crypto

Ethereum Restaking Poised to Take Center Stage in 2024 Crypto Scene

With the dust settling around the anticipated Bitcoin ETF approval, a new contender emerges for the hottest crypto narrative of 2024: Ethereum restaking. Eyes are turning towards this innovative financial tool as analysts predict it could be the next big driver of growth in the crypto market.

What is Ethereum Restaking?

In simple terms, restaking allows investors to earn additional yield on their already staked Ethereum (ETH). Traditionally, ETH holders can stake their tokens to support the Ethereum network and earn rewards. Restaking platforms take this a step further by leveraging these staked tokens in DeFi protocols, generating even higher returns for investors.

Why is it gaining traction?

Several factors are fueling the excitement around Ethereum restaking:

- Increased DeFi Adoption: The explosive growth of DeFi offers new ways to utilize staked ETH, unlocking hidden earning potential. Restaking platforms bridge the gap, making participation accessible and profitable for everyone.

- Enhanced Yields: Compared to standard staking, restaking promises amplified returns by exposing ETH to various DeFi strategies. This prospect is incredibly attractive, especially in a bear market where investors crave higher yields.

- New CoinGecko Category: The recent addition of a dedicated “restaking token” category on CoinGecko further validates the emerging trend. This provides increased visibility and potentially attracts fresh capital to the sector.

Early Movers Gaining Momentum:

Leading restaking platforms like Pendle Finance (PENDLE) and Picasso (PICA) have already witnessed significant price surges amidst the growing hype. PENDLE alone saw a 20% jump in value within a day, demonstrating investor confidence in the market’s potential.

Not Without Risks:

Despite the optimism, it’s crucial to acknowledge the inherent risks associated with restaking. DeFi protocols involve complexities and potential security vulnerabilities. Moreover, the nascent nature of the restaking market carries additional uncertainty.

A Promising Horizon:

While challenges remain, the potential of Ethereum restaking cannot be ignored. It offers a compelling solution for maximizing passive income on staked ETH and unlocking the power of DeFi for a broader audience. Whether it becomes the defining narrative of 2024 remains to be seen, but one thing is certain: Ethereum restaking is definitely worth watching.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Analysis

ETFs Are Eating the World: AI Jitters and Oil’s Reversal

ETFs are reshaping markets as AI hype drives volatility and oil reversals hit energy. A political‑economy view of risk, power, and flows.

ETFs are “eating the world” because low‑cost indexing has pulled vast amounts of capital into a small set of benchmarks, concentrating ownership and flows. AI‑fueled swings intensify crowding in tech, while oil’s reversal exposes how passive portfolios can lag real‑economy shifts and geopolitics.

Key Takeaways

- ETFs made investing cheaper and easier—but they also concentrate flows, power, and price discovery in a handful of indexes and providers.

- AI‑driven enthusiasm creates crowding risk inside passive vehicles, amplifying both rallies and selloffs.

- Oil’s reversal shows the blind spot of broad indexing: real‑economy shocks can move faster than passive portfolios.

- Regulators see the plumbing risks, but policy still lags the market reality.

- Investors need to understand the political economy of indexing, not just its fees.

The Hook: A Market Built for Speed, Not Reflection

Picture a day when the market opens with a jolt: an AI‑themed mega‑cap sells off on a single earnings comment, energy stocks surge on an OPEC headline, and most retail portfolios barely blink—because the flows are pre‑programmed. That’s the new normal. ETFs have turned markets into a high‑speed logistics network where money moves with incredible efficiency, but not always with great wisdom.

This is the core paradox: ETFs are eating the world, yet the world they’re eating is becoming more concentrated, more narrative‑driven, and more sensitive to macro shocks. The political economy angle matters here—because when capital becomes more passive, power becomes more centralized.

1) ETFs Are Eating the World—And It’s Not Just About Fees

ETFs won because they made investing easy: low costs, intraday liquidity, diversification in one click. The U.S. SEC’s ETF rulemaking in 2019 standardized and accelerated ETF growth by making it easier to launch and operate funds, effectively industrializing the format’s expansion (SEC Rule 6c‑11). Add zero‑commission trading and mobile brokerages, and the ETF wrapper became the market’s default delivery system.

