Crypto currency

Bitcoin ban could backfire on Pakistan

Pakistanis were third biggest crypto adopters in 2021, pumping up digital currency holdings to more than central bank’s foreign reserves

Pakistan’s central bank has proposed a ban on all forms of cryptocurrency, saying the risks involved in trading Bitcoin, Ethereum and other crypto coins far outweigh the potential benefits.

The State Bank of Pakistan’s (SBP) “risk-benefit analysis” committee, constituted under a High Court directive, recently announced that cryptocurrencies were depleting national foreign reserves and encouraging illicit financing.

The body, comprised of representatives from the Ministry of Finance, Information Technology, Pakistan Telecommunication Authority (PTA) and Security and Exchange Commission of Pakistan (SECP) recommended a complete ban on virtual currencies and other related activities in Pakistan.

India, which has the second-highest crypto holdings worldwide, is moving in the same direction and plans to ban most cryptocurrencies as part of a proposed Cryptocurrency and Regulation of Official Digital Currency Bill, likely to be debated in the parliament’s winter session. The legislation aims to establish a framework for an official digital currency to be issued by the Reserve Bank of India (RBI).

However, Pakistan does not plan to introduce its own official digital currency to replace existing digital money. Instead, authorities intend to ban all forms of crypto, with proposals on the table to block even the websites dealing in cryptocurrencies.

The SBP committee believes a clampdown is necessary because existing laws governing electronic crimes, foreign exchange remittances and anti-money laundering lack provisions for criminalizing the misuse of cryptocurrencies.

Business leaders, blockchain experts and crypto influencers have countered with a proposal for a digital currency regulatory framework. A blanket ban, they claim, would backfire badly and further damage the economy, which is already in tatters.

Karachi Chamber of Commerce and Industry (KCCI) former president Majyd Aziz told Asia Times that the government’s mindset of imposing bans to deal with emerging risks was highly flawed. “The authorities seldom figure out the outcome to analyze the risks and benefits of such an action,” he said. “You cannot ban digital currencies before evaluating its impact on the huge investments people made in the digital economy.

“In my opinion, there is an imperative need for an International Cryptocurrency Regulatory Authority that could run the crypto-related activities in the country. We do not need to ban crypto because the people would still invest in digital currency despite a ban,” Majyd added.

At the same time, he echoed regulators’ concerns in warning, “Greed and lust for fast bucks always result in big-time losses and I pray that cryptocurrency investment may not become another Ponzi scheme.”

Opinion is mixed, however.

Waqar Zaka, a prominent crypto influencer with related online platforms with over four million followers, recently tweeted, “There are minds who are claiming that 20 billion dollars {had} left Pakistan because of Crypto, incorrect. When there is Hundi {system in place}, why {would} anyone want to be on {the} FATF radar? By the way, Facebook {and} YouTube ads are dragging out more dollars from a country where a majority still have no idea about crypto.”

Federation of Pakistan Chamber of Commerce & Industry (FPCCI) estimates total cryptocurrency investments in Pakistan at US$20 billion, or more than the country’s total foreign currency reserves now held by the central bank.

A FPCCI policy brief, compiled in late December, underscored the risks endemic in the lack of crypto-related legislation and other digital assets in the country. It also noted Pakistan’s trading and lending partners such as China and the International Monetary Fund (IMF) have both warned unregulated blockchain technology is susceptible to money laundering and other digital crimes.

The report also noted that the Financial Action Task Force (FATF), an intergovernmental body that fights money-laundering globally, has called on Pakistani authorities to better regulate its crypto industry, as most investors currently use a peer-to-peer (P2P) crypto investment mechanism that renders crypto assets almost undetectable.

Chainalysis, a blockchain data platform that provides data, software, services and research analysis, reported in October last year that Pakistan recorded 711% growth in crypto-related investments during the 2020-21 fiscal year, even higher than India’s explosive 641% growth.

The robust growth in digital currency holdings has made Pakistan one of the most robust crypto markets outside of Europe and the United States, with Chainalysis ranking the country third on its Global Crypto Adoption Index for the year 2021.

Chainalysis opined that Pakistan’s actual crypto holdings could be even higher than the official estimates because many citizens purchase bitcoin through P2P deals, which mostly remain undocumented.

