Technology

Microsoft co-founder Bill Gates meets PM Imran on first-ever visit to Pakistan

Microsoft co-founder and billionaire philanthropist Bill Gates met Prime Minister Imran Khan on Thursday during his first-ever visit to Pakistan.

Sharing pictures of the meeting on Twitter, Senator Faisal Javed Khan said Gates “greatly appreciated steps [regarding polio eradication] in Pakistan, the National Command and Operation Centre’s (NCOC) performance in relation to the Covid-19 pandemic and initiatives such as the Ehsaas programme”.

Later in the day, PM Imran hosted a luncheon in Gates’ honour. The Prime Minister’s Office, which shared pictures from the luncheon, added that the Microsoft co-founder was visiting the country on the premier’s “special invitation”.

The prime minister said that it was a pleasure to welcome Gates to Pakistan.

“Apart from his many achievements, he is admired globally for his philanthropy. On behalf of our nation, I thank him for his immense contribution towards polio eradication and poverty alleviation initiatives,” he said.

Earlier in the day, Gates met Planning and Development Minister and NCOC head Asad Umar and Special Assistant to the Prime Minister (SAPM) on Health Dr Faisal Sultan.

In a statement, the NCOC said the philanthropist attended the forum’s morning session.

During his visit, Gates was informed about the NCOC’s role and methodology, its achievements since the start of the Covid-19 pandemic, the coronavirus situation in Pakistan as well as the non-pharmaceutical interventions by the forum to control the spread of the disease.

Gates and his delegation were also informed about genome sequencing and coronavirus variants detected in Pakistan, the statement added.

“Gates took keen interest on various initiatives by NCOC, particularly smart lockdown and micro-smart lockdown strategy enforcement measures and Pakistan’s vaccine administration regime which enabled NCOC to formulate and implement a comprehensive Covid response.”

During his visit to the NCOC, the Bill and Melinda Gates Foundation chairman also shared his views on the pandemic, especially the vaccination drive.

“Gates appreciated Pakistan’s success against Covid-19 despite resource constraints and introducing excellent initiatives and measures for public health safety,” according to the statement.

For his part, Planning Minister Umar credited “a true national response, executed through an effective communication campaign mechanism of the NCOC” for the success in dealing with the coronavirus.

The minister thanked Gates for his foundation’s support to Pakistan during the Covid-19 pandemic.

Gates awarded Hilal-i-Pakistan

In addition, President Dr Arif Alvi conferred the Hilal-i-Pakistan award on Gates during a special investiture ceremony in Islamabad in “recognition of his support for poverty alleviation and healthcare”, according to Radio Pakistan.

The report added that the ceremony was attended by federal ministers, senior officials and members of the Diplomatic Corps.

The famous philanthropist has held conversations with Prime Minister Imran in the past on various issues and their possible solutions. In October last year, the premier urged Gates to consider providing humanitarian assistance to poverty-stricken people in Afghanistan.

The two had also discussed the polio situation in Afghanistan and Pakistan with the premier appreciating the assistance provided by Bill and Melinda Gates Foundation in that regard. In turn, the Microsoft co-founder had praised the prime minister for the progress in eliminating the disease and pledged his foundation’s continued support to the country’s polio programme.

Prior to that, in April 2021, the two had discussed matters relating to the Covid-19 response, polio eradication and climate change, and agreed to continue working together on the shared objectives.

