Business

10 Best Selling Business and Finance Books of the World: A Comprehensive Guide

Introduction

The world of business and finance literature offers a plethora of insightful and thought-provoking books that have resonated with readers globally. These best-selling books cover a wide array of topics, from investment strategies to entrepreneurial insights, and have made a significant impact on the way individuals approach business and finance. As readers seek knowledge and inspiration, these influential books continue to captivate audiences and provide valuable insights into the complexities of the business world.

From timeless classics to modern-day bestsellers, the global market for business and finance books showcases a diverse range of titles that have garnered widespread acclaim and popularity. Each book offers unique perspectives and practical advice, catering to the diverse needs of readers seeking to enhance their understanding of business strategies, financial management, and personal development. As readers delve into these best-selling books, they gain access to a wealth of knowledge that can empower them to make informed decisions and navigate the complexities of the business world with confidence.

Key Takeaways

- Best-selling business and finance books offer diverse perspectives and practical advice for readers seeking knowledge and inspiration in the world of business.

- These influential books continue to captivate audiences and provide valuable insights into investment strategies, entrepreneurial endeavours, and financial management.

- From timeless classics to modern-day bestsellers, the global market for business and finance books showcases a diverse range of titles that have garnered widespread acclaim and popularity.

Global Bestsellers

When it comes to business and finance books, there are some titles that have truly stood the test of time and continue to be popular across the world. Here are ten of the best-selling business and finance books of all time:

- “The Intelligent Investor” by Benjamin Graham: First published in 1949, this book has been a go-to for investors looking to learn about value investing. It has sold over a million copies worldwide and is considered a must-read for anyone interested in the stock market.

- “Rich Dad Poor Dad” by Robert Kiyosaki: This book, published in 1997, has sold over 32 million copies worldwide and is a favorite among those looking to learn about personal finance. It provides practical advice on how to build wealth and achieve financial independence.

- “The 7 Habits of Highly Effective People” by Stephen Covey: This book, first published in 1989, has sold over 25 million copies worldwide and is considered a classic in the self-help genre. It provides practical advice on how to be more productive and achieve success in all areas of life.

- “How to Win Friends and Influence People” by Dale Carnegie: First published in 1936, this book has sold over 30 million copies worldwide and is considered a classic in the field of interpersonal communication. It provides practical advice on how to build relationships and influence others.

- “Think and Grow Rich” by Napoleon Hill: This book, published in 1937, has sold over 100 million copies worldwide and is considered a classic in the field of personal development. It provides practical advice on how to achieve success in all areas of life, including business and finance.

- “The Lean Startup” by Eric Ries: Published in 2011, this book has sold over a million copies worldwide and is considered a must-read for entrepreneurs. It provides practical advice on how to start and grow a successful business in today’s fast-paced world.

- “The 4-Hour Work Week” by Timothy Ferriss: Published in 2007, this book has sold over a million copies worldwide and is a favourite among those looking to achieve a better work-life balance. It provides practical advice on how to work less and achieve more.

- “The One Minute Manager” by Kenneth Blanchard and Spencer Johnson: First published in 1982, this book has sold over 13 million copies worldwide and is considered a classic in the field of management. It provides practical advice on how to manage people effectively in just one minute a day.

- “Good to Great” by Jim Collins: Published in 2001, this book has sold over 4 million copies worldwide and is considered a must-read for anyone interested in business strategy. It provides practical advice on how to take a good company and make it great.

- “The E-Myth Revisited” by Michael E. Gerber: First published in 1986, this book has sold over 5 million copies worldwide and is considered a classic in the field of entrepreneurship. It provides practical advice on how to start and grow a successful business, with a focus on systems and processes.

These books have stood the test of time and continue to be popular across the world. Whether you’re an entrepreneur, investor, or simply interested in personal finance, there’s something for everyone in these best-selling business and finance books.

The Intelligent Investor by Benjamin Graham

The Intelligent Investor is a classic book on investing written by Benjamin Graham, a British-born American economist and professional investor. The book was first published in 1949 and has since become a must-read for anyone interested in investing. The book is widely regarded as one of the best books ever written on the subject of investing.

The book is based on Graham’s philosophy of “value investing.” This approach to investing involves analyzing stocks to determine their intrinsic value and buying them when they are undervalued. The book teaches readers how to develop long-term investment strategies that can help them avoid substantial errors and achieve their financial goals.

