Finance

The Impact of the Russia-Ukraine Conflict on Global Financial Markets

Since the outbreak of the Russia-Ukraine war, the global capital markets had experienced the initial plunge on February 24, and then stabilized and rebounded in the second trading day on February 25. The three major U.S. stock indexes closed up collectively, with the Dow Jones industrial average, the S&P 500, and the Nasdaq up 2.51%, 2.24%, and 1.64% respectively.

European stocks also rallied, with Russia’s RTS index up 26.12% after tumbling more than 50% during the previous session, while the UK’s FTSE 100, France’s CAC 40, and Germany’s DAX all rose more than 3%. The prices of gold, crude oil, and other safe-haven commodities all fell sharply and gave up their sharp gains from the first trading day. Taken as a whole, this implies that the impact of the Russia-Ukraine conflict on global capital markets is relatively limited for now.

Judging from the reflection of the capital market, the initial impact of the Russia-Ukraine crisis on the financial market was not too drastic. This may have something to do with the intensity of the war, as well as the influence of the countries involved in the capital markets. If the war is limited in scale, it will not cause a systemic crisis like the COVID-19 pandemic.

However, in terms of its long-term development, researchers at ANBOUND believe that the evolution of geopolitical conflict patterns brought about by the Russia-Ukraine crisis will inevitably affect global investment decisions and capital flows. These effects will be gradual and profound, indicating that global financial markets will evolve with geopolitical changes.

Russia, which started the war, will be hit hardest. On the one hand, the war itself, as an escalation of the Russia-Ukraine crisis, will not end soon. On the other hand, even if Russia wins an overwhelming military victory, there will still be a long period of instability in Ukraine, a situation that investors would not want to see. Moreover, as the crisis escalated, both the United States and the European Union have imposed economic and financial sanctions against Russia.

The latest information shows that Europe and the U.S. have decided to exclude some Russian financial institutions from the SWIFT system. SWIFT sanctions will have a significant negative impact on Russia’s economy, foreign trade, and various financial transactions. The U.S. and Europe also threatening sanctions on Russia’s central bank’s USD 600 billion-worth of foreign reserves. The expulsion of most Russian banks from the SWIFT system has left Russia isolated in international financial markets, meaning it will pay a huge price for this, regardless of whether it wins in the conflict or not.

For the EU, since it is not at the heart of the conflict, its direct losses are small. However, the financial markets in Europe will be in a state of instability due to the geopolitical impact of the war that is geographically near the region, which will not only hit the financial markets in Europe, but will also drag down the euro. Europe, which has close economic ties with Russia, will also suffer from the sanctions against Russia. European banks are heavily exposed to Russian corporate and financial debt, and any rise in risk could destabilize the global financial system.

The U.S. has little to lose from relevant geopolitical conflicts, and the fact that much of the capital withdrawn from Europe is expected to flow back to the U.S. is undoubtedly beneficial to the relatively stable U.S. capital markets. The continued rise in energy prices will likewise further push up the level of inflation in the U.S., posing long-term risks for its financial market. This will further increase the difficulty of the Federal Reserve’s monetary policy implementation, and the policy risk of the Fed’s “hindsight” will further intensify, bringing instability to the U.S. capital market.

In terms of the impact on China, ANBOUND noted that the USD/RMB exchange rate rose again recently. On February 26, both the onshore and offshore USD/RMB exchange rate traded around the 6.30 mark. Data showed the RMB’s correlation with global market volatility fell to a three-year low early last week, underscoring the currency’s safe-haven ability.

In fact, this means that international capital is seeking new safe-haven, bringing incremental international capital to China’s domestic capital market, making China’s financial market one of the beneficiaries of the crisis. However, China’s ability to maintain the stability of its surrounding environment remains a major consideration for international capital flows in the face of growing geopolitical competition and conflict.

However, the war between Russia and Ukraine will have an impact on energy prices such as oil and natural gas, as well as food and commodity prices. The economic and financial sanctions imposed by the U.S. and Europe will also exacerbate Russia’s recession. Nonetheless, Russia can still utilize its energy resources for its geopolitical interest. Russia is said to have substantially raised natural gas prices.

European natural gas prices have soared 41%. In addition, nearly 35% of palladium, an important element used in the U.S. semiconductor industry, was imported from Russia. Once Russia stops supplying palladium to the United States, the shortage of chips in the U.S. will be exacerbated. At the same time, 90% of neon, another element used in the U.S. semiconductor industry, was imported from Ukraine.