Meet TripleA, a cryptocurrency and blockchain technology outfit, estimates that over 9 million people, or 4.1% of Pakistan’s total population, currently own cryptocurrencies. The firm claims that interest in Bitcoin, judging by online searches and other measures, has risen following the government’s discussion of new cryptocurrency regulations.

Meet TripleA said that despite Pakistan’s surging interest in cryptocurrency, the country’s potential was is being hampered by low banking penetration and limited proof-of-stake (POS) terminals for processing transactions and creating new blocks in a blockchain. Even so, the outfit said the bitcoin market is a “fast-growing sector of the economy.”

Regulatory screws are already tightening on crypto-trading platforms. Last week, Pakistan’s Federal Investigation Agency (FIA) said it approached Binance Holdings Limited, one of the world’s biggest Bitcoin hubs, as part of an investigation into a suspected $100 million scam.

The agency claimed that several thousand Pakistani investors had been cheated through “fraudulent online investment mobile applications” and money transferred to at least 26 suspect Binance blockchain wallet addresses. The agency directed Binance to give the details of these blockchain accounts and mark a lien on the funds.

Soon thereafter, FIA director-general Sanaullah Abbasi said during an SBP briefing in Karachi on January 15 that the agency would soon block websites dealing in cryptocurrencies to prevent fraud and possible money laundering.

The meeting was informed that there was no section of law available in the Prevention of Electronic Crimes Act 2016, Foreign Exchange Remittance Act 1947 (FERA) or Anti-Money Laundering Act 2010 (AMLA) to criminalize the misuse of cryptocurrency.

The meeting also observed that there was no regulatory framework for virtual asset service providers to comply with FATF requirements.

China, Bangladesh, Saudi Arabia, Egypt, Iraq, Qatar, Oman, Morocco, Algeria and Tunisia have all already banned crypto transactions, while 42 other countries, including Algeria, Bahrain, Bolivia, India and Pakistan have implicitly banned digital currencies by restricting banks and cryptocurrency exchanges from dealing in the digital assets.

In 2018, Pakistan’s central bank declared that it had not authorized or licensed any individual or entity for the issuance, sale, purchase, exchange, or investment in virtual currencies like bitcoin and others. Digital currencies, SBP said at the time, were not a legal tender issued under the bank’s guarantee.

The SBP not only prevented banks from processing, using, trading, holding, transferring value, promoting and investing in virtual currencies but also advised them not to facilitate their account holders’ cryptocurrency transactions. Now, that regulatory noose will likely tighten into an outright crypto ban.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