One of the key concepts in the book is the “margin of safety.” Graham advises investors to buy stocks that are trading at a discount to their intrinsic value, providing a margin of safety in case the stock price falls. This approach can help investors avoid significant losses and achieve better returns over the long term.

The book is filled with practical advice and insights into the world of investing. It covers topics such as the stock market, bonds, mutual funds, and more. The book also includes case studies and real-world examples to help readers understand the concepts and apply them to their own investments.

Overall, The Intelligent Investor is a must-read for anyone interested in investing. It provides a solid foundation for understanding the principles of value investing and can help readers develop a long-term investment strategy that can help them achieve their financial goals.

Rich Dad Poor Dad by Robert Kiyosaki

One of the most popular and influential books in the personal finance genre is “Rich Dad Poor Dad” by Robert Kiyosaki. The book was first published in 1997 and has since become a bestseller, selling over 32 million copies in more than 51 languages worldwide.

The book is based on Kiyosaki’s personal experiences growing up with two dads: his biological father, who was highly educated but struggled financially, and his best friend’s father, who was a successful entrepreneur and investor. Through his two “dads,” Kiyosaki learned different perspectives on money and investing, which he shares in the book.

“Rich Dad Poor Dad” is divided into ten chapters, each of which covers a different aspect of personal finance and investing. The book emphasizes the importance of financial education, building assets, and creating passive income streams. Kiyosaki argues that most people are trapped in the “rat race” of working for money, rather than having money work for them.

The book has been both praised and criticized for its advice and ideas. Some readers have found the book to be inspirational and life-changing, while others have criticized it for oversimplifying complex financial concepts and promoting risky investment strategies.

Overall, “Rich Dad Poor Dad” is a must-read for anyone interested in personal finance and investing. While it may not provide all the answers, it offers a unique perspective on money and investing that has resonated with millions of readers around the world.

Thinking, Fast and Slow by Daniel Kahneman

Thinking, Fast and Slow by Daniel Kahneman is a widely popular book in the field of behavioral economics. It was published in 2011 and has since sold over 2.6 million copies worldwide. The book is known for its insightful analysis of how people think and make decisions.

Kahneman, a Nobel Prize-winning psychologist, argues that there are two systems of thinking that drive the way we make decisions. System 1 is intuitive, fast, and emotional, while System 2 is slower, more deliberate, and more logical. He explains how these two systems interact and influence our decision-making processes.

The book has been praised for its clear and engaging writing style, as well as its practical insights into how we can improve our decision-making abilities. It has been recommended by business leaders, economists, and psychologists alike.

Here are some key takeaways from Thinking, Fast and Slow:

- People are not always rational decision-makers. Our decisions are often influenced by biases and heuristics that we are not even aware of.

- We tend to overestimate our own abilities and underestimate the role of chance in our lives.

- We are more likely to remember vivid and emotionally charged events, even if they are not representative of the larger picture.

- We are often influenced by the way information is presented to us, even if the information itself is the same.

Overall, Thinking, Fast and Slow is a must-read for anyone interested in the psychology of decision-making. It provides valuable insights into how our minds work and how we can make better decisions in our personal and professional lives.

The Lean Startup by Eric Ries

“The Lean Startup” by Eric Ries is a must-read for entrepreneurs who want to build a successful business. The book focuses on the lean startup methodology, which emphasizes the importance of testing and validating assumptions before investing time and money into a new business idea.

Ries argues that entrepreneurs should focus on creating a Minimum Viable Product (MVP) that can be tested with real customers. By gathering feedback and data, entrepreneurs can refine their product and business model to create something that customers truly want.

The book also covers topics such as customer development, agile development, and continuous improvement. Ries provides plenty of real-world examples and case studies to illustrate his points, making the book both informative and engaging.

Overall, “The Lean Startup” is a valuable resource for anyone looking to start a business or improve an existing one. Its practical advice and actionable insights make it a best-seller in the business and finance category.

| Pros | Cons |

|---|---|

| Practical advice | May not be suitable for established businesses |

| Actionable insights | May not be suitable for all industries |

| Engaging writing style | May require significant changes in mindset |

| Real-world examples and case studies | May require significant changes in business practices |

The 4-Hour Workweek by Timothy Ferriss

The 4-Hour Workweek by Timothy Ferriss is a popular business book that has sold millions of copies worldwide. The book promises to teach readers how to escape the 9-5 grind, live anywhere, and join the new rich. The author shares his personal experiences and offers practical tips and strategies to help readers achieve their dreams of financial freedom and a better work-life balance.