A sharp increase in the price of neon as a result of the war could also have some impact on the U.S. semiconductor industry. Some market institutions have analyzed that crude oil prices may once again exceed the USD 140 mark, which will benefit Russia, a major energy exporter, enough to compensate for the losses caused by rising financial settlement costs. Changes in supply and demand in areas such as energy and commodities will undoubtedly exacerbate global inflationary pressures.

Financial markets have conventionally been one of the most globalized areas, and as geopolitical conflict intensifies, this change will have implications for the long-term evolution of global financial capital markets. In particular, Europe and the United States, which have advantages in the financial field, have imposed financial sanctions on Russia, exposing the global financial market to geopolitical hazards, as well as increasing financial transaction costs and risks. These policy and market changes arising from the Russia-Ukraine conflict will indicate an increase in risk for global capital.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Finance

Maximize Your Millions: The Ultimate 2026 Guide to IRAs and Tax-Smart Retirement

Unlock the power of IRAs! Learn the latest IRA contribution limits for 2026, master the Roth IRA vs Traditional IRA debate, and find out how high earners use the backdoor Roth strategy. Start saving smarter today.

📈 Retirement Revolution: Why IRAs Are Your Most Powerful Financial Tool

If you’re serious about financial freedom, you need to understand the IRA (Individual Retirement Arrangement). Far more than just a savings account, IRAs are legally established, tax-advantaged investment vehicles designed to help you build a massive, protected nest egg.

Whether you’re a young professional just starting your career or a high earner looking to legally bypass income caps, mastering the nuances of the Traditional IRA and the Roth IRA is the foundation of retirement success.

This definitive guide breaks down the essential rules, the most current IRA contribution limits 2026, and advanced strategies to ensure you beat the competition and secure your tax-free future.

The Core: Defining the IRA Landscape

An IRA is simply a trust or custodial account set up solely to hold assets for your retirement, offering powerful tax benefits. The IRS provides these benefits as a massive incentive to save, but they come with strict rules regarding contributions, eligibility, and withdrawals.

The central decision you face is choosing between a Traditional IRA and a Roth IRA. This choice hinges entirely on when you prefer to pay taxes: now or later.

1. The Great Showdown: Roth IRA vs Traditional IRA

| Metric | Roth IRA | Traditional IRA |

| Tax Treatment (Contribution) | After-Tax. Contributions are not tax-deductible. | Pre-Tax. Contributions may be tax-deductible in the current year. |

| Tax Treatment (Withdrawal) | Tax-Free. Qualified withdrawals in retirement are never taxed. | Taxable. Withdrawals in retirement are taxed as ordinary income. |

| Income Limits | Yes. Eligibility is phased out above certain Modified Adjusted Gross Income (MAGI) levels (e.g., $168,000 for singles in 2026). | No. Anyone with earned income can contribute, but deductibility phases out if covered by a workplace plan. |

| Required Minimum Distributions (RMDs) | No. RMDs are not required during the original owner’s lifetime. | Yes. RMDs must begin at age 73 (for most). |

| Best User Profile | Those who expect to be in a higher tax bracket in retirement than they are now (e.g., young professionals, high-growth careers). | Those who need an immediate tax break now and expect to be in a lower tax bracket in retirement. |

2. The Contribution Blueprint: Limits and Eligibility for 2026

The IRS has adjusted the limits for 2026, making it easier to save more than ever. Leveraging these limits is the most effective way to grow your retirement savings.

IRA Contribution Limits 2026 (Roth and Traditional combined)

| Age Bracket | Annual Limit |

| Under Age 50 | $7,500 |

| Age 50 and Older (Catch-Up) | $8,600 ($7,500 + $1,100 catch-up) |

Important Rule: Regardless of the limit, your contribution cannot exceed your earned income for the year.

IRA Eligibility Rules

While the contribution limits are the same for both accounts, eligibility is the major difference:

- Traditional IRA: Anyone with earned income can contribute. However, your ability to deduct the contribution is limited if you (or your spouse) are covered by a workplace retirement plan (like a 401(k)) and your income exceeds certain Modified Adjusted Gross Income (MAGI) thresholds.