Via Dawn/APP

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Analysis

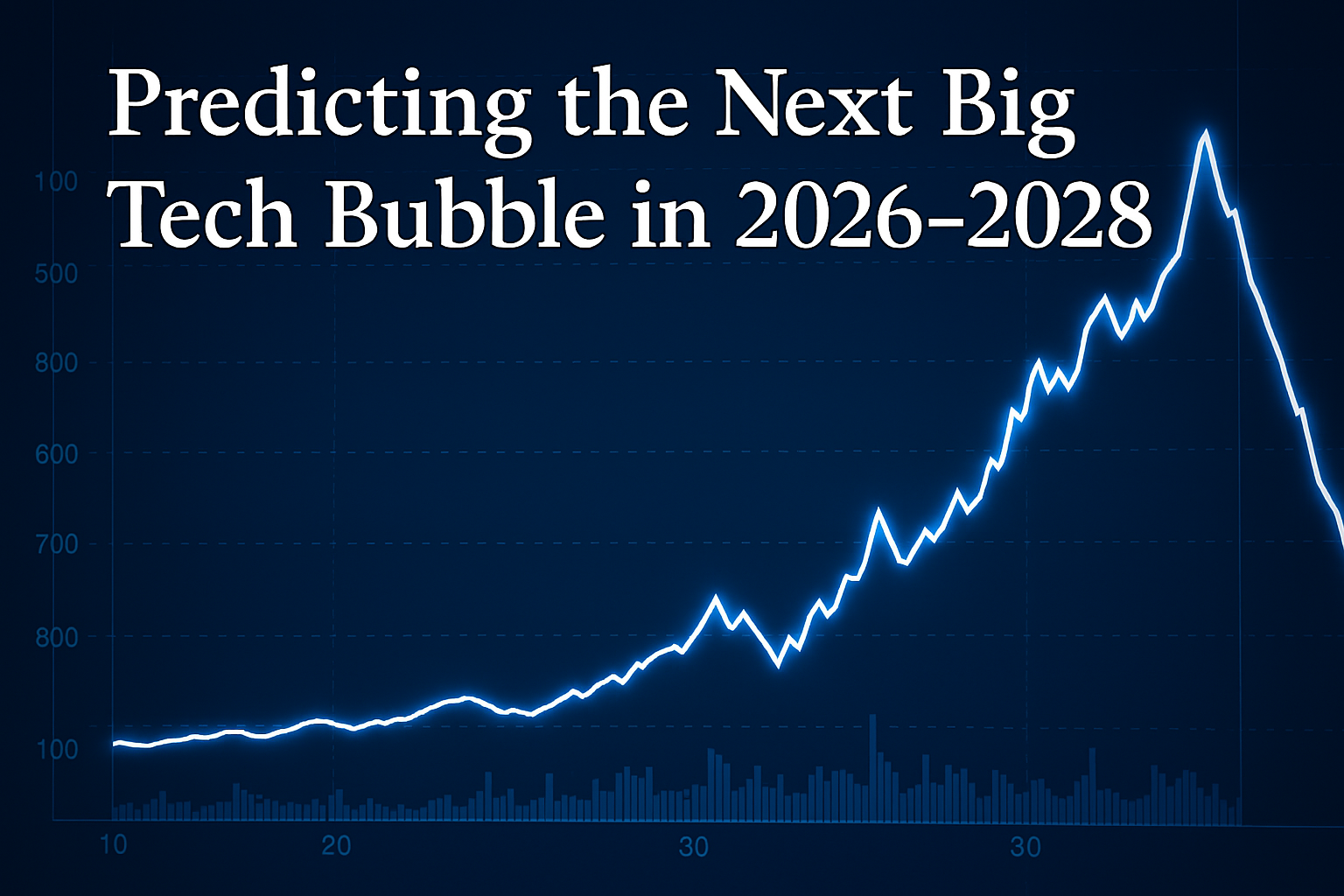

Editorial Deep Dive: Predicting the Next Big Tech Bubble in 2026–2028

It was a crisp evening in San Francisco, the kind of night when the fog rolls in like a curtain call. At the Yerba Buena Center for the Arts, a thousand investors, founders, and journalists gathered for what was billed as “The Future Agents Gala.” The star attraction was not a celebrity CEO but a humanoid robot, dressed in a tailored blazer, capable of negotiating contracts in real time while simultaneously cooking a Michelin-grade risotto.

The crowd gasped as the machine signed a mock term sheet projected on a giant screen, its agentic AI brain linked to a venture capital fund’s API. Champagne flutes clinked, sovereign wealth fund managers whispered in Arabic and Mandarin, and a former OpenAI board member leaned over to me and said: “This is the moment. We’ve crossed the Rubicon. The next tech bubble is already inflating.”

Outside, a line of Teslas and Rivians stretched down Mission Street, ferrying attendees to afterparties where AR goggles were handed out like party favors. In one corner, a partner at one of the top three Valley VC firms confided, “We’ve allocated $8 billion to agentic AI startups this quarter alone. If you’re not in, you’re out.” Across the room, a sovereign wealth fund executive from Riyadh boasted of a $50 billion allocation to “post-Moore quantum plays.” The mood was euphoric, bordering on manic. It felt eerily familiar to anyone who had lived through the dot-com bubble of 1999 or the crypto mania of 2021.