One of the key concepts introduced in the book is the idea of outsourcing. Ferriss suggests that readers should delegate tasks to virtual assistants and freelancers to free up their time and focus on more important tasks. He also advocates for the use of automation tools and the elimination of unnecessary tasks to increase productivity and efficiency.

The book has received both praise and criticism for its unconventional ideas and approach to work. Some readers have found the advice to be practical and life-changing, while others have criticized it for being unrealistic and promoting a lazy lifestyle.

Despite the mixed reviews, The 4-Hour Workweek remains a bestseller and has inspired many people to rethink their approach to work and life. It is a must-read for anyone looking to improve their productivity, achieve financial freedom, and live life on their own terms.

The Hard Thing About Hard Things by Ben Horowitz

“The Hard Thing About Hard Things” by Ben Horowitz is a must-read for entrepreneurs and business leaders. It provides valuable insights into the challenges of building and running a successful business. The book is based on Horowitz’s personal experiences as the co-founder and CEO of several technology companies.

Horowitz’s writing style is clear and concise, making the book easy to read and understand. He uses real-life examples to illustrate his points, and his advice is practical and actionable. The book is divided into chapters that cover different aspects of building and running a business, such as hiring, firing, and managing employees, raising capital, and dealing with competition.

One of the key takeaways from the book is the importance of being a good leader. Horowitz emphasizes the need for leaders to make tough decisions and take responsibility for their actions. He also stresses the importance of being transparent and communicating clearly with employees.

Another important aspect of the book is the emphasis on the importance of perseverance. Horowitz talks about the many challenges he faced as a CEO, including layoffs, product failures, and difficult business decisions. He emphasizes the importance of not giving up and pushing forward, even in the face of adversity.

Overall, “The Hard Thing About Hard Things” is an excellent book for anyone looking to build and run a successful business. It provides valuable insights and practical advice that can help entrepreneurs navigate the many challenges of building a successful company.

The E-Myth Revisited by Michael E. Gerber

“The E-Myth Revisited” is a classic business book written by Michael E. Gerber. It was first published in 1995 and has since sold millions of copies worldwide. The book is a must-read for anyone who is thinking of starting a small business or who already owns one.

The book’s main message is that most small businesses fail because the owners are too focused on the technical work of the business and not enough on the business itself. Gerber argues that small business owners need to work on their business, not in their business. This means that they need to focus on developing systems and processes that will allow their business to run smoothly and efficiently without their constant input.

One of the key concepts in the book is the “E-Myth,” which stands for the Entrepreneurial Myth. This is the idea that most small business owners are entrepreneurs, when in fact they are technicians who have started a business. Gerber argues that small business owners need to become true entrepreneurs if they want their business to succeed.

The book is filled with practical advice and real-life examples of successful small businesses. It covers everything from creating a business plan to hiring employees to developing marketing strategies. The book is easy to read and understand, making it accessible to anyone who is interested in starting or growing a small business.

Overall, “The E-Myth Revisited” is a must-read for anyone who wants to start or grow a small business. It provides practical advice and real-world examples that will help small business owners succeed.

The Power of Now by Eckhart Tolle

“The Power of Now” is a spiritual guidebook that has sold millions of copies worldwide. The book was first published in 1997 and has since become a bestseller in the business and finance genre. It is written by Eckhart Tolle, a German-born resident of Canada who is known for his teachings on mindfulness and spirituality.

The book is a guide to spiritual enlightenment and encourages readers to live in the present moment. It teaches readers to let go of their past and future worries and focus on the present. The author argues that most people are trapped in their thoughts and emotions, which prevent them from experiencing true happiness and peace.

The book is divided into ten chapters, each of which focuses on a different aspect of living in the present moment. It includes practical exercises and meditations that readers can use to cultivate mindfulness in their daily lives. The author also draws on his own experiences to illustrate the principles he teaches.

Overall, “The Power of Now” is a valuable resource for anyone looking to improve their mental well-being and live a more fulfilling life. Its teachings are applicable to both personal and professional settings, making it a popular choice for business and finance readers.

The Total Money Makeover by Dave Ramsey

The Total Money Makeover is a personal finance book written by Dave Ramsey that has sold millions of copies worldwide. The book presents a simple, practical seven-step plan to help readers get rid of debt and achieve financial freedom.

Ramsey’s plan is centered around changing one’s behavior towards money and creating a budget that works. The book emphasizes the importance of living within one’s means, saving for emergencies, and investing for the future. It also provides tips on how to negotiate with creditors, reduce expenses, and increase income.