But the bigger story is market structure. When indexing dominates, the market stops being a collection of independent price judgments and starts behaving like an ecosystem of shared pipes. The evidence is in decades of data on active manager underperformance: the persistence of indexing’s edge has been documented by S&P Dow Jones Indices’ SPIVA reports, which track active‑vs‑index outcomes across asset classes and regions (SPIVA Scorecards). As more capital goes passive, the marginal price setter becomes thinner.

The Power Shift You Don’t See in Your Brokerage App

Every ETF is a wrapper around an index. That means index providers and mega‑asset managers now sit at the center of capital allocation. Methodology choices—what gets included, what gets excluded, how often rebalanced—are no longer small technical details; they are de facto policy decisions. Index providers publish their methodologies and governance processes, but their influence has outgrown their public visibility (S&P Dow Jones Indices Methodology, MSCI Index Methodology Hub).

The political economy question is straightforward: who governs the gatekeepers? When a handful of index decisions can redirect billions overnight, “neutral” becomes a powerful political claim—one that deserves scrutiny.

2) Market Plumbing: When the Wrapper Becomes the Market

ETF liquidity is often secondary‑market liquidity—trading of ETF shares between investors. But the primary market (where new shares are created or redeemed via authorized participants) is what keeps the ETF aligned with its underlying holdings. This is sophisticated plumbing that works beautifully—until it doesn’t.

Regulators have flagged the risks of liquidity mismatch and stress dynamics in market‑based finance. The IMF’s Global Financial Stability Reports have repeatedly examined how investment funds can amplify shocks through redemptions and market depth constraints (IMF Global Financial Stability Report). The BIS Quarterly Review has also analyzed how ETFs can transmit stress across markets when liquidity in underlying assets dries up (BIS Quarterly Review).

This doesn’t mean ETFs are fragile by default. It means ETF stability is conditional—on underlying liquidity, dealer balance sheets, and the health of market‑making infrastructure. That’s a systemic issue, not an investor‑education footnote.

3) AI Jitters: Narrative Crowding Meets Passive Plumbing

AI is a genuine technological shift—but the market’s response has a familiar shape: concentration, hype cycles, and correlation spikes.

As AI narratives accelerate, money tends to flow into the same handful of mega‑cap names and thematic ETFs. That can create a feedback loop: flows drive prices, prices validate the narrative, and the narrative attracts more flows. Research institutions and regulators have emphasized how valuation sensitivity and concentrated exposures can heighten market vulnerability, especially when expectations outrun fundamentals (Federal Reserve Financial Stability Report).

The irony? Passive investing is supposed to diversify risk. But when the market’s capitalization itself is concentrated, indexing becomes a lever that amplifies concentration. Index providers track and publish concentration metrics, but the shift is structural: if the index is top‑heavy, the index fund is top‑heavy.

Morningstar’s fund flow research highlights how investor demand often clusters in the same categories at the same time—precisely the behavior that can exacerbate crowding in narrative‑driven sectors (Morningstar Fund Flows Research). In an AI‑fueled cycle, this means the same ETF wrapper that democratized access can also democratize risk.

4) Oil’s Reversal: The Old Economy Bites Back

While AI dominates headlines, oil reminds us that real‑world supply and geopolitics still run the table. When oil reverses—whether due to OPEC decisions, demand surprises, or geopolitical shocks—sector weights and macro assumptions change faster than broad passive portfolios can adapt.

The most credible real‑time oil data comes from institutions that track physical balances and policy developments. The International Energy Agency’s Oil Market Report, the U.S. EIA’s Short‑Term Energy Outlook, and OPEC’s Monthly Oil Market Report provide the market’s core macro narrative (IEA Oil Market Report, EIA Short‑Term Energy Outlook, OPEC MOMR).