- Roth IRA: Eligibility is strictly based on your MAGI, regardless of whether you have a workplace plan.

| Roth IRA Eligibility MAGI Thresholds (2026) | Full Contribution | Partial Contribution | No Contribution |

| Single Filers | $\le \$153,000$ | Between $\$153,000$ and $\$168,000$ | $\ge \$168,000$ |

| Married, Filing Jointly | $\le \$242,000$ | Between $\$242,000$ and $\$252,000$ | $\ge \$252,000$ |

Advanced IRA Tactics for High-Earners

If your income places you outside the direct Roth IRA eligibility window, don’t despair. Savvy financial planning allows high-income earners to utilize the backdoor Roth strategy.

The Backdoor Roth Strategy

The backdoor Roth is not an official account type but a legal two-step process used to bypass the income limit and convert non-deductible Traditional IRA contributions into a Roth IRA.

- Step 1: Non-Deductible Contribution: Contribute the annual maximum ($7,500 in 2026) to a Traditional IRA with after-tax dollars. Since your income is high, this contribution is not tax-deductible.

- Step 2: Roth Conversion: Immediately convert the entire Traditional IRA balance into a Roth IRA. Since the money was contributed with after-tax dollars, the conversion is generally tax-free (assuming no earnings accrue between steps).

⚠️ The Pro-Rata Rule Warning: If you already hold pre-tax dollars in any Traditional, SEP, or SIMPLE IRA (e.g., from a past 401(k) rollover), the conversion will be subject to the pro-rata rule. This rule dictates that a portion of your conversion will be taxable, potentially wiping out the benefit. The clean path requires having zero pre-tax IRA dollars.

The Rollover IRA: Unifying Your Retirement Funds

A rollover IRA is simply a Traditional IRA designated to receive money from a former employer’s retirement plan (like a 401(k)). This account serves several vital functions:

- Consolidation: Simplifies your portfolio by merging old work accounts into one place.

- Wider Investment Choice: Provides access to investment options far beyond the typical limited 401(k) lineup.

- Backdoor Strategy Prep: Rolling old pre-tax IRAs into a current 401(k) (if the 401(k) plan allows it) is the most common way to “clean up” your existing IRA balances to avoid the pro-rata rule when executing a backdoor Roth.

Specialized Accounts: SEP IRA and SIMPLE IRA

For the self-employed, small business owners, and gig workers, the standard IRA limits often aren’t enough. The IRS provides two key alternatives to allow for much higher contributions.

💼 SEP IRA for Self-Employed

The Simplified Employee Pension (SEP) IRA is the ideal choice for solo entrepreneurs or businesses with fluctuating cash flow.

- Key Feature: Only the employer (i.e., you, the self-employed individual) can contribute. Employee contributions are not allowed.

- Contribution Limits: You can contribute up to 25% of an employee’s compensation (or 20% of your net self-employment income) up to a maximum limit (which is $\approx \$72,000$ for 2026).

- Flexibility: Contributions are entirely discretionary. You can contribute 20% one year and 0% the next, which is excellent for unpredictable revenue streams.

SIMPLE IRA

The Savings Incentive Match Plan for Employees (SIMPLE) IRA is designed for small businesses with 100 or fewer employees.

- Key Feature: Allows both employee salary deferrals and employer contributions (matching or non-elective).

- Contribution Limits (2026): Employees can defer up to $\approx \$17,000$, plus a catch-up contribution for those 50 and older.

- Requirement: The employer is required to contribute every year, either a dollar-for-dollar match up to 3% of compensation or a non-elective contribution of 2% of compensation for all eligible employees.

Protecting Your Future: Smart IRA Withdrawal Rules

The power of tax-advantaged growth is protected by a penalty: the 10% additional tax (often called the early withdrawal penalty) on distributions taken before age 59½.

When Can I Withdraw from an IRA Without Penalty?

While the general rule is to wait until 59½, the IRS allows several penalty exceptions for both Traditional and Roth IRAs:

- First-Time Home Purchase: Up to $\$10,000$ for the purchase of a first home.

- Higher Education Expenses: For you, your spouse, children, or grandchildren.

- Unreimbursed Medical Expenses: If they exceed a certain percentage of your Adjusted Gross Income (AGI).

- Permanent Disability: If you become totally and permanently disabled.

- Substantially Equal Periodic Payments (SEPPs): A strategy for early retirees to take penalty-free distributions.

Roth IRA Specific Withdrawal Advantage

- Contributions Come First: Since you paid tax on your Roth IRA contributions already, you can withdraw your contributed principal at any time, for any reason, tax- and penalty-free. Only earnings are subject to the penalty and five-year holding rule.