I’ve covered four major bubbles in my career — PCs in the ’80s, dot-com in the ’90s, housing in the 2000s, and crypto/ZIRP in the 2020s. Each had its own soundtrack of hype, its own cast of villains and heroes. But what I witnessed in November 2025 was different: a collision of narratives, a tsunami of capital, and a retail investor base armed with apps that can move billions in seconds. The signs of the next tech bubble are unmistakable.

Historical Echoes

Every bubble begins with a story. In 1999, it was the promise of the internet democratizing commerce. In 2021, it was crypto and NFTs rewriting finance and art. Today, the narrative is agentic AI, AR/VR resurrection, and quantum supremacy.

The parallels are striking. In 1999, companies with no revenue traded at 200x forward sales. Pets.com became a household name despite selling dog food at a loss. In 2021, crypto tokens with no utility reached market caps of $50 billion. Now, in late 2025, robotics startups with prototypes but no customers are raising at $10 billion valuations.

Consider the table below, comparing three bubbles across eight metrics:

| Metric | Dot-com (1999–2000) | Crypto/ZIRP (2021–2022) | Emerging Bubble (2025–2028) |

|---|---|---|---|

| Valuation multiples | 200x sales | 50–100x token revenue | 150x projected AI agent ARR |

| Retail participation | Day traders via E-Trade | Robinhood, Coinbase | Tokenized AI shares via apps |

| Fed policy | Loose, then tightening | ZIRP, then hikes | High rates, capital trapped |

| Sovereign wealth | Minimal | Limited | $2–3 trillion allocations |

| Corporate cash | Modest | Buybacks dominant | $1 trillion redirected to AI/quantum |

| Narrative strength | “Internet changes everything” | “Decentralization” | “Agents + quantum = inevitability” |

| Crash velocity | 18 months | 12 months | Predicted 9–12 months |

| Global contagion | US-centric | Global retail | Truly global, sovereign-driven |

The echoes are deafening. The question is not if but when will the next tech bubble burst.

The Three Horsemen of the Coming Bubble

Agentic AI + Robotics

The hottest narrative is agentic AI — autonomous systems that act on behalf of humans. Figure, a humanoid robotics startup, has raised $2.5 billion at a $20 billion valuation despite shipping fewer than 50 units. Anduril, the defense-tech darling, is pitching AI-driven battlefield agents to Pentagon brass. A former OpenAI board member told me bluntly: “Agentic AI is the new cloud. Every corporate board is terrified of missing it.”

Retail investors are piling in via tokenized shares of robotics startups, available on apps in Dubai and Singapore. The valuations are absurd: one startup projecting $100 million in revenue by 2027 is already valued at $15 billion. Is AI the next tech bubble? The answer is staring us in the face.

AR/VR 2.0: The Metaverse Resurrection

Apple’s Vision Pro ecosystem has reignited the metaverse dream. Meta, chastened but emboldened, is pouring $30 billion annually into AR/VR. A partner at Sequoia told me off the record: “We’re seeing pitch decks that look like 2021 all over again, but with Apple hardware as the anchor.”

Consumers are buying in. AR goggles are marketed as productivity tools, not toys. Yet the economics are fragile: hardware margins are thin, and software adoption is speculative. The next dot com bubble may well be wearing goggles.

Quantum + Post-Moore Semiconductor Mania

Quantum computing startups are raising at valuations that defy physics. PsiQuantum, IonQ, and a dozen stealth players are promising breakthroughs by 2027. Meanwhile, post-Moore semiconductor firms are hyping “neuromorphic chips” with little evidence of scalability.

A Brussels regulator told me: “We’re seeing lobbying pressure from quantum firms that rivals Big Tech in 2018. It’s extraordinary.” The hype is global, with Chinese funds pouring billions into quantum supremacy plays. The AI bubble burst prediction may hinge on quantum’s failure to deliver.

The Money Tsunami

Where is the capital coming from? The answer is everywhere.

- Sovereign wealth funds: Abu Dhabi, Riyadh, and Doha are allocating $2 trillion collectively to tech between 2025–2028.

- Corporate treasuries: Apple, Microsoft, and Alphabet are redirecting $1 trillion in cash from buybacks to strategic AI/quantum investments.

- Retail investors: Apps in Asia and Europe allow fractional ownership of AI startups via tokenized assets.