Now connect that to ETFs: broad‑market indexes rebalance slowly, while sector ETFs can swing on a dime. If oil’s reversal signals a structural shift—say, prolonged supply constraints or a geopolitical premium—passive portfolios are late to the party by design. In the meantime, ESG‑tilted portfolios may under‑ or over‑expose investors to energy at precisely the wrong time, a tension widely discussed in responsible‑investment circles (UN‑supported PRI).

Oil’s reversal isn’t just a commodity story. It’s a governance and allocation story—about how passive capital interacts with geopolitics, energy policy, and the physical economy.

5) The Political Economy of Passive Power

ETFs feel apolitical because they’re built on formulas. But formulas are choices, and choices accumulate power. When a few providers and index committees control the rules, the market’s “neutrality” becomes a governance issue.

Concentration of Ownership and Voting

Large asset managers now represent substantial voting power across public companies—a fact regulators and policy analysts have debated extensively. The SEC’s resources on proxy voting and fund stewardship underscore the governance significance of fund voting policies (SEC Proxy Voting Spotlight). The OECD’s corporate governance work also highlights how ownership structures influence accountability and long‑term capital allocation (OECD Corporate Governance).

The result is a paradox: indexing reduces fees, but concentrates influence. That influence is often exercised behind closed doors via stewardship teams, policy statements, and index inclusion decisions.

Regulatory Lag

Central banks and financial authorities increasingly focus on market‑based finance and nonbank intermediation. Yet ETF‑specific regulation still looks incremental compared with the speed of market evolution. The IMF and BIS acknowledge these dynamics, but the policy response remains cautious—partly because ETFs have also delivered undeniable investor benefits (IMF GFSR, BIS Annual Economic Report).

In short: we have system‑level dependence on a structure whose governance remains diffuse.

6) What This Means for Investors, Policymakers, and Markets

For long‑term investors

- Know what you own: broad ETFs are only as diversified as the underlying index. If the index is top‑heavy, your portfolio is too.

- Understand liquidity layers: ETF trading liquidity can mask underlying asset illiquidity during stress.

- Treat thematic ETFs as tactical: AI‑focused ETFs can be useful, but they behave like crowded trades, not balanced portfolios.

For policymakers

- Index governance deserves visibility: transparency in methodology changes, inclusion criteria, and stewardship votes matters.

- Stress‑test the plumbing: market‑making capacity and authorized participant resilience should be policy priorities.

- Don’t confuse access with resilience: ETFs democratize investing, but democratization can also democratize systemic risk.

For institutions

- Scenario‑test the narrative: what if AI expectations compress sharply? What if oil flips the inflation story?

- Use active risk where it matters: passive core can coexist with active hedges or sector rotations.

- Engage stewardship intentionally: if you own the market, you own its outcomes.

7) Three Scenarios to Watch

- Crowding unwind: AI‑exposed indexes and ETFs face synchronized selling, revealing liquidity gaps.

- Oil regime shift: a sustained energy price reversal reshapes inflation expectations and sector leadership, forcing passive reweighting.

- Regulatory recalibration: a policy move on ETF transparency or index governance changes the economics of passive flows.

None of these scenarios are destiny—but all are plausible.

Conclusion: Convenience Won. Power Concentrated.

ETFs didn’t just win on price—they won on architecture. They are the pipes through which modern capital flows. But when the pipes grow large enough, they shape the city.

AI jitters and oil’s reversal are not separate stories. They are stress tests for a market that now relies on passive plumbing to allocate active realities. The promise of ETFs was democratization; the risk is centralization without accountability.