Traditional IRA Specific Rule

- Required Minimum Distributions (RMDs): Unlike the Roth IRA, you must begin taking RMDs from your Traditional IRA at age 73 (for most individuals born after 1950). This forces you to pay income tax on your tax-deferred savings.

Conclusion: Your Next Steps to Retirement Success

Mastering IRAs is the single best step you can take toward a secure retirement. By understanding the updated IRA contribution limits 2026 and strategically selecting between the Roth IRA vs Traditional IRA, you control your tax burden—now or in the future.

If your income limits your options or you have complex accounts (like a mix of pre-tax and after-tax IRAs), consulting with a Certified Financial Planner (CFP) is the wisest move. Don’t leave tax efficiency on the table.

Would you like a side-by-side comparison of the tax implications for a specific income level using a Roth vs. Traditional IRA?

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Business

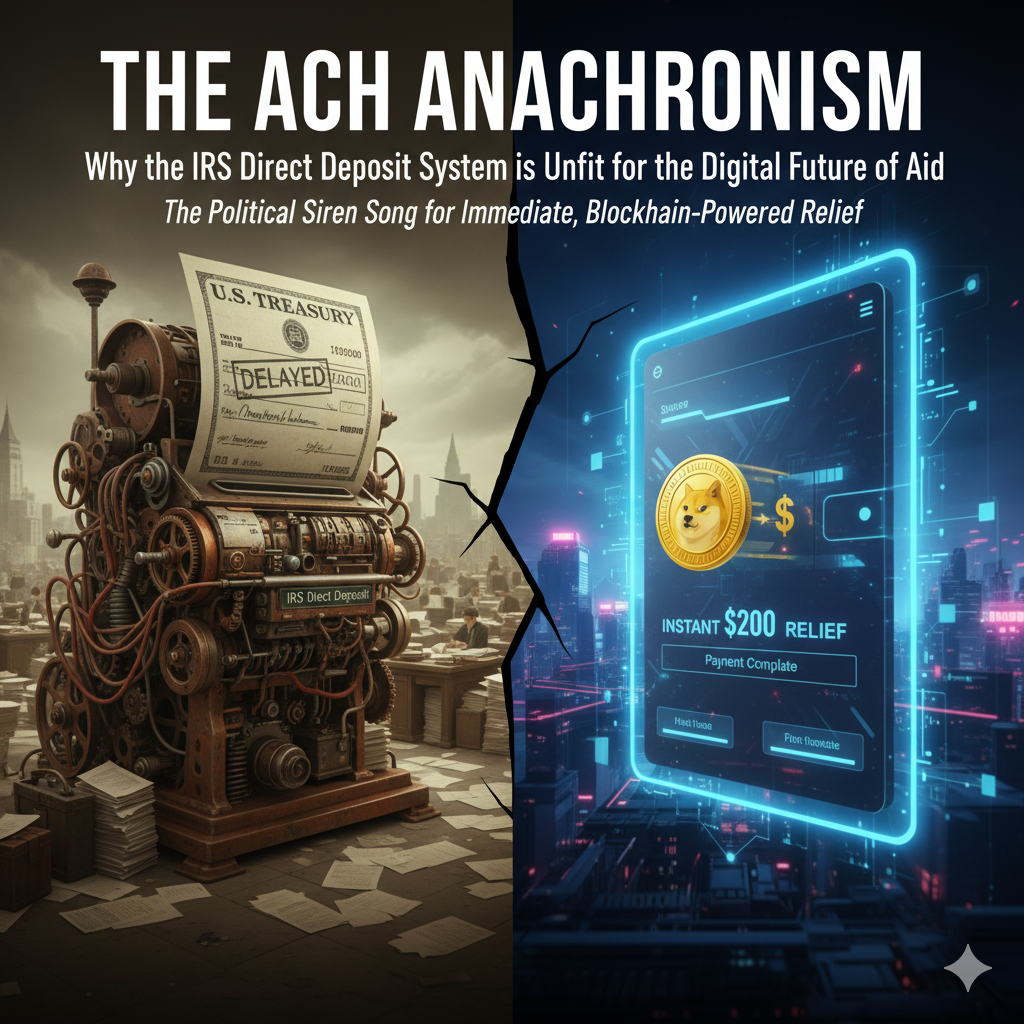

The ACH Anachronism: Why the IRS Direct Deposit System is Unfit for the Digital Future of Aid

The political siren song for immediate, blockchain-powered relief—however hyperbolic the idea of doge checks may be—is forcing a reckoning with the ageing IRS direct deposit infrastructure, a system ill-equipped for instant, mass-scale payments.