AI

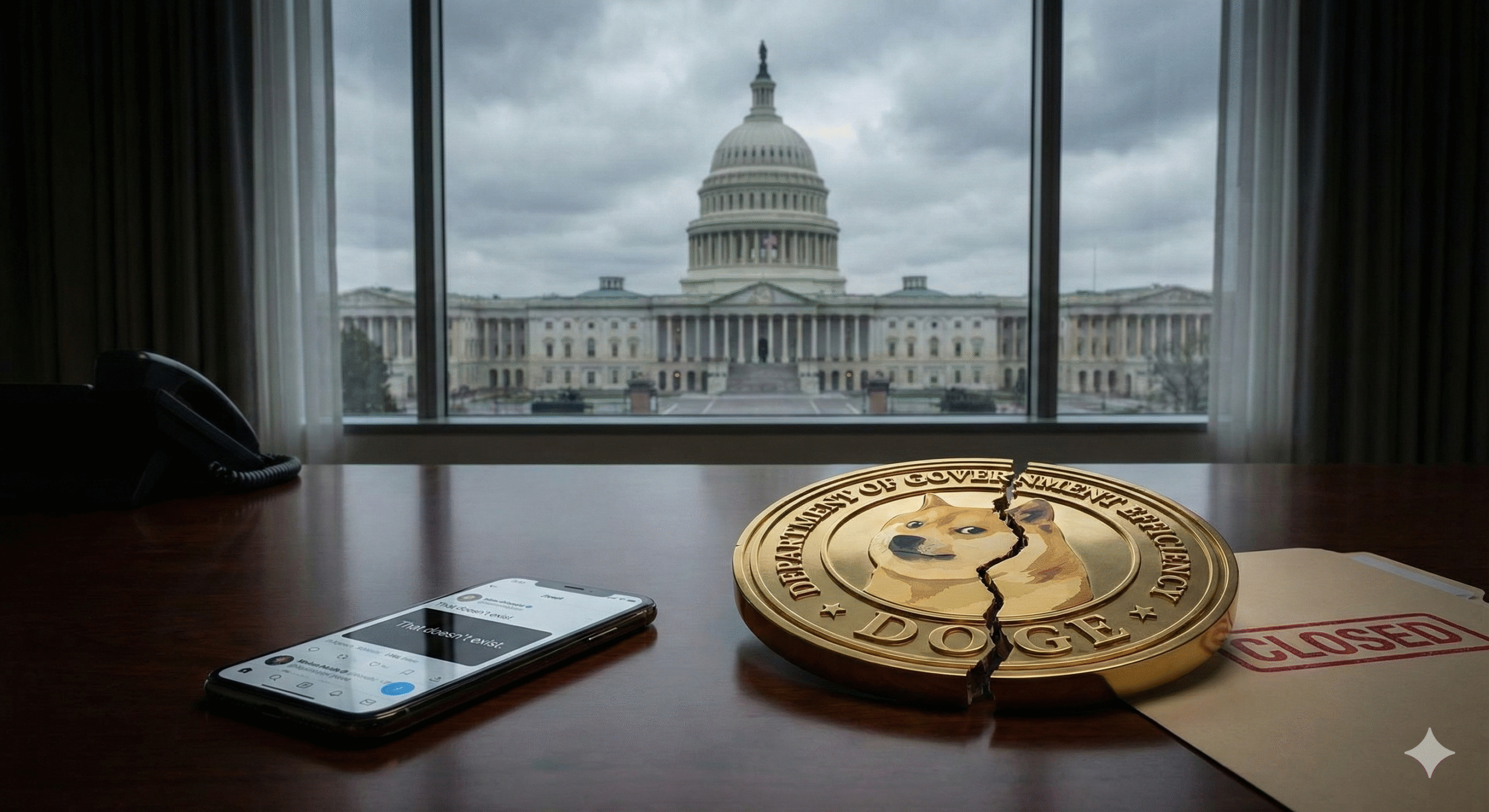

‘That doesn’t exist’: The Quiet, Chaotic End of Elon Musk’s DOGE

DOGE is dead. Following a statement from OPM Director Scott Kupor that the agency “doesn’t exist”, we analyse how Musk’s “chainsaw” approach failed to survive Washington.

If T.S. Eliot were covering the Trump administration, he might note that the Department of Government Efficiency (DOGE) ended not with a bang, but with a bureaucrat from the Office of Personnel Management (OPM) politely telling a reporter, “That doesn’t exist.”

Today, November 24, 2025, marks the official, unceremonious end of the most explosive experiment in modern governance. Eight months ahead of its July 2026 deadline, the agency that promised to “delete the mountain” of federal bureaucracy has been quietly dissolved. OPM Director Scott Kupor confirmed the news this morning, stating the department is no longer a “centralised entity.”

It is a fittingly chaotic funeral for a project that was never built to last. DOGE wasn’t an agency; it was a shock therapy stunt that mistook startup velocity for sovereign governance. And as of today, the “Deep State” didn’t just survive the disruption—it absorbed it.

The Chainsaw vs. The Scalpel

In January 2025, Elon Musk stood on a stage brandishing a literal chainsaw, promising to slice through the red tape of Washington. It was great television. It was terrible management.

The fundamental flaw of DOGE was the belief that the U.S. government operates like a bloatware-ridden tech company. Musk and his co-commissioner Vivek Ramaswamy applied the “move fast and break things” philosophy to federal statutes that require public comment periods and congressional oversight.

For a few months, it looked like it was working. The unverified claims of “billions saved” circulated on X (formerly Twitter) daily. But you cannot “bug fix” a federal budget. When the “chainsaw” met the rigid wall of administrative law, the blade didn’t cut—it shattered. The fact that the agency is being absorbed by the OPM—the very heart of the federal HR bureaucracy—is the ultimate irony. The disruptors have been filed away, likely in triplicate.

The Musk Exodus: A Zombie Agency Since May

Let’s be honest: DOGE didn’t die today. It died in May 2025.