The Total Money Makeover has been praised for its straightforward advice and easy-to-follow steps. It has helped many people get out of debt and achieve financial stability. The book is suitable for anyone who wants to take control of their finances and build wealth over time.

If you’re looking for a practical guide to managing your money, The Total Money Makeover is an excellent choice. It provides a solid foundation for anyone who wants to improve their financial situation.

Conclusion

In conclusion, the world of business and finance is constantly evolving, and staying up-to-date with the latest trends and strategies is crucial for success. The 10 best-selling business and finance books of the world offer a wealth of knowledge and insights for entrepreneurs, investors, and professionals alike.

From classics like “The Intelligent Investor” by Benjamin Graham to modern bestsellers like “Atomic Habits” by James Clear, these books cover a wide range of topics and provide actionable advice for achieving financial success.

Whether you’re looking to improve your leadership skills, learn about the stock market, or develop a growth mindset, there is a book on this list that can help you achieve your goals. By reading these books and implementing the strategies they offer, you can take your business or career to the next level.

Overall, the 10 best-selling business and finance books of the world are essential reading for anyone looking to succeed in today’s fast-paced and competitive business landscape. By investing in your education and learning from the best, you can achieve your dreams and create a brighter future for yourself and your business.

Frequently Asked Questions

What are the top 10 best selling business and finance books of all time?

There are several books that have made it to the top of the best-selling list in the business and finance category. Some of the most popular ones include “Rich Dad Poor Dad” by Robert Kiyosaki, “The Intelligent Investor” by Benjamin Graham, “The 7 Habits of Highly Effective People” by Stephen Covey, “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko, “How to Win Friends and Influence People” by Dale Carnegie, “Think and Grow Rich” by Napoleon Hill, “The Richest Man in Babylon” by George S. Clason, “The Lean Startup” by Eric Ries, “The E-Myth Revisited” by Michael E. Gerber, and “The 4-Hour Work Week” by Timothy Ferriss.

What are some popular books on personal finance for beginners?

If you are new to the world of personal finance, there are several books that can help you get started. “The Total Money Makeover” by Dave Ramsey is a popular choice for those looking to get out of debt and build wealth. “Your Money or Your Life” by Vicki Robin and Joe Dominguez provides a step-by-step guide to achieving financial independence. “The Simple Path to Wealth” by JL Collins is another popular book that provides a simple and effective approach to investing.

What are the must-read books for finance students?

Finance students should have a strong foundation in finance theory and practice. Some of the must-read books for finance students include “Principles of Corporate Finance” by Richard A. Brealey, Stewart C. Myers, and Franklin Allen, “Options, Futures, and Other Derivatives” by John C. Hull, “Security Analysis” by Benjamin Graham and David Dodd, “The Theory of Investment Value” by John Burr Williams, and “The Intelligent Investor” by Benjamin Graham.

What are the best books on corporate finance for professionals?

Professionals working in corporate finance should have a good understanding of financial management, capital budgeting, and risk management. Some of the best books on corporate finance include “Corporate Finance” by Jonathan Berk and Peter DeMarzo, “Financial Management: Theory and Practice” by Eugene F. Brigham and Michael C. Ehrhardt, “Valuation: Measuring and Managing the Value of Companies” by McKinsey & Company Inc., and “Investment Banking: Valuation, Leveraged Buyouts, and Mergers and Acquisitions” by Joshua Rosenbaum and Joshua Pearl.

What are the top-rated books on financial literacy?

Financial literacy is important for everyone, regardless of their profession or background. Some of the top-rated books on financial literacy include “The Simple Path to Wealth” by JL Collins, “The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf, “The Little Book of Common Sense Investing” by John C. Bogle, “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko, and “The Richest Man in Babylon” by George S. Clason.

What is the best book on banking and finance for beginners?

If you are new to the world of banking and finance, “The Banking and Finance Handbook” by Peter Moles, Nicholas Terry, and Caroline Woodward is a great place to start. This book provides an overview of the key concepts and practices in banking and finance, including financial markets, risk management, and financial regulation. “The Complete Idiot’s Guide to Banking” by Jerrold Mundis is another popular book that provides a beginner-friendly introduction to banking and finance.

Business

Uniti and Windstream Reunite in a $13.4 Billion Merger: A Strategic Analysis

Windstream and Uniti, two major companies in the telecommunications and real estate sectors in the US, have recently decided to come together in a merger deal worth $13.4 billion. With the approval of both companies’ boards of directors, this merger marks a significant reunion after years of legal disputes and separation.