The United States government is quietly approaching a major inflexion point in its relationship with its citizens: the speed and method of its financial disbursements. While the current tax season may feature the familiar, reliable process of the IRS direct deposit, the future of federal aid—from universal basic income (UBI) pilots to targeted economic relief—demands a technological leap the Internal Revenue Service is fundamentally unprepared to make. The conflict is straightforward: the political desire for instant, transparent relief directly clashes with a legacy system, the ACH network, which is slow, prone to errors, and structurally resistant to digital innovation. The absurd, yet viral, idea of doge checks—payments tied to volatile digital assets—serves as a useful, if hyperbolic, symbol for the intense political and public pressure to adopt a 21st-century payment infrastructure.

My core argument is this: The future of federal aid hinges on transforming the slow, traditional irs direct deposit relief payment system to handle not just fiat currency, but the inevitable political pushes for digital and crypto distributions, symbolised by the far-fetched idea of doge checks. Failure to act will not only result in massive administrative costs but also undermine the effectiveness of future government interventions, leaving millions of the unbanked behind.

1: The Reliability and Limitations of Traditional Infrastructure

The sheer scale of the existing IRS direct deposit system is impressive. It can manage billions in tax refunds and, as demonstrated during the pandemic, process emergency IRS direct deposit relief payment disbursements to over 150 million Americans. This process, facilitated by the Automated Clearing House (ACH) network, is a testament to the stability of the traditional U.S. banking system.

However, its reliability comes with severe limitations. The ACH network operates on a batch-processing schedule, meaning fund transfer is not instantaneous, often taking several business days to move from the Treasury to an individual bank account. During a crisis, this delay is not merely inconvenient; it is economically damaging, as aid meant to be immediate is delayed.

Furthermore, the integrity of the direct deposit irs system relies on having accurate, up-to-date bank information. During the emergency stimulus payouts, the IRS struggled massively with stale bank account numbers, leading to countless payments being rejected and reverted back to slow, fraud-prone paper checks. A significant percentage of Americans remain unbanked or underbanked, forcing them to rely on costly cheque-cashing services that extract value from the very aid the government provides. Any IRS direct deposit relief payment program that relies solely on this legacy mechanism guarantees a continuation of this disparity, benefiting those already securely entrenched in the formal banking system while penalising the most vulnerable.

2: The Crypto and Novel Payment Concept

The idea of doge checks is admittedly a jest—the notion of the U.S. government issuing relief payments tied to a volatile meme coin is financially reckless and legally complex. Yet, the concept serves as a vital lightning rod for a real political and technological shift. The underlying pressure is for speed, transparency, and a system that bypasses the old banking intermediaries.

Digital payment advocates point to the benefits of blockchain technology: instant settlement, immutable records, and programmable money that could, in theory, ensure funds are spent for their intended purpose. The political allure is undeniable: immediate relief hitting digital wallets, eliminating the delays of the traditional IRS direct deposit system. Imagine a UBI pilot where funds are disbursed in real-time, 24/7, without the weekend and holiday delays inherent in the direct deposit IRS process.

But the challenges of moving beyond the IRS direct deposit relief payment are immense. The IRS currently treats cryptocurrency as property, not currency, for tax purposes. Distributing doge checks or any stablecoin would create immediate, cascading tax complexity for every recipient, requiring the individual to track the value of the digital asset from the moment of receipt until it is spent. This would be a compliance nightmare. Moreover, the security protocols, wallet management, and key custody requirements necessary to protect the government and citizens from hacking, fraud, and lost funds are simply nonexistent within the current IRS direct deposit regulatory framework. The political noise around non-traditional payments is getting louder, but the practical infrastructure is nowhere close to ready.

3: The Path Forward: Digitizing Federal Aid

The solution is not necessarily literal doge checks but rather adopting the spirit of instant digital transfer within the safety of the fiat system. The immediate, achievable goal must be to render the slow, two-to-three-day IRS direct deposit relief payment obsolete.