A Wall Street banker told me: “We’ve never seen this much dry powder chasing so few narratives. It’s a venture capital bubble 2026 in the making.”

Charts show venture funding in Q3 2025 hitting $180 billion globally, surpassing the peak of 2021. Sovereign allocations alone dwarf the dot-com era by a factor of ten. The signs of the next tech bubble are flashing red.

The Cracks Already Forming

Yet beneath the euphoria, cracks are visible.

- Revenue reality: Most agentic AI startups have negligible revenue.

- Hardware bottlenecks: AR/VR adoption is limited by cost and ergonomics.

- Quantum skepticism: Physicists quietly admit breakthroughs are unlikely before 2030.

Regulators in Washington and Brussels are already drafting rules to curb AI agents in finance and defense. A senior EU official told me: “We will not allow autonomous systems to trade securities without oversight.”

Meanwhile, retail investors are overexposed. In Korea, 22% of household savings are now in tokenized AI assets. In Dubai, AR/VR tokens trade like penny stocks. Is there a tech bubble right now? The answer is yes — and it’s accelerating.

When and How It Pops

Based on historical cycles and current capital flows, I predict the bubble peaks between Q4 2026 and Q2 2027. The triggers will be:

- Regulatory clampdowns on agentic AI in finance and defense.

- Quantum delays, with promised breakthroughs failing to materialize.

- AR/VR fatigue, as consumers tire of expensive goggles.

- Liquidity crunch, as sovereign wealth funds pull back in response to geopolitical shocks.

The correction will be violent, sharper than dot-com or crypto. Retail apps will amplify panic selling. Tokenized assets will collapse in hours, not months. The next tech bubble burst will be global, instantaneous, and brutal.

Who Gets Hurt, Who Gets Rich

The losers will be retail investors, late-stage VCs, and sovereign funds overexposed to hype. Figure, Anduril, and quantum pure-plays may 10x before crashing to near-zero. Apple’s Vision Pro ecosystem plays will soar, then collapse as adoption stalls.

The winners will be incumbents with real cash flow — Microsoft, Nvidia, and TSMC — who can weather the storm. A few VCs who resist the mania will emerge as heroes. One Valley veteran told me: “We’re sitting out agentic AI. It smells like Pets.com with robots.”

History suggests that those who short the bubble early — hedge funds in New York, sovereigns in Norway — will profit handsomely. The next dot com bubble redux will crown new villains and heroes.

The Bottom Line

The next tech bubble will not be a slow-motion phenomenon like housing in 2008 or crypto in 2021. It will be a compressed, violent cycle — inflated by sovereign wealth funds, corporate treasuries, and retail apps, then punctured by regulatory shocks and technological disappointments.

I’ve covered bubbles for 35 years, and the pattern is unmistakable: the louder the narrative, the thinner the fundamentals. Agentic AI, AR/VR resurrection, and quantum computing are extraordinary technologies, but they are being priced as inevitabilities rather than possibilities. When the correction comes — between late 2026 and mid-2027 — it will erase trillions in paper wealth in weeks, not years.

The winners will be those who recognize that hype is not the same as adoption, and that capital cycles move faster than technological ones. The losers will be those who confuse narrative with inevitability.

The bottom line: The next tech bubble is already here. It will peak in 2026–2027, and when it bursts, it will be larger in scale than dot-com but shorter-lived, leaving behind a scorched landscape of failed startups, chastened sovereign funds, and a handful of resilient incumbents who survive to build the real future.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Business

Nvidia’s Blackwell: Revolutionizing AI Hardware Dominance

Introduction

In a bold move to maintain its supremacy in the artificial intelligence (AI) market, Nvidia has recently unveiled its latest powerhouse: the Blackwell GPUs. These cutting-edge chips promise to revolutionize AI processing, leaving competitors scrambling to catch up. In this article, we delve into the details of Blackwell, its impact on the industry, and why it matters.