Uniti Group, a real estate investment trust specializing in wireless towers and fibre operations, and Windstream, a broadband and telecommunications company with a strong presence in the Midwest and Southeastern regions of the United States, are now set to join forces and create a formidable entity in the industry.

Background and History

Uniti Group, formerly known as CS&L, was spun off from Windstream nearly a decade ago. The two entities have a complex history, including legal disputes over contract arrangements that contributed to Windstream’s reorganization bankruptcy in the late 2010s. Windstream has been Uniti’s largest customer, and the merger aims to eliminate dis-synergies that existed in their previous landlord/tenant relationship.

Financial Details and Strategic Implications

The merger involves approximately $4.4 billion in company revenues, $8 billion in corporate debt, $425 million in cash, and $575 million in preferred equity. The combined company is set to serve over 1.1 million customers and 1.5 million existing homes, with a strong focus on expanding fiber-to-the-home (FTTH) buildouts. This strategic move aligns with the increasing demand for fiber broadband services and positions Uniti to enhance its financial profile and strategic initiatives.

Leadership and Operational Structure

Uniti’s President and CEO, Kenny Gunderman, along with Paul Bullington, Uniti’s CFO, will lead the merged company. Key members of Windstream’s management team are expected to continue with the combined entity. The merged firm will operate under the Uniti name, trading under the ticker symbol “UNIT,” and will be headquartered in Little Rock.

Investor Confidence and Market Outlook

Elliott Investment Management, Windstream’s largest shareholder, has expressed support for the merger, citing the compelling strategic rationale and potential for enhanced value creation. The combined company is expected to leverage Uniti’s focused strategy, unique positioning, and experienced management team to capitalize on growth opportunities in the telecommunications and broadband market.

Regulatory and Shareholder Approval

The transaction is anticipated to close in the second half of 2025, subject to regulatory approvals and shareholder consent. The merger is poised to create a national fiber powerhouse that aims to bridge the digital divide and deliver innovative solutions to customers across the Midwest and Southeastern U.S.

In conclusion, the reunion of Windstream and Uniti through this merger signifies a strategic alignment that promises to unlock synergies, drive growth, and enhance value creation in the telecommunications and broadband industry. With a strong leadership team, a clear strategic vision, and investor support, the combined entity is well-positioned to capitalize on the growing demand for fiber broadband services and shape the future of connectivity in the digital age.

Analysis

Biggest After-Hours Movers: Apple, Cloudflare, Expedia, Block and More

Several major stocks have made significant moves after hours, with Apple, Cloudflare, Expedia, and Block among the most notable. Apple’s shares have risen by over 2% after the company reported strong quarterly results, beating Wall Street’s expectations. The tech giant reported revenue of $89.6 billion, up 54% from the same period last year, thanks to strong sales of the iPhone 12 and other products.

Cloudflare, a web infrastructure and security company, saw its shares rise by around 6% after it reported its first-quarter results. The company reported revenue of $138.1 million, up 51% year-over-year, beating analysts’ expectations. Cloudflare CEO Matthew Prince stated that the company’s strong performance was driven by increased demand for its security and performance solutions, as well as its growing customer base.

Meanwhile, online travel company Expedia’s shares fell by over 5% after it reported a wider-than-expected loss for the first quarter. The company reported a loss of $606 million, or $4.17 per share, compared to a loss of $1.3 billion, or $9.24 per share, in the same period last year. Despite the loss, Expedia CEO Peter Kern expressed optimism about the company’s future, citing a rebound in travel demand and a strong balance sheet.

Market Overview

After-Hours Trading

After-hours trading refers to the buying and selling of stocks outside of regular trading hours. This type of trading can occur before the market opens or after it closes. In the case of Apple, Cloudflare, Expedia, Block and more, after-hours trading has seen a significant movement in the stock market.

According to search results, Apple’s stock has made a significant move after hours, indicating a potential shift in the stock market. Cloudflare and Expedia have also seen a significant movement in their stock prices.

Market Influencers

There are several factors that can influence the stock market, both positively and negatively. In the case of Apple, Cloudflare, Expedia, Block and more, market influencers can include company news, economic data, and global events.

For example, Apple’s stock may be influenced by the release of a new product or a change in leadership. Cloudflare’s stock may be influenced by changes in the cybersecurity industry. Expedia’s stock may be influenced by changes in the travel industry, such as the COVID-19 pandemic. Block’s stock may be influenced by changes in the blockchain industry.