First, the direct deposit irs system must fully embrace instant payment technologies now available across major banking systems (like FedNow or RTP), allowing funds to clear and settle in seconds, not days. Second, the IRS must partner strategically with regulated digital payment providers and prepaid debit card issuers to provide easy, no-fee digital wallets for the unbanked. The focus must shift from simply gathering bank account numbers to ensuring every eligible citizen has a functional, real-time payment endpoint.

This modernisation effort is not just about speed; it’s about security. The legacy IRS direct deposit system is vulnerable to mass fraud when personal information is compromised. By migrating to modern, tokenised payment methods and leveraging state-of-the-art encryption, the IRS can drastically reduce the risk of fraud while improving service. The demand for instant, transparent funds—the core value proposition embedded within the political hype of doge checks—will not vanish. If the IRS’s direct deposit system doesn’t modernise, it risks becoming a bottleneck that strangles necessary economic aid at the moment of peak crisis.

Conclusion

The challenge facing federal agencies is profound: to move beyond the analogue, batch-processed reality of the IRS direct deposit system and prepare for a digital-first future. The hyperbolic call for doge checks is a powerful symbol, demonstrating the public’s appetite for immediate, unencumbered funds. That political will, however disruptive, must catalyse change. The failure of the direct deposit IRS to handle the scale and speed of a modern crisis will be more than an administrative delay; it will be an economic and moral failure. The question is whether the inertia of the current system will prevail, or if the demands of future aid will force a rapid, potentially chaotic leap into digital disbursement methods, ensuring that the legacy of the doge checks concept is not a joke but a powerful catalyst for necessary technological evolution.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Economy

Pension Reforms or Financial Massacre?

Since the announcement of Budget 2025-26, the government employees in the centre and the provinces are immersed in protest for their rightful demands, such as Disparity Reduction Allowance (DRA) , a raise in salaries given the prevailing inflation, and old age benefits such as pension. Millions of employees belonging to various departments under the banner of the Sindh Employees Alliance (SEA) have been protesting in the provincial Quarter Karachi and at the division level.

The heat, anger and frustration pervaded Sindh’s air in August 2025. The same scene was repeated from Hyderabad to Nawabshah, from Badin to tiny towns nestled in the rural centre of the province: government workers locking up their offices, getting up from their desks, and taking to the streets. Teachers, clerks, revenue employees, and others who support the province’s operations were now chanting together against what they described as an “economic murder” of their future.

Some held handwritten signs, while others carried banners with bold slogans. At the edge of a rally, one of them, Razia Bibi, a primary school teacher with almost thirty years of experience, stood silently. “I taught generations; now I’m left with uncertainty,” was the simple message on her sign. The words spoke for themselves, so she didn’t have to yell. She and thousands of others felt that the government’s new pension regulations were a betrayal rather than merely a change in policy.

The Sindh Finance Department’s announcement of the Sindh Civil Servants (Defined Contribution Pension) Rules 2025 on August 21 served as the impetus for this unrest. The official justification was straightforward: a new system was required to make the pension bill sustainable because it had become too large for the provincial budget. For those impacted, however, the situation was much more chaotic. The old, guaranteed pension system will be replaced by one that is based on market fluctuations under the new regulations, which will be applicable to anyone hired or regularised after July 1, 2024.

A civil servant could retire under the previous arrangement, knowing exactly how much they would get each month for the rest of their life. They were able to plan, dream, and feel safe because of that promise. That certainty is no longer there. Workers will be required to deposit 10% of their pay into a personal account, with the government contributing the remaining 12%. Private pension fund managers will invest the funds, and the ultimate distribution will be solely based on the performance of those investments. The pension may be sufficient if the markets perform well. That’s the retiree’s problem if they don’t.

Furthermore, the changes don’t end there. Even for those who are currently employed, benefits are being subtly reduced by changes to the West Pakistan Civil Services Pension Rules, 1963, which were announced along with the new program. Instead of using final pay, which is a smaller amount, pensions will be calculated using the average of the last 24 months’ salary. After ten years, some dependents’ family pensions will expire. A person’s pension could be reduced by up to 10% if they decide to retire early.

These measures are about numbers for the government. They are about survival for workers. More than just a technical adjustment, the transition from a defined benefit to a defined contribution system involves a risk transfer. That risk was borne by the government under the previous system. The person does in the new one. And that risk feels like a loaded dice in a nation where salaries have only increased by 12%, inflation has recently risen above 200 percent, and many workers already make less than their counterparts in other provinces.