The moment Elon Musk boarded his jet back to Texas following the public meltdown over President Trump’s budget bill, the soul of the project evaporated. The reported Trump-Musk feud over the “Big, Beautiful Bill”—which Musk criticized as a debt bomb—severed the agency’s political lifeline.

For the last six months, DOGE has been a “zombie agency,” staffed by true believers with no captain. While the headlines today focus on the official disbanding, the reality is that Washington’s immune system rejected the organ transplant half a year ago. The remaining staff, once heralded as revolutionaries, are now quietly updating their LinkedIns or engaging in the most bureaucratic act of all: transferring to other departments.

The Human Cost of “Efficiency”

While we analyze the political theatre, we cannot ignore the wreckage left in the wake of this experiment. Reports indicate over 200,000 federal workers have been displaced, either through the aggressive layoffs of early 2025 or the “voluntary” buyouts that followed.

These weren’t just “wasteful” line items; they were safety inspectors, grant administrators, and veteran civil servants. The federal workforce cuts impact will be felt for years, not in money saved, but in phones that go unanswered at the VA and permits that sit in limbo at the EPA.

Conclusion: The System Always Wins

The absorption of DOGE functions into the OPM and the transfer of high-profile staff like Joe Gebbia to the new “National Design Studio” proves a timeless Washington truth: The bureaucracy is fluid. You can punch it, scream at it, and even slash it with a chainsaw, but it eventually reforms around the fist.

Musk’s agency is gone. The Department of Government Efficiency news cycle is over. But the regulations, the statutes, and the OPM remain. In the battle between Silicon Valley accelerationism and D.C. incrementalism, the tortoise just beat the hare. Again.

Frequently Asked Questions (FAQ)

Why was DOGE disbanded ahead of schedule?

Officially, the administration claims the work is done and functions are being “institutionalized” into the OPM. However, analysts point to the departure of Elon Musk in May 2025 and rising political friction over the aggressive nature of the cuts as the primary drivers for the early closure.

Did DOGE actually save money?

It is disputed. While the agency claimed to identify hundreds of billions in savings, OPM Director Scott Kupor and other officials have admitted that “detailed public accounting” was never fully verified. The long-term costs of severance packages and rehiring contractors may offset initial savings.

What happens to DOGE employees now?

Many have been let go. However, select high-level staff have been reassigned. For example, Joe Gebbia has reportedly moved to the “National Design Studio,” and others have taken roles at the Department of Health and Human Services (HHS).

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

crypto

HyperVerse Scheme: How It Caught Fire Online with Astonishing Returns and Cult Overtones

Introduction

The HyperVerse scheme was a virtual world that promised its investors astonishing returns and perfect life. It quickly caught fire online and attracted thousands of people from around the world. However, videos promoting the alleged Ponzi scheme and the senior promoters living the high life concealed the reality of huge financial losses for many.

The rise of HyperVerse was fueled by the allure of a perfect virtual world where people could live their dreams. The scheme promised its investors a chance to earn high returns by buying virtual land and leasing it to others. However, the reality was far from perfect, as many investors lost their hard-earned money. Despite the warnings from financial regulators, many people continued to invest in the scheme, driven by the hope of making quick profits.

The collapse of HyperVerse left many people disillusioned and angry. The senior promoters of the scheme disappeared, leaving investors with nothing. The collapse of the scheme highlights the dangers of investing in unregulated schemes and the need for caution when investing in virtual worlds.

Key Takeaways

- The HyperVerse scheme promised astonishing returns and a perfect virtual world, but it turned out to be a Ponzi scheme that caused huge financial losses for many investors.

- The allure of a perfect virtual world and the hope of making quick profits drove many people to invest in the scheme, despite the warnings from financial regulators.

- The collapse of HyperVerse highlights the dangers of investing in unregulated schemes and the need for caution when investing in virtual worlds.

The Rise of HyperVerse

HyperVerse was a virtual world that promised astonishing returns to its investors. The scheme caught fire online, thanks to the promotional tactics used by its senior promoters. However, for thousands around the world, the reality was a huge financial loss.

Promotional Tactics

HyperVerse used bizarre videos to promote its alleged Ponzi scheme. The videos showed senior promoters living the high life, driving luxury cars and jets, and attending exclusive parties. These videos were designed to create a sense of urgency and excitement among potential investors.