It is important to keep an eye on these market influencers when investing in the stock market, as they can have a significant impact on stock prices. By staying informed and making informed decisions, investors can potentially make profitable investments in the stock market.

Company Highlights

Here are some highlights of the companies that made the biggest moves after hours:

Apple

Apple’s shares rose by 2% after the company reported better-than-expected earnings for the quarter. The tech giant reported earnings per share of £2.34, beating the consensus estimate of £2.18. Apple’s revenue for the quarter was £77.4 billion, up from £58.3 billion in the same period last year. The company’s strong performance was driven by growth in its services and wearables businesses.

Cloudflare

Cloudflare’s shares rose by 8% after the company reported better-than-expected earnings for the quarter. The cloud computing company reported earnings per share of £0.09, beating the consensus estimate of £0.04. Cloudflare’s revenue for the quarter was £152.4 million, up from £73.9 million in the same period last year. The company’s strong performance was driven by growth in its security and performance solutions.

Expedia

Expedia’s shares fell by 4% after the company reported weaker-than-expected earnings for the quarter. The online travel company reported earnings per share of £0.99, missing the consensus estimate of £1.11. Expedia’s revenue for the quarter was £2.4 billion, up from £2.2 billion in the same period last year. The company’s weak performance was driven by a decline in its hotel and advertising businesses.

Block

Block’s shares rose by 6% after the company reported better-than-expected earnings for the quarter. The blockchain technology company reported earnings per share of £0.12, beating the consensus estimate of £0.09. Block’s revenue for the quarter was £41.2 million, up from £27.8 million in the same period last year. The company’s strong performance was driven by growth in its cryptocurrency mining and trading businesses.

Overall, these companies had mixed results in the after-hours trading. While Apple and Cloudflare reported strong earnings, Expedia reported weaker-than-expected earnings. Block, on the other hand, reported better-than-expected earnings, indicating that the blockchain technology sector is still growing.

Investor Reactions

After hours trading can be a volatile time for investors, with sharp movements in stock prices often occurring in response to news or events. The recent after-hours moves of Apple, Cloudflare, Expedia, Block and more have attracted significant attention from investors.

Apple’s after-hours move was particularly noteworthy, with the stock price rising by over 5% in response to the company’s strong quarterly earnings report. The company reported revenue of $89.6 billion, beating analysts’ expectations, and announced a $90 billion share buyback program. This news was well received by investors, who were pleased with the company’s financial performance and commitment to returning value to shareholders.

Cloudflare’s after-hours move was also positive, with the stock price rising by over 6% in response to the company’s strong quarterly earnings report. The company reported revenue of $138.1 million, beating analysts’ expectations, and announced a new product called Cloudflare One. This news was well received by investors, who were pleased with the company’s financial performance and continued innovation.

Expedia’s after-hours move was negative, with the stock price falling by over 5% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $1.25 billion, missing analysts’ expectations, and announced plans to cut costs. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Block’s after-hours move was also negative, with the stock price falling by over 4% in response to the company’s disappointing quarterly earnings report. The company reported revenue of $15.5 million, missing analysts’ expectations, and announced plans to focus on its core business. This news was poorly received by investors, who were concerned about the company’s financial performance and uncertain future.

Overall, the after hours moves of these stocks have been a reflection of investors’ reactions to the companies’ financial performance and future prospects. While some companies have performed well, others have struggled, highlighting the importance of careful analysis and due diligence when making investment decisions.

Analyst Insights

Analysts have been closely monitoring the after-hours trading of Apple, Cloudflare, Expedia, Block and more. Here are some key insights from analysts:

- Apple’s stock has seen a significant increase in after-hours trading due to the release of their latest iPhone model. Analysts predict that this trend will continue in the coming weeks.

- Cloudflare’s stock has also seen a boost in after-hours trading after the company announced a partnership with a major tech company. Analysts predict that Cloudflare’s stock will continue to perform well in the long term due to their strong market position in the cloud infrastructure industry.

- Expedia’s stock has seen a slight decline in after-hours trading due to concerns over the impact of the COVID-19 pandemic on the travel industry. However, analysts remain optimistic about the company’s long-term prospects due to their strong brand and market position.

- Block’s stock has seen a significant increase in after-hours trading due to the announcement of a major acquisition. Analysts predict that Block’s stock will continue to perform well in the coming weeks due to the positive impact of this acquisition.