The wound is only made worse by the elimination of additional benefits for new hires, like group insurance and the Disparity Reduction Allowance. It creates a two-class system in which those hired after July 2024 must live with uncertainty while those hired before that time retain their guaranteed pensions. This division is destructive in addition to being unfair. It causes animosity, lowers morale, and deters young talent from choosing public service as a career in Sindh.

The contrast with how elected officials are treated is even more painful. Low-paid employees are told to make sacrifices for the sake of fiscal restraint, while lawmakers continue to enjoy lavish benefits and allowances. Discussing shared hardship is challenging when the burden is so unequally divided.

The reaction has been quick. In support of their colleagues who were protesting, the Sindh Professors and Lecturers Association in Hyderabad observed a black day by donning armbands. Clerks in Sanghar staged a sit-in outside the office of the district commissioner. Revenue employees in Moro and Daur locked their offices and participated in protests calling for the reinstatement of job quotas for the surviving family members of deceased workers, a privilege that the new framework had taken away. Female educators have been particularly outspoken in rural areas. For many women, the only way to become financially independent is to work for the government. That independence is jeopardised in the absence of a stable pension.

Public services have already been interrupted by the protests. Thousands of students’ lessons have been delayed as a result of school closures. In many offices, administrative work has slowed or ceased. It is difficult to overlook the irony: the government has incited unrest that is undermining the very services it purports to protect in the name of preserving the province’s finances.

There are alternative paths. Employees would have a stronger foundation for their retirement savings if the government increased its contribution to the new pension plan to at least 15% or 20%. It could link pensions to inflation to maintain their value over time and guarantee a minimum pension amount, preventing any retiree from falling into poverty. It could address corruption in procurement and budgeting, reduce unnecessary spending elsewhere, and enhance pension fund management. By taking these actions, financial issues would be resolved without fully burdening workers.

Above all, the government could speak with those whose lives these policies are changing. In a ledger, civil servants are more than just numbers. They are the health professionals who work in distant clinics, the teachers who open young minds, and the clerks who keep the government’s machinery running. Their efforts serve as the cornerstone for the province’s future. The services they offer are compromised when their security is compromised.

There is more to the August 2025 protests than just a response to one policy. They serve as a warning, an indication that public employees will not stand by and watch their rights being taken away. They also serve as a reminder of the annoyance that has been brewing for years due to low income, growing expenses, and a feeling of being ignored. Ignoring this puts the government at risk for both ongoing instability and a long-term drop in the calibre and stability of its workforce.

Reforming pensions is not always bad. Numerous nations have had to modify their systems to take into account shifting economic conditions and demographic trends. However, reform needs to be transparent, equitable, and aimed at preserving the honor of those who have dedicated their professional lives to serving the public good. It shouldn’t serve as an excuse to cut costs at the expense of the most vulnerable. That test is not met by the Sindh Defined Contribution Pension Rules 2025 as they currently stand. They remove guarantees without providing sufficient safeguards. Employees are separated into winners and losers. They make retirement a question mark instead of a promise.

Now, the Sindh government must make a decision. It may continue, resulting in short-term cost savings but long-term instability and mistrust. Alternatively, it can pay attention to the voices on the streets, accept the justifiable concerns of its workers, and seek a solution that strikes a balance between social justice and financial responsibility. Although it will be more difficult, the second route is the only one that pays tribute to the sacrifices and service of those who keep this province running.

Pensions are ultimately about more than just money. They are about acknowledgement—a means by which society can tell its public servants, “Your work was important, and we won’t leave you in your old age.” A generation-old bond of trust would be broken if that were taken away. Fairness, respect, and the freedom to retire fearlessly were the main concerns of the August 2025 protests, which went beyond financial figures. Until the promise of public service in Sindh is restored with dignity, that is a cause worth fighting for.

Amid fear of less pension and cut in pensionary benefits, thousands of teachers and other employees have opted for voluntary retirement before their superannuation, being unsure about the future to escape financial loss. Until the promise of public service in Sindh is restored with dignity, that is a cause worth fighting for.

Hence, it is believed by various public sector employees that instead of the provision of DRA, the Sindh government has committed the financial massacre of employees in the guise of Pension reforms.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

-

Digital5 years ago

Social Media and polarization of society

-

Digital5 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital5 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News5 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Digital5 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Kashmir5 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Business4 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China5 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?