The real question isn’t whether ETFs are “good” or “bad.” It’s whether we’re willing to govern the system they’ve become. Because in a world where ETFs are eating the world, the rules of the dinner table matter more than the menu.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

AI

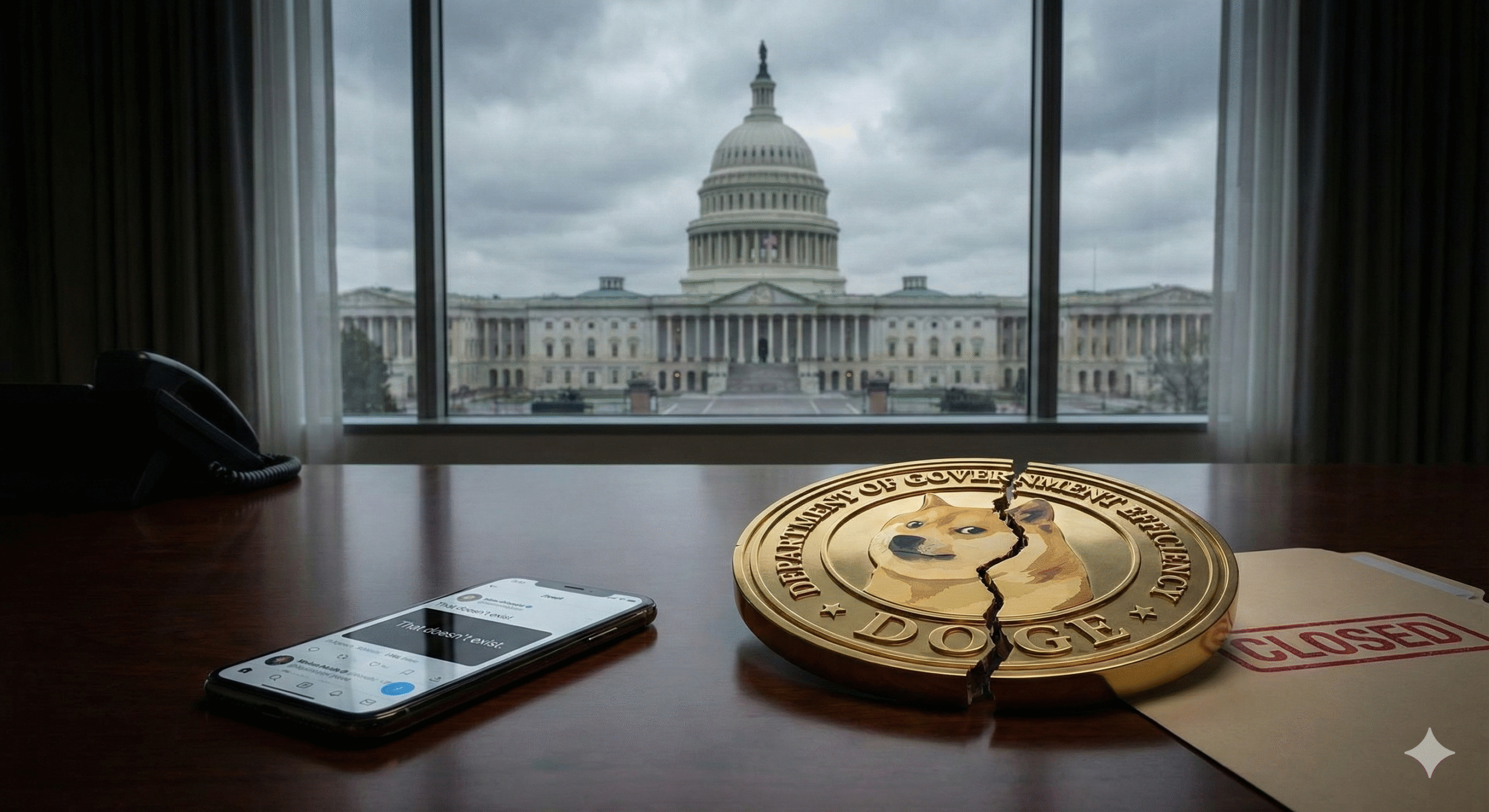

‘That doesn’t exist’: The Quiet, Chaotic End of Elon Musk’s DOGE

DOGE is dead. Following a statement from OPM Director Scott Kupor that the agency “doesn’t exist”, we analyse how Musk’s “chainsaw” approach failed to survive Washington.

If T.S. Eliot were covering the Trump administration, he might note that the Department of Government Efficiency (DOGE) ended not with a bang, but with a bureaucrat from the Office of Personnel Management (OPM) politely telling a reporter, “That doesn’t exist.”