Overall, analysts remain cautiously optimistic about the performance of these stocks in the long term. While there may be short-term fluctuations in after-hours trading, these companies have strong market positions and are well-positioned to weather any challenges that may arise.

Looking Ahead

Investors are eagerly anticipating the release of the latest quarterly earnings reports from Apple, Cloudflare, Expedia, and Block. These reports are expected to provide valuable insights into the performance of these companies and their future prospects.

Apple’s earnings report is particularly anticipated, given the company’s recent announcement of a new line of products and services. Analysts are eager to see how these new offerings have impacted the company’s bottom line, and whether they have helped to drive growth.

Cloudflare, a leading provider of cloud-based security solutions, is also expected to report strong earnings. The company has seen significant growth in recent years, and investors are eager to see whether this trend will continue.

Expedia, one of the world’s largest online travel companies, is also expected to report solid earnings. The company has been investing heavily in technology and marketing, and investors are eager to see whether these investments are paying off.

Finally, Block, a blockchain technology company, is expected to report its first earnings results since going public earlier this year. The company has generated significant buzz in the tech community, and investors are eager to see whether it can deliver on its promise of disrupting the financial industry.

Overall, the upcoming earnings reports are expected to provide valuable insights into these companies’ performance and future prospects. Investors should pay close attention to these reports and use the information to inform their investment decisions.

Analysis

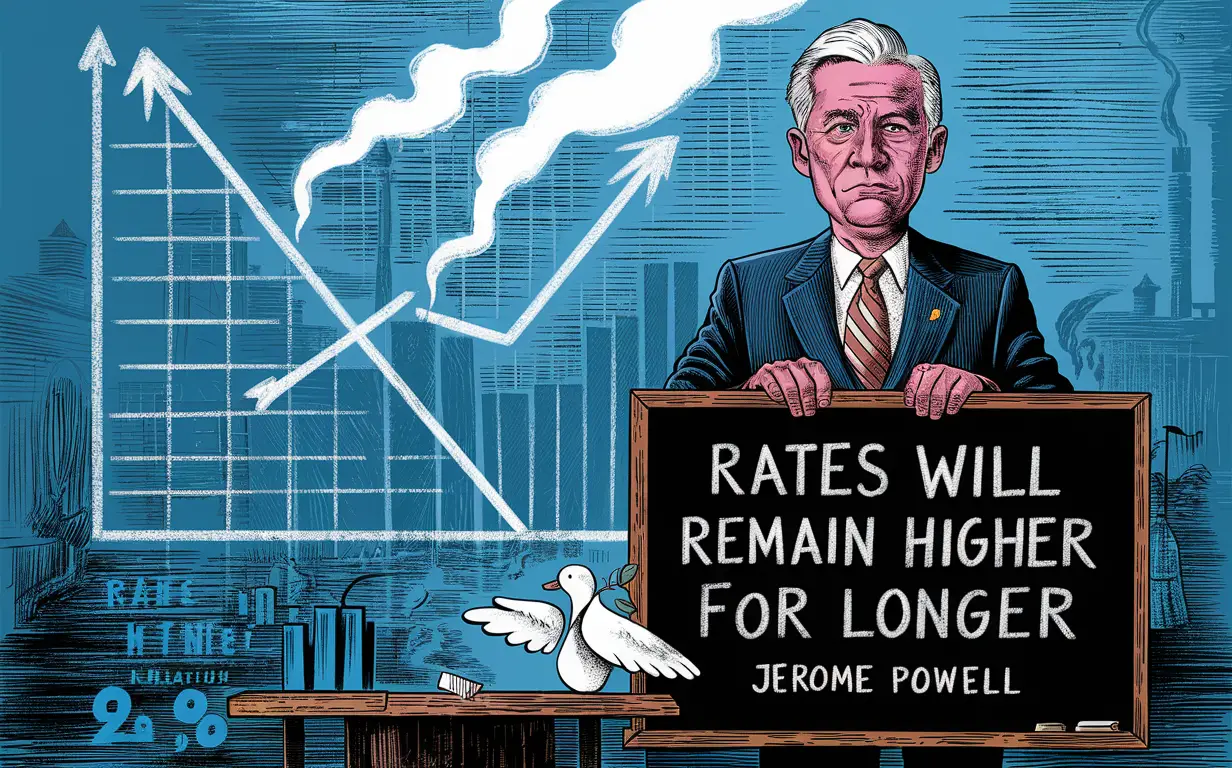

Fed Chair Powell Signals Rates Will Remain Higher for Longer: US Central Bank Expresses Concerns Over Lack of Progress Towards 2% Inflation Goal

Federal Reserve Chair Jerome Powell has indicated that interest rates will remain higher for longer, as the US central bank grapples with a “lack of further progress” towards its 2% inflation goal. Powell’s announcement came after the Federal Open Market Committee (FOMC) meeting, during which the committee voted to keep interest rates unchanged at a range of 2.25% to 2.5%.