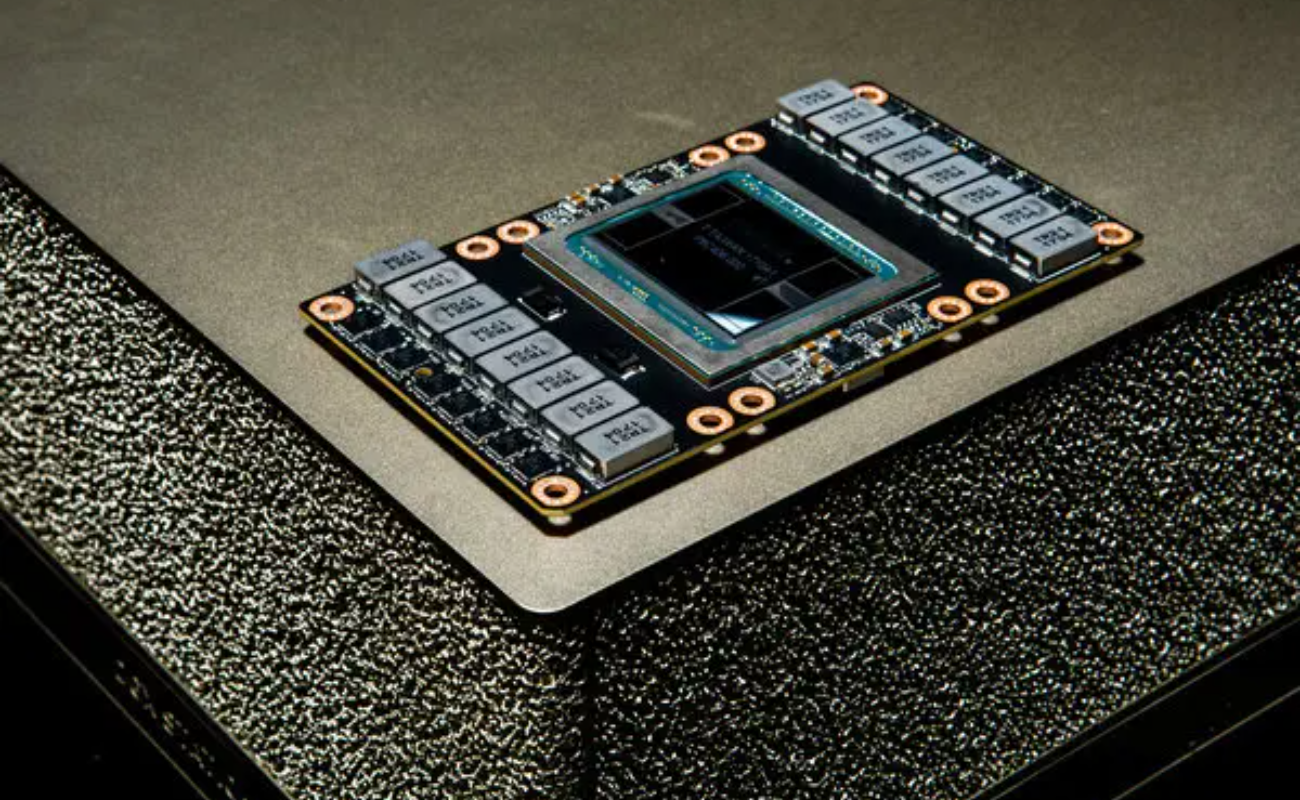

What Is Blackwell?

- Blackwell is not just another chip; it’s a seismic shift in AI hardware. Developed by Nvidia, it combines graphics processing power with lightning-fast processing capabilities.

- Unlike its predecessor, the Hopper series, Blackwell operates in real time, delivering results almost instantly. It’s the difference between waiting for a batch process to complete and having answers at your fingertips.

Unleashing the Power of Blackwell

- Unprecedented Speed: Blackwell boasts up to 30 times the performance of the Hopper series for AI inference tasks. Imagine the leap—from crawling to supersonic speeds.

- Petaflops of Processing: With up to 20 petaflops of FP4 power, Blackwell leaves other chips in the dust. It’s like strapping a rocket to your data center.

- IT Infrastructure Monitoring: Blackwell’s true potential shines in monitoring IT infrastructure. Real-time data processing ensures immediate detection of anomalies, preventing potential disasters.

Why Blackwell Matters

- Market Dominance: Nvidia already holds an 80% market share in AI hardware. Blackwell cements its position as the go-to provider.

- Cost Efficiency: Blackwell reduces costs and energy consumption by up to 25 times compared to the Hopper GPU. Efficiency meets excellence.

- Cybersecurity: Immediate detection of cyber threats is crucial. Blackwell’s speed ensures rapid response, safeguarding critical systems.