Today, November 24, 2025, marks the official, unceremonious end of the most explosive experiment in modern governance. Eight months ahead of its July 2026 deadline, the agency that promised to “delete the mountain” of federal bureaucracy has been quietly dissolved. OPM Director Scott Kupor confirmed the news this morning, stating the department is no longer a “centralised entity.”

It is a fittingly chaotic funeral for a project that was never built to last. DOGE wasn’t an agency; it was a shock therapy stunt that mistook startup velocity for sovereign governance. And as of today, the “Deep State” didn’t just survive the disruption—it absorbed it.

The Chainsaw vs. The Scalpel

In January 2025, Elon Musk stood on a stage brandishing a literal chainsaw, promising to slice through the red tape of Washington. It was great television. It was terrible management.

The fundamental flaw of DOGE was the belief that the U.S. government operates like a bloatware-ridden tech company. Musk and his co-commissioner Vivek Ramaswamy applied the “move fast and break things” philosophy to federal statutes that require public comment periods and congressional oversight.

For a few months, it looked like it was working. The unverified claims of “billions saved” circulated on X (formerly Twitter) daily. But you cannot “bug fix” a federal budget. When the “chainsaw” met the rigid wall of administrative law, the blade didn’t cut—it shattered. The fact that the agency is being absorbed by the OPM—the very heart of the federal HR bureaucracy—is the ultimate irony. The disruptors have been filed away, likely in triplicate.

The Musk Exodus: A Zombie Agency Since May

Let’s be honest: DOGE didn’t die today. It died in May 2025.

The moment Elon Musk boarded his jet back to Texas following the public meltdown over President Trump’s budget bill, the soul of the project evaporated. The reported Trump-Musk feud over the “Big, Beautiful Bill”—which Musk criticized as a debt bomb—severed the agency’s political lifeline.

For the last six months, DOGE has been a “zombie agency,” staffed by true believers with no captain. While the headlines today focus on the official disbanding, the reality is that Washington’s immune system rejected the organ transplant half a year ago. The remaining staff, once heralded as revolutionaries, are now quietly updating their LinkedIns or engaging in the most bureaucratic act of all: transferring to other departments.

The Human Cost of “Efficiency”

While we analyze the political theatre, we cannot ignore the wreckage left in the wake of this experiment. Reports indicate over 200,000 federal workers have been displaced, either through the aggressive layoffs of early 2025 or the “voluntary” buyouts that followed.

These weren’t just “wasteful” line items; they were safety inspectors, grant administrators, and veteran civil servants. The federal workforce cuts impact will be felt for years, not in money saved, but in phones that go unanswered at the VA and permits that sit in limbo at the EPA.

Conclusion: The System Always Wins

The absorption of DOGE functions into the OPM and the transfer of high-profile staff like Joe Gebbia to the new “National Design Studio” proves a timeless Washington truth: The bureaucracy is fluid. You can punch it, scream at it, and even slash it with a chainsaw, but it eventually reforms around the fist.

Musk’s agency is gone. The Department of Government Efficiency news cycle is over. But the regulations, the statutes, and the OPM remain. In the battle between Silicon Valley accelerationism and D.C. incrementalism, the tortoise just beat the hare. Again.

Frequently Asked Questions (FAQ)

Why was DOGE disbanded ahead of schedule?

Officially, the administration claims the work is done and functions are being “institutionalized” into the OPM. However, analysts point to the departure of Elon Musk in May 2025 and rising political friction over the aggressive nature of the cuts as the primary drivers for the early closure.

Did DOGE actually save money?

It is disputed. While the agency claimed to identify hundreds of billions in savings, OPM Director Scott Kupor and other officials have admitted that “detailed public accounting” was never fully verified. The long-term costs of severance packages and rehiring contractors may offset initial savings.

What happens to DOGE employees now?

Many have been let go. However, select high-level staff have been reassigned. For example, Joe Gebbia has reportedly moved to the “National Design Studio,” and others have taken roles at the Department of Health and Human Services (HHS).

