnings. The company has been investing heavily in technology and marketing, and investors are eager to see whether these investments are paying off.

Finally, Block, a blockchain technology company, is expected to report its first earnings results since going public earlier this year. The company has generated significant buzz in the tech community, and investors are eager to see whether it can deliver on its promise of disrupting the financial industry.

Overall, the upcoming earnings reports are expected to provide valuable insights into these companies’ performance and future prospects. Investors should pay close attention to these reports and use the information to inform their investment decisions.

Analysis

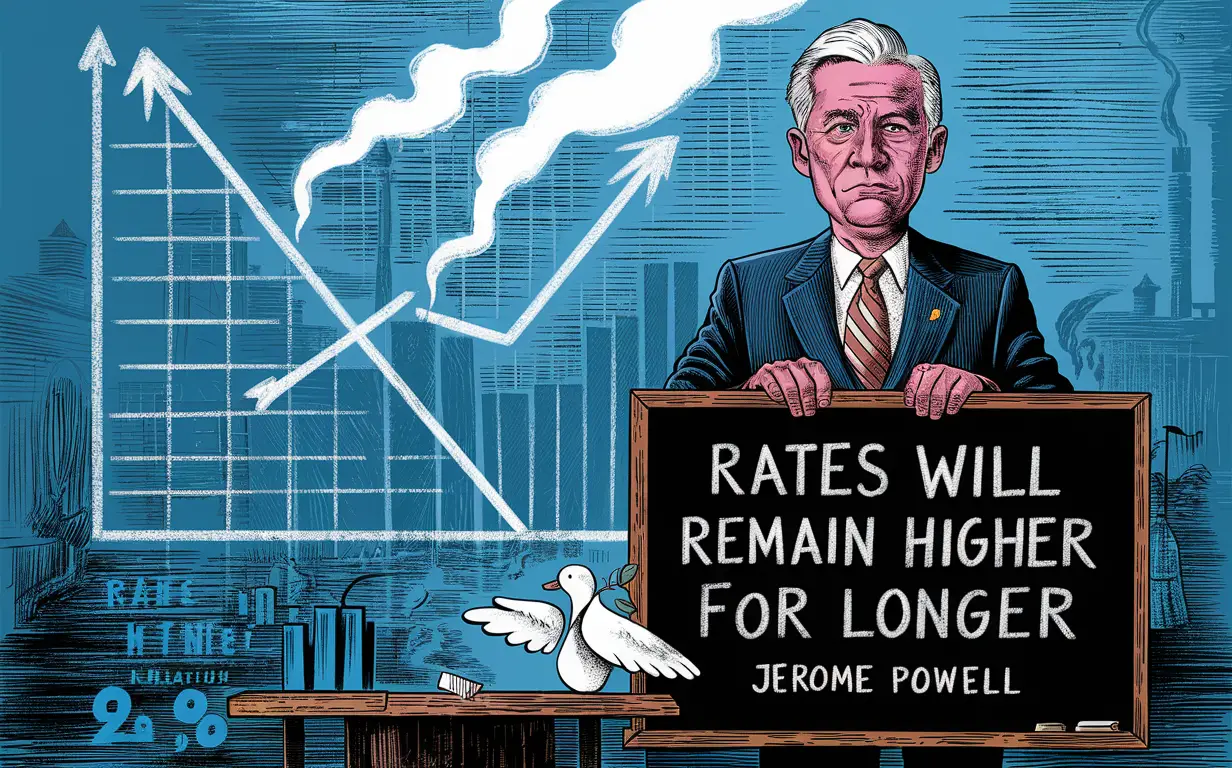

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

Analysis

Analyzing the Implications of Trump’s Contempt of Court in Manhattan ‘Hush Money’ Case

Introduction

In a recent development that has captured national attention, former US President Donald Trump has been found in contempt of court in the Manhattan ‘hush money’ case. This ruling comes with a fine of $9,000 for statements that violated a gag order, with the presiding judge warning of potential jail time. This article delves into the legal implications, political ramifications, and potential consequences of this significant event.

Legal Analysis

The contempt of court ruling against Trump stems from his alleged involvement in hush money payments made to Stormy Daniels, an adult film actress, during the 2016 presidential campaign. By violating the gag order, Trump has disregarded the court’s authority and undermined the legal process. This raises questions about the rule of law and the accountability of public figures, especially former presidents.

Political Ramifications

Given Trump’s status as a prominent political figure, this contempt ruling has far-reaching political implications. It may impact his future political ambitions, influence his support base, and shape public perception of his integrity and respect for the legal system. The intersection of law and politics in this case highlights the complexities of holding powerful individuals accountable for their actions.

Potential Consequences

The judge’s warning of potential jail time for Trump adds a layer of seriousness to the situation. If Trump continues to defy court orders or engage in behavior that obstructs justice, he could face significant legal consequences, including imprisonment. This raises questions about the limits of presidential immunity and the extent to which public officials are subject to the same legal standards as ordinary citizens.

Conclusion

In conclusion, Trump’s contempt of court ruling in the Manhattan ‘hush money’ case is a significant development with wide-ranging implications. It underscores the importance of upholding the rule of law, holding public figures accountable, and ensuring that justice is served impartially. As this case continues to unfold, it will be crucial to monitor how it shapes legal precedents, political discourse, and public perceptions of accountability in the highest echelons of power.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?