- Sales Insights: Real-time data empowers sales teams. Imagine predicting customer behavior as it happens.

Real-Time Data: The Fuel for Blackwell

- What Is Real-Time Data?

- Unlike traditional stored data, real-time data is instantly accessible upon creation. It fuels live decision-making.

- Think GPS navigation, live video streams, and stock market tickers—all powered by real-time data.

- Benefits of Real-Time Data Analytics:

- Error Reporting: Swiftly identify and rectify issues.

- Improved Services: Real-time insights enhance customer experiences.

- Cost Savings: Efficient resource allocation.

- Cybercrime Detection: Immediate threat response.

- Sales Optimization: Understand customer behavior in the moment.

Conclusion

Nvidia’s Blackwell isn’t just a chip; it’s a paradigm shift. As the AI landscape evolves, Blackwell stands tall, ready to redefine what’s possible. Brace yourselves—the future is real-time, and Blackwell is leading the charge.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Business

Unleashing NVIDIA’s AI Dominance: A Tale of Shares Soaring and Innovation Surges

As the world’s premier semiconductor powerhouse, NVIDIA has once again made headlines with its meteoric stock rise—a whopping 14% increase following an impressive sales spike driven by the AI revolution. This seismic shift in technology is not only reshaping industries but also redefining the future of computing as we know it. In this comprehensive analysis, we delve into the catalyst behind these record-breaking gains and explore what lies ahead for NVIDIA in the era of Artificial Intelligence (AI).

The ‘Tipping Point’: When AI Metamorphosed from Hype to Reality

The term “AI tipping point” refers to the moment when AI technologies transitioned from mere buzzwords to tangible solutions that are transforming businesses across various sectors. As companies worldwide embrace AI to enhance their operations, drive innovation, and gain competitive advantages, demand for cutting-edge hardware like NVIDIA’s GPUs has skyrocketed.

This trend was further fueled by the pandemic, which accelerated digital transformation efforts globally. With remote work becoming the norm, organizations have been forced to adapt quickly, leading them to invest heavily in cloud infrastructure and advanced data processing capabilities provided by NVIDIA’s AI chips.

NVIDIA’s Strategic Positioning: Leading the Charge in AI Computing

At the heart of NVIDIA’s success story lies its strategic positioning within the AI landscape. By focusing on developing high-performance GPU architectures tailored specifically for AI applications, NVIDIA has managed to establish itself as the go-to provider for enterprises seeking to leverage AI effectively.

In addition to its market-leading GPUs, NVIDIA offers a robust suite of software tools designed to simplify AI development and deployment. These include CUDA, TensorRT, and NGC, all of which enable developers to build powerful AI systems more efficiently than ever before.

Moreover, NVIDIA’s acquisition of Mellanox Technologies in 2020 strengthened its position in the data centre space, providing the company with access to state-of-the-art networking solutions that can support the growing demands of AI-driven applications.

The Future of AI Spending: An Endless Horizon for Growth

With AI set to become a $596 billion industry by 2028, there is no doubt that NVIDIA stands poised to capitalize on this unprecedented growth opportunity. According to Jensen Huang, CEO of NVIDIA, the company expects to see even stronger sales due to increased AI spending frenzies.

To ensure continued dominance in the AI sector, NVIDIA plans to expand its product portfolio beyond traditional GPUs. For instance, the company recently announced its intention to develop specialized processors called DPUs (Data Processing Units) aimed at enhancing the performance of AI-based applications running on servers.

By diversifying its offerings and staying one step ahead of emerging trends, NVIDIA aims to maintain its leadership role in the AI ecosystem while driving innovation forward.

Conclusion: Embracing the AI Revolution with Confidence

As NVIDIA continues to lead the charge in AI computing, investors and tech enthusiasts alike must remain vigilant about the potential risks and challenges associated with such rapid growth. However, given the company’s strong track record of innovation and strategic decision-making, it seems safe to say that NVIDIA will continue to thrive amidst the ongoing AI revolution.

So, whether you’re an aspiring entrepreneur looking to harness the power of AI or simply someone interested in keeping up with the latest developments in the tech sphere, stay tuned for exciting times ahead as NVIDIA spearheads the AI revolution!

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

-

Digital5 years ago

Social Media and polarization of society

-

Digital5 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital5 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News5 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Digital5 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Kashmir5 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Business4 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China5 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?