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

Blockchain

Bitcoin Volatility Deepens as Fear and Greed Index Signals Extreme Fear

Cryptocurrency Bitcoin faces sharp declines, with BTC-USD sliding amid fears of a crypto crash and investor sentiment turning cautious.

The cryptocurrency market is once again in turmoil, with Bitcoin (BTC) leading a sharp downturn that has rattled investors worldwide. As headlines ask “why is crypto crashing?” the Fear and Greed Index has plunged to levels not seen since the pandemic-era meltdown, underscoring the depth of anxiety across the sector. With BTC price USD slipping below key support levels, traders are questioning whether this marks a temporary correction or the start of a deeper bear cycle.

Fear and Greed Index Analysis

The Fear and Greed Index, a widely followed sentiment gauge, has dropped to 10 — extreme fear. This collapse reflects widespread panic selling, fueled by macroeconomic uncertainty, hawkish Federal Reserve signals, and rising Treasury yields. Historically, such extreme readings have coincided with heightened volatility and, in some cases, buying opportunities for long-term holders. Yet, for many retail investors, the index’s plunge is a stark reminder of crypto’s inherent risks.

Bitcoin Price Movements (BTC USD)

In recent sessions, BTC USD has fallen sharply, dipping below $86,000 before attempting to stabilize near $91,000–$96,000. The sell-off wiped out nearly $0.19 trillion in market value within 24 hours, with altcoins like Ethereum and Solana also suffering steep losses. Liquidations across leveraged positions exceeded $1 billion, amplifying the downward spiral.

Why Is Crypto Crashing?

Several factors explain why crypto is crashing:

- Macroeconomic pressures: Rising bond yields and Fed tightening have reduced appetite for risk assets.

- Regulatory uncertainty: Ongoing debates around crypto oversight in major markets have unsettled investors.

- Market structure: Heavy leverage and speculative trading magnify downturns, leading to cascading liquidations.

- Broader sentiment: With the stock market today also under pressure, correlations between equities and crypto have intensified, dragging digital assets lower.

Expert and Market Commentary

Analysts note that while short-term sentiment is bleak, long-term accumulation continues. Institutional players are quietly buying dips, betting on Bitcoin’s resilience as a store of value. However, retail investors remain cautious, with bitcoin news dominated by headlines about collapsing portfolios and vanishing trillions in market capitalisation.

Broader Market Context

The crypto crash has unfolded alongside turbulence in global equities. The stock market today reflects similar risk-off behaviour, with investors shifting toward safe-haven assets. This correlation highlights how the cryptocurrency bitcoin is increasingly tied to broader financial conditions, challenging the narrative of Bitcoin as a purely independent hedge.

Outlook: Bitcoin’s Path Ahead

Despite the current downturn, history suggests that extreme fear often precedes recovery. If BTC price USD can stabilise above key support levels, confidence may return. Yet, persistent macro headwinds mean volatility will remain elevated. For now, the Fear and Greed Index serves as both a warning and a potential contrarian signal: while many ask “why is bitcoin dropping?”, seasoned investors see opportunity in crisis.

Discover more from Startups Pro,Inc

Subscribe to get the latest posts sent to your email.

-

Digital5 years ago

Social Media and polarization of society

-

Digital5 years ago

Pakistan Moves Closer to Train One Million Youth with Digital Skills

-

Digital5 years ago

Karachi-based digital bookkeeping startup, CreditBook raises $1.5 million in seed funding

-

News5 years ago

Dr . Arif Alvi visits the National Museum of Pakistan, Karachi

-

Digital5 years ago

WHATSAPP Privacy Concerns Affecting Public Data -MOIT&T Pakistan

-

Kashmir5 years ago

Pakistan Mission Islamabad Celebrates “KASHMIRI SOLIDARITY DAY “

-

Business4 years ago

Are You Ready to Start Your Own Business? 7 Tips and Decision-Making Tools

-

China5 years ago

TIKTOK’s global growth and expansion : a bubble or reality ?