HyperVerse also used social media and online forums to spread the word about its virtual world. The scheme promised to create a perfect virtual world where users could live out their dreams. The promise of a perfect world, combined with the prospect of high returns, attracted thousands of investors from around the world.

Cult Overtones

As the scheme grew, it began to take on cult overtones. Senior promoters were treated like gurus, and investors were encouraged to recruit others into the scheme. Those who questioned the legitimacy of the scheme were dismissed as naysayers and non-believers.

Investors were also encouraged to invest more money into the scheme, with the promise of even higher returns. Those who invested the most money were given special privileges, such as access to exclusive events and virtual worlds.

In conclusion, the rise of HyperVerse was fueled by its promotional tactics and cult-like atmosphere. While some investors made money, many others suffered huge financial losses. The lesson to be learned is that if something seems too good to be true, it probably is.

The Collapse

Financial Fallout

As the HyperVerse scheme came crashing down, thousands of investors around the world were left with huge financial losses. The alleged Ponzi scheme had promised astonishing returns, but the reality was a devastating financial blow for many. According to reports, the scheme had raised more than $1 billion from investors, but the money had been largely squandered on luxury cars, yachts, and other extravagant expenses.

Many investors who had put their life savings into the scheme were left with nothing. Some reported losing tens or even hundreds of thousands of dollars. The collapse of the scheme sent shockwaves through the online community, with many people expressing anger and frustration at the senior promoters who had lived the high life while others suffered.

Legal Actions

In the aftermath of the collapse, legal actions were taken against the perpetrators of the scheme. Several senior promoters were arrested and charged with fraud, money laundering, and other crimes. However, for many investors, the legal actions provided little consolation for their financial losses.

Despite the collapse of the HyperVerse scheme, the online world continued to be a breeding ground for similar schemes and scams. The lure of astonishing returns and the promise of a perfect virtual world proved to be a powerful draw for many people, and the collapse of the HyperVerse scheme served as a stark reminder of the risks involved in investing in unregulated online ventures.

Life Inside the Scheme

The HyperVerse scheme promised its investors astonishing returns and a “perfect virtual world,” but for many, it turned out to be a financial nightmare. As the scheme caught fire online, bizarre videos promoted the alleged Ponzi scheme, and senior promoters lived the high life.

Senior Promoters’ Lifestyle

Senior promoters of the HyperVerse scheme lived lavishly, flaunting their wealth on social media. They were often seen driving luxury cars, traveling to exotic destinations, and attending high-end events. Some even claimed to have purchased private islands.

However, for the thousands of investors who poured their hard-earned money into the scheme, the reality was far from glamorous. Many lost their life savings, and some were left with huge debts.

The senior promoters of the HyperVerse scheme have since faced legal action, with some even being arrested for their involvement in the alleged Ponzi scheme. Despite the promises of a “perfect virtual world,” the reality of life inside the scheme was one of financial ruin and shattered dreams.

The Allure of a Perfect Virtual World

The HyperVerse scheme promised investors a “perfect virtual world” where they could earn astonishing returns. The idea of a virtual world where one could earn a fortune without leaving the comfort of their own home was very alluring to many people.

The scheme was marketed heavily on social media platforms such as Facebook, Twitter, and Instagram. Bizarre videos featuring people dressed in futuristic costumes and promoting the scheme were shared widely on these platforms. The videos promised investors that they would be able to earn huge returns on their investment in a matter of weeks.

The allure of the HyperVerse scheme was also fueled by the fact that senior promoters of the scheme were living the high life. They posted pictures on social media platforms of themselves driving luxury cars, traveling to exotic locations, and staying in five-star hotels. This created the impression that the scheme was legitimate and that investors would be able to enjoy the same lifestyle if they invested in the scheme.

However, for thousands of people around the world, the reality was a huge financial loss. The HyperVerse scheme turned out to be a Ponzi scheme, where early investors were paid using the money of new investors. When the scheme collapsed, many investors lost their life savings.

In conclusion, the allure of a perfect virtual world where one can earn huge returns without leaving the comfort of their own home was very alluring to many people. However, the reality of the HyperVerse scheme was very different, and many people ended up losing their money.

Frequently Asked Questions

What is the HyperVerse scheme and how does it operate?