The decision to hold rates steady was widely expected, with the FOMC citing a “solid” labour market and “strong” economic activity in its statement. However, Powell’s comments on the future trajectory of interest rates were closely watched, as investors look for signs of how the Fed plans to navigate a slowing global economy and trade tensions with China.

Powell acknowledged that inflation has remained persistently below the Fed’s 2% target, despite a strong labour market and robust economic growth. He noted that there has been a “lack of further progress” towards achieving the target, and suggested that the Fed may need to be patient in waiting for inflation to pick up.

Fed Chair Powell’s Stance on Interest Rates

Jerome Powell, the Chair of the Federal Reserve, has recently signaled that interest rates will remain higher for longer due to a lack of further progress towards the central bank’s 2% inflation goal. This decision was made during the Federal Open Market Committee (FOMC) meeting held on April 27-28, 2021.

During the meeting, Powell stated that although the US economy has made progress towards its maximum employment goal, inflation has continued to run below the central bank’s 2% target. This has led the FOMC to maintain its current monetary policy stance, which includes keeping the federal funds rate at the target range of 0.00%-0.25%.

Powell also acknowledged that the pandemic continues to pose risks to the economy, and the FOMC will continue to monitor the situation closely. He stated that the central bank is committed to using its full range of tools to support the economy and help ensure that the recovery is as strong as possible.

Overall, Powell’s stance on interest rates suggests that the Federal Reserve will maintain its current monetary policy stance for the foreseeable future, as the central bank continues to monitor the progress of the US economy towards its inflation and employment goals.

Challenges in Achieving the 2% Inflation Target

Economic Indicators

The US Federal Reserve has set a target of 2% inflation, but achieving this goal has proven to be challenging. One of the main reasons for this is the lack of progress in economic indicators that signal a healthy economy.

For example, despite the US economy growing at a steady pace, wage growth has remained stagnant. This has led to concerns that the economy is not generating enough inflationary pressure to meet the Fed’s target. Additionally, the unemployment rate has fallen to historic lows, but this has not translated into higher inflation as expected.

Global Financial Factors

Another challenge in achieving the 2% inflation target is the impact of global financial factors. The US economy is heavily influenced by global events, such as the ongoing trade tensions between the US and China. These tensions have led to a slowdown in global growth, which has had a knock-on effect on the US economy.

Furthermore, the strength of the US dollar has made imports cheaper, which has put downward pressure on prices. This has made it difficult for the Fed to achieve its inflation target, as it has little control over global financial factors.

Overall, the challenges in achieving the 2% inflation target are multifaceted and complex. While the Fed has implemented various policies to stimulate inflation, such as cutting interest rates, it remains to be seen whether these measures will be effective in the long term.

Implications for the US Economy

Market Reactions

The announcement by the Federal Reserve Chairman, Jerome Powell, that interest rates will remain higher for longer has had a significant impact on the financial markets. The stock markets have reacted negatively to the news, with the Dow Jones Industrial Average and the S&P 500 both falling by more than 1% on the day of the announcement. This suggests that investors are concerned about the impact that higher interest rates will have on corporate profits and economic growth.

Long-Term Economic Outlook

The decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is concerned about the long-term economic outlook for the US economy. The Fed has stated that there has been a “lack of further progress” towards its 2% inflation goal, which suggests that the economy is not growing as quickly as the central bank would like.

Higher interest rates can have a dampening effect on economic growth, as they make borrowing more expensive for businesses and consumers. This can lead to a slowdown in investment and spending, which can in turn lead to a slowdown in economic growth. However, the Federal Reserve has stated that it will continue to monitor economic conditions and adjust its policies as necessary to support the economy.

Overall, the decision by the Federal Reserve to keep interest rates higher for longer is a signal that the central bank is taking a cautious approach to the US economy. While this may cause short-term volatility in the financial markets, it is ultimately aimed at ensuring long-term economic stability and growth.

-

Digital3 years ago

Social Media and polarization of society

-

Digital3 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital3 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News3 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Kashmir3 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Digital3 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Business2 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China3 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?