The HyperVerse scheme is an alleged Ponzi scheme that promised investors high returns on their investments through a virtual world platform. The scheme operated by recruiting new investors and using their money to pay off older investors. The virtual world platform was supposed to generate revenue through in-game purchases, but there is no evidence to suggest that this was actually happening.

What are the signs that suggest HyperVerse might be a Ponzi scheme?

There are several signs that suggest that HyperVerse might be a Ponzi scheme. Firstly, the promised returns are too good to be true. Secondly, the scheme relies on recruiting new investors to pay off older investors. Thirdly, there is no clear explanation of how the virtual world platform generates revenue.

How have HyperVerse promoters been living a high life, and what evidence supports this?

Senior promoters of HyperVerse have been seen living the high life, with reports of luxury cars, private jets, and expensive vacations. Bizarre videos promoting the scheme also suggest that the promoters were spending money lavishly. However, it is unclear where the money for these expenses came from.

What type of financial losses have been reported by those involved in HyperVerse?

Thousands of investors around the world have reported huge financial losses as a result of investing in HyperVerse. Some investors have reported losing their life savings, while others have reported losing smaller amounts of money.

How did HyperVerse manage to gain popularity and spread online?

HyperVerse managed to gain popularity and spread online through a combination of social media marketing and word of mouth. Bizarre videos promoting the scheme were shared widely on social media platforms, and many people were drawn in by the promise of high returns.

What legal actions are being taken against HyperVerse for its alleged fraudulent activities?

Several legal actions are being taken against HyperVerse for its alleged fraudulent activities. The scheme has been shut down in some countries, and the promoters are facing criminal charges in others. However, it is unclear whether investors will be able to recover their lost funds.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

crypto

European Retail Investors Favour BTC Over ETH After January ETF Ruling: Spectrum Markets

Introduction

In the dynamic world of cryptocurrencies, European retail investors are making strategic choices. The recent January ETF ruling by the United States Securities and Exchange Commission (SEC) has significantly impacted investor sentiment. Spectrum Markets, the pan-European trading venue for securities, has closely monitored these trends. Let’s delve into the contrasting behaviours surrounding Bitcoin (BTC) and Ethereum (ETH) in the wake of this regulatory development.

The SERIX® Sentiment Indicator

Spectrum Markets utilizes the SERIX® sentiment indicator to gauge investor sentiment. This proprietary tool provides insights into market psychology. A value above 100 indicates bullish sentiment, while a value below 100 suggests bearish sentiment. Armed with this data, let’s explore the divergent paths taken by BTC and ETH.

Bitcoin Continues Its Ascent

The SERIX® sentiment for Bitcoin has been on an upward trajectory since November of the previous year. In January 2024, it reached an impressive 109 points. The SEC’s decision to approve ETFs on Bitcoin opened new investment avenues, attracting both retail and institutional investors. Spectrum Markets witnessed a surge in Bitcoin-related trading, with activity reaching 2.5 times the monthly average in 2023.

Ether Faces a Different Reality

In contrast, Ethereum’s journey has been less straightforward. The SERIX® sentiment index for Ether declined to 103 points during the same period. While Bitcoin basked in the ETF spotlight, Ether’s fate remains uncertain. The SEC’s approval of a Bitcoin ETF did not extend to Ether, leaving investors in suspense.

Spectrum Markets’ Role

Spectrum Markets has been at the forefront of innovation. In May 2022, it expanded its product offering to include turbo warrants on both cryptocurrencies. These derivatives allow retail investors to participate in price movements without maintaining a separate crypto wallet. The regulated trading environment ensures transparency and accessibility.

Institutional Money Awaits

While retail investors capitalize on Spectrum Markets’ offerings, the approval of the ETF wrapper in the US signals a broader shift. Institutional investors now have a pathway to enter the crypto asset class. The demand for enhanced regulatory standards continues to grow globally, and the SEC’s decision aligns with this trend.

Conclusion

Valentine’s Day may be a celebration of love, but in the financial world, it’s about strategic choices. As Bitcoin and Ether navigate their divergent paths, investors must stay informed. Spectrum Markets remains committed to providing a regulated, transparent, and innovative trading environment for all. Whether you’re a crypto enthusiast or a curious observer, keep an eye on these digital titans – their journey is far from over.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

-

Digital5 years ago

Social Media and polarization of society

-

Digital5 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital5 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News5 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Digital5 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Kashmir5 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Business4 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